China’s EV war: Tesla’s rivals rev up the fight as Nio, Xpeng, Li Auto, BYD and Huawei roll out new models to bite at the bellwether’s ankles

- Five new electric vehicles, including models from Li Auto to Huawei’s Aito, aim to siphon off demand for foreign luxury brands

- China’s ascendant EV market accounts for roughly half the units sold worldwide, helping BYD dethrone Tesla as the world’s largest EV maker in the first half

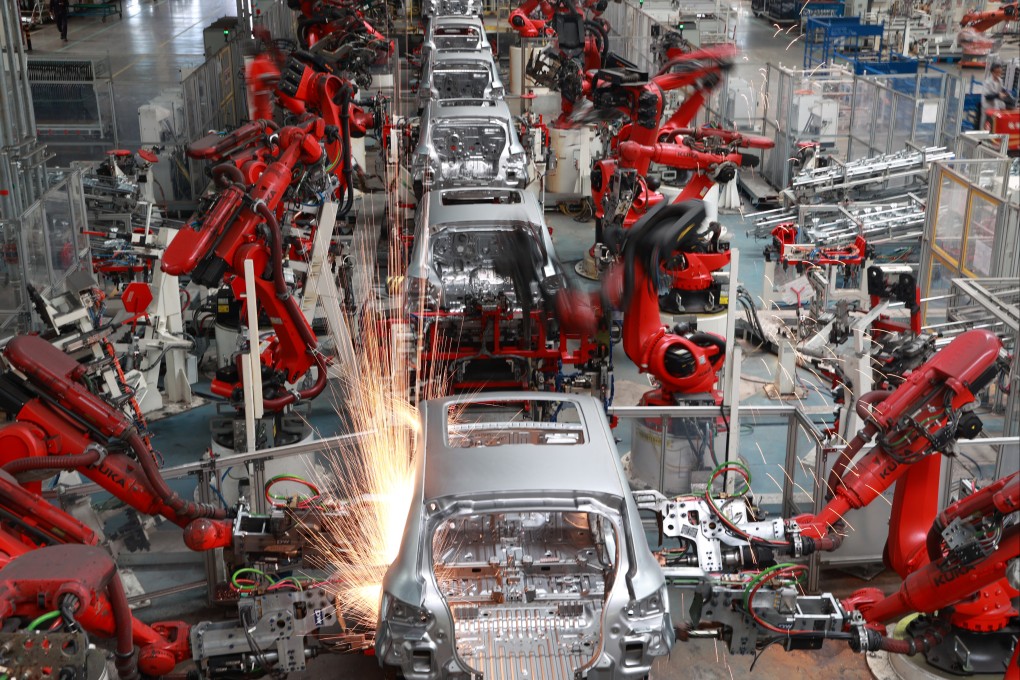

The battle cries in China’s electric vehicles (EVs) market rose to a crescendo, as five new models by the nation’s homegrown makers are poised to roll off the assembly line for delivery, offering buyers more choices and intensifying the rivalry with the industry bellwether Tesla.

All five battery-powered models are so-called next-generation cars, with object-detection technology, assisted parking and semi-autonomous driving as standard features. They also come packed with high-performance batteries, each receiving accolades and massive pre-orders from customers.

“Some of the new models are superior to Tesla’s cars, given the new technology and better components they use,” said David Zhang, a researcher at the North China University of Technology. “In the Chinese market, they will be able to lure some buyers away from Tesla’s Model 3 and Model Y.”

These new models are priced well into the six-digit price range, offering themselves as direct competitors to Tesla, and even the premium segment like BMW. Their journey up the price ladder marks the growing maturity of China’s EV makers, underscoring the challenges for Tesla to maintain its sales lead.