Advertisement

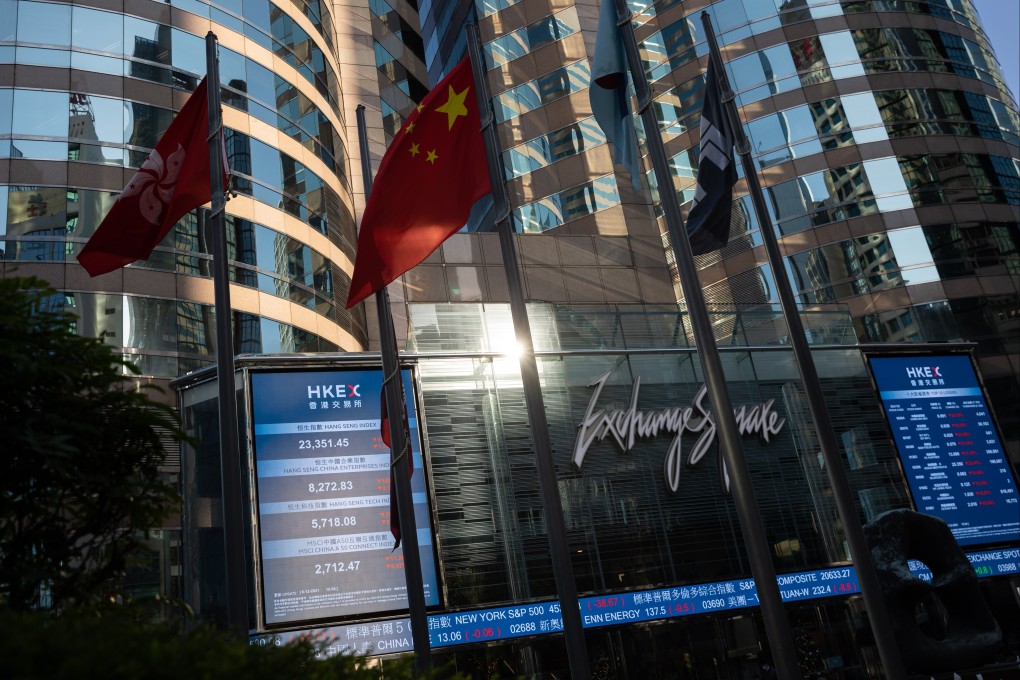

Hong Kong stock index tumbles the most in two weeks, weighed down by Tencent’s earnings miss and US rout

- The Hang Seng Index tumbled 2.5 per cent to 20,120.68 at the close on Thursday

- The Hang Seng Tech Index sank 4 per cent, while the mainland’s Shanghai Composite Index added 0.4 per cent despite the city’s Covid-19 lockdown

Reading Time:2 minutes

Why you can trust SCMP

12

Hong Kong’s key stock index slumped by the most in two weeks, weighed down by more than a 6 per cent slump in one of its biggest constituents, after Tencent Holdings missed its earnings estimates.

Sentiment in the broader market worsened amid the biggest declines in US equities in two years.

The Hang Seng Index tumbled 2.5 per cent to 20,120.68 at the close on Thursday, the steepest one-day decline since May 6. The Hang Seng Tech Index sank 4 per cent, while the mainland’s Shanghai Composite Index gained 0.4 per cent, the only winner among the key benchmarks in Asia.

Advertisement

Tencent plunged 6.5 per cent to HK$341.80, making it one of the biggest drags on the benchmark gauge. The operator of the omnipresent Chinese super app, WeChat, posted no growth in revenue in the first quarter and a 51 per cent decline in net income. The disappointing result reflected the drawn-out effect of China’s year-long regulatory crackdown and the fallout of the most severe Covid-19 flare-up since the Wuhan outbreak in 2019.

“Its earnings will continue to be under pressure in the short term as a result of the headwind from the macroeconomy and the ravaging from the pandemic in some parts of China,” said Ren Jie, an analyst at Citic Securities in Beijing.

Advertisement

Citic Securities cut its earnings forecasts for Tencent this year by 6.3 per cent and for 2023 by 5.9 per cent.

Advertisement

Select Voice

Select Speed

1.00x