Soho China says CFO faces insider trading probe, punishing shares in Hong Kong trading

- The Company is aware that Ni (the CFO) is under the investigation in relation to the alleged insider trading in the company’s shares: filing

- Probe said to involve CFO Ni Kuiyang and other executives at the Chinese property investment firm, mainland media reports

The stock slipped as much as 3.5 per cent to HK$1.39 before closing at HK$1.40 in Hong Kong on Thursday. It has declined 6 per cent since last Friday, set for the worst week since April 22, according to Bloomberg data.

“The Company is aware that Ni (Kuiyang) is under the Investigation in relation to the alleged insider trading in the company’s shares,” Soho China said in an exchange filing on Thursday. “None of the directors or other senior officers is aware of the circumstances of the alleged insider trading and is not directly involved in the investigation.”

Soho China added that the relevant senior officers have, however, cooperated fully at all times with requests for information from the relevant authorities.

The filing came after an earlier post on Chinese microblogging site Weibo on Wednesday said Ni was detained by police for an insider trading probe, while other executives were also being investigated. State-backed Global Times on Thursday said the information was “not unfounded.”

Ni, 45, joined the company in 2008 and became its CFO in 2018, according to Soho China’s annual report. She has over 20 years experience in accounting and finance and is a certified public accountant.

The probe follows another investigation by authorities into Ganfeng Lithium for insider trading involving shares in an undisclosed listed company. China’s market watchdog launched 201 such probes last year, a 25 per cent increase over 2020, according to official statistics.

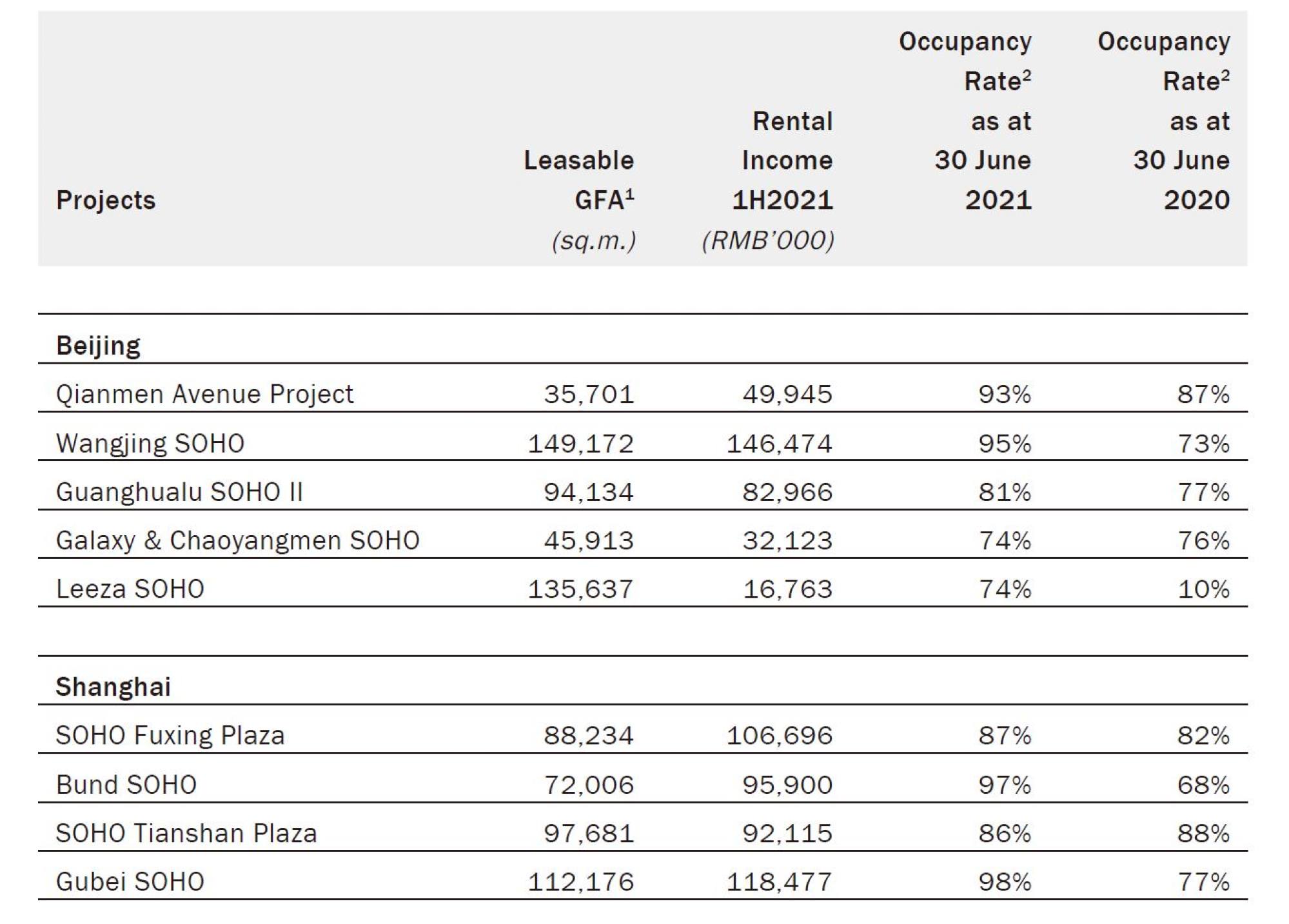

Soho China, which held a combined 830,654 square metres in nine office and serviced flat projects at the end of June 2021, has resorted to selling its assets to help generate profits and repay debt. The group lost 123 million yuan (US$17.9 million) last year, versus a 537 million yuan profit in 2020.

Founded in 1996 by Pan Shiyi and Zhang Xin, who serve as the company’s chairman and chief executive, Soho China is known for its commercial real estate projects in Shanghai and Beijing’s central business districts. It also has a villa project in the tropical Hainan province and a boutique hotel in Beijing that is managed by Hyatt Hotels, according to its website.