China’s easing of zero-Covid restraints set to release stocks into bull-market territory for first time in three years

- A change in quarantine rules comes as the CSI 300 Index is within less than 3 per cent of bull-market status after an 18 per cent rebound from an April low

- However, analyst opinion remains mixed about how heavily Beijing’s zero-Covid policy will continue to weigh on the market

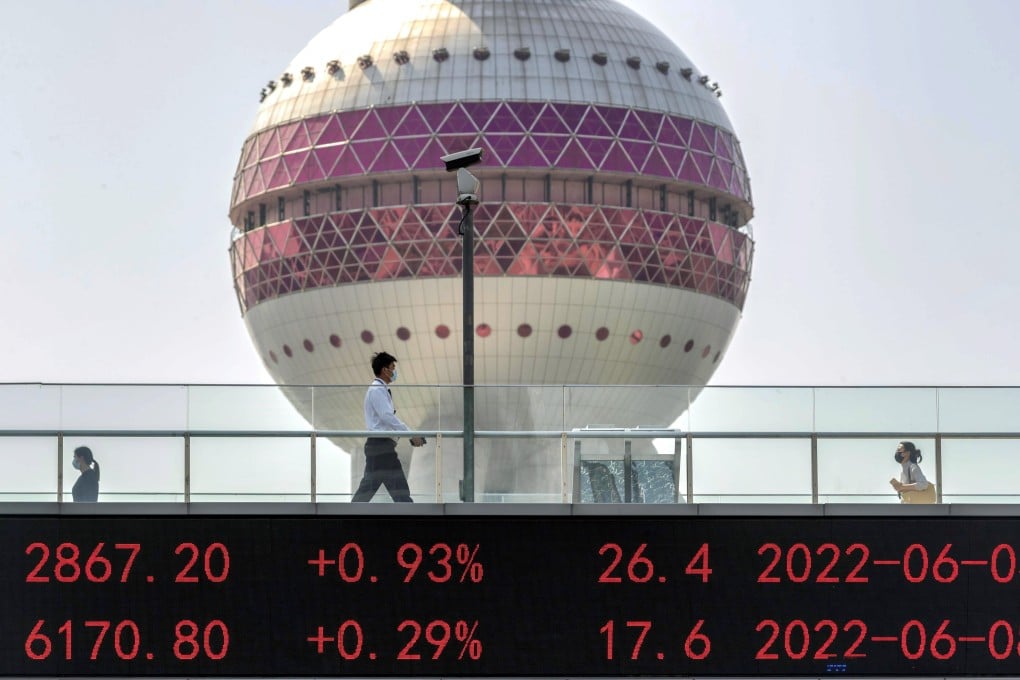

The quarantine change announced on Tuesday – the first such easing since the outbreak of Covid-19 in 2020 – comes as the CSI 300 Index is within about 3 per cent of bull-market status after a 17 per cent rebound from an April low. Still, traders fret about the sustainability of the bounce-back because of policy uncertainty.

“There’s some conviction among the market that China will be back onto the track of having economic growth as the core,” said Tao Yifei, a fund manager at HFT Investment Management in Shanghai. “From the recent policy tones, we have seen the efforts by the government to revitalise the economy, and that has improved expectations.”

The CSI 300 slipped 1.5 per cent to 4,421.36 on Wednesday, reversing the 1 per cent it gained the previous day when Beijing announced it would slash the quarantine period to seven days and standardise testing procedures in regions that report infections.

A further 2.7 per cent gain would take the gauge into bull-market status, which is defined as a 20 per cent rise from a low by some technical traders. It would be the first time the CSI 300 entered bull-market territory since early 2019.