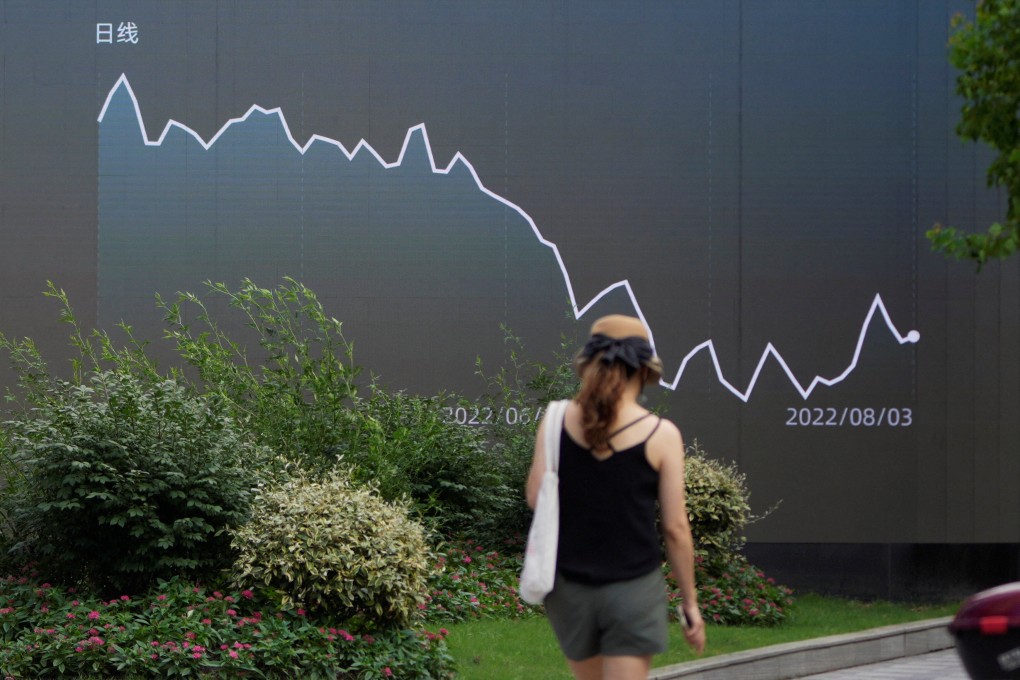

Chinese stocks’ post-Shanghai lockdown rally fizzles out as zero-Covid policy and beleaguered property market bite

- The CSI 300 Index of the biggest stocks on China’s onshore market has lost almost half of the gains that followed the reopening of Shanghai

- Covid-19 flare-ups and a property market that is in downturn after two decades of growth translate to dim prospects for onshore stocks, analysts say

Traders betting on a post-pandemic rally in Chinese stocks are now facing a reality check, as a run-up spurred by the lifting of Shanghai’s two-month lockdown appears to be sputtering.

“China’s post-pandemic economic recovery still leads the world, but this advantage could diminish if the country persists with the zero-Covid strategy,” said Preston Caldwell, chairman of the China economics committee at Morningstar in Chicago. “As long as China persists with [the] policy, growth will likely remain weak.”

More worrisome to traders, top leaders now seem to be downplaying the country’s annual GDP growth target, calling into question further stimulus action such as reductions in interest rates or the reserve requirement. A recent Politburo meeting chaired by President Xi Jinping made no reference to the annual growth goal of about 5.5 per cent.