It’s all gone bad for ChiNext stocks as lockdowns drag China’s start-up champions deeper into bear market

- The ChiNext gauge has slumped 31 per cent this year, erasing US$442 billion of market value from its 100 constituents

- China’s zero-Covid policy in tackling outbreaks has pushed two thirds of provinces and municipalities into lockdown this year

The ChiNext gauge has slumped 31 per cent this year, erasing US$442 billion of market value from its 100 constituents and making it the worst among all Chinese stock barometers. It is also triple the decline in the MSCI World Small Cap Index and the Russell 2000 Index of smaller US companies.

China’s zero-Covid policy in tackling outbreaks has pushed two thirds of provinces and municipalities into lockdown this year. Funds are selling as China’s take-it-easy approach downplays supply-chain failures, factory shutdowns and recession worries.

“Investors are very sensitive to bad news now,” said Shen Chao, a strategist at HSBC Jintrust Fund Management in Shanghai. “The risk of production halts make investors’ confidence very fragile,” besides pressures from US rate increases and commodity inflation, he added.

The ChiNext gauge lost 2.6 per cent at local midday trading break on Monday, taking it to the lowest level in almost two years. Lithium-ion battery maker Contemporary Amperex Technology tumbled 4.2 per cent, contributing one-third to the index decline.

As of April 15, local cities that have experienced full or partial lockdowns accounted for about 40 per cent of China’s GDP, affecting more than 250 million residents, according to BCA Research. President Xi Jinping, meanwhile, has defended the zero-Covid policy at the Boao Forum, while more economists trimmed their forecasts for China on output losses.

The ChiNext’s three biggest members – Contemporary Amperex, Shenzhen Mindray Bio-Medical Electronics and East Money Information – have declined by 21 to 44 per cent this year, hitting funds including those managed by BlackRock, Vanguard and Allianz SE.

The trio suffered net selling by overseas investors via the Stock Connect in March, ranging from 1.5 billion yuan (US$230.7 million) to 6 billion yuan. On a year-to-date basis, the outflow from the Northbound stock link has amounted to at least 17.9 billion yuan, according to exchange data.

“We [also] exited our China exposure amid increasing uncertainties related to renewed Covid lockdowns,” Swiss private bank Union Bancaire Privee said in a report. Earnings upgrades looks “highly unlikely,” it added, partly due to headwinds in China.

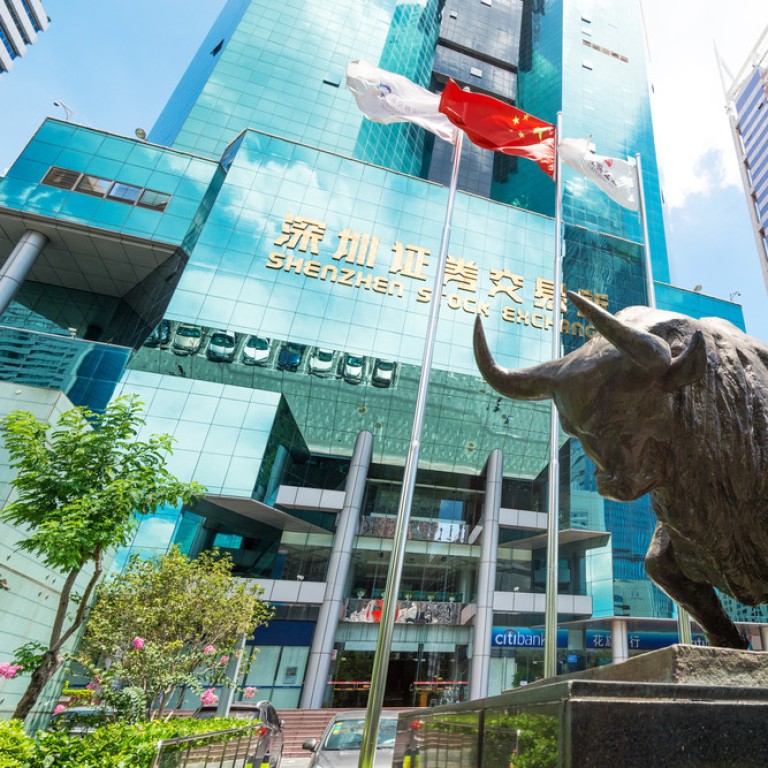

The ChiNext board, established in 2009 in the mould of Nasdaq, is now home to 1,138 companies with a combined market capitalisation of 7.5 trillion yuan, or one tenth of the onshore stock market.

Analysts have trimmed their earnings forecasts for Chinese companies in the MSCI China Index by 3 per cent over a four-week period, according to Goldman Sachs. Healthcare, real estate and consumer stocks suffered the most. Earnings at Sungrow, a power-supply parts maker, crashed 90 per cent last quarter on raw material costs.

Goldman remains upbeat on Chinese stocks, banking on policy stimulus to shore up the economy. JPMorgan Private Bank sees value in Hong Kong and Chinese onshore stocks, even as it has become more concerned with markets in the late-cycle investing stage.

Notably, China’s market regulator last week called for institutional investors to invest in local companies, the third time it has chimed in to support the market over the past two months.

While the People’s Bank of China has already started easing some policies to support businesses, its measures have been mild and underwhelming for market bulls. The policy support is also likely to lose its efficacy as lockdowns sap private sector confidence.

Unlike in the second half of 2020, the chances are lower for a quick and strong post-lockdown recovery because the nation’s policy easing will be less aggressive and is less effective, BCA Research said in a report on April 20.

“The scale of China’s monetary easing will be smaller than in 1H2020 given the Fed is raising interest rates,” said Sima Jing, its China strategist. “The country’s fiscal balance sheet is also in worse shape than in 2020,” thus limiting room for pump-priming, she added.

The ChiNext companies thrive on explosive earnings from growth stocks. Its 100 index members currently trade at about 42 times earnings multiple, versus 59 times in 2021, according to Bloomberg data. The country’s biggest companies trade at 14.4 times on average.

So far, nearly a quarter of the 100 stocks have reported their first-quarter earnings with a 27 per cent negative surprise on average, according to Bloomberg data. In an economy struggling under lockdown strains and brittle confidence, investors may balk at those lofty valuations.

“There’s a big chance that the ChiNext market will drop further,” said Zhang Gang, a strategist at Central China Securities in Shanghai. “We recommend that investors sit on the sidelines.”