Stock Connect: fewer holidays to bring US$110 billion trading boost for HKEX and mainland bourses

- Optimisation process could reduce the number of non-trading days by half, likely starting from next year, with tweaks to settlement and clearing facilities

- Foreign investors could get at least four extra days to trade A shares, while mainland funds get eight more days to trade Hong Kong-listed stocks, brokers say

Global money managers will probably get up to five additional days annually to trade yuan-denominated stocks, following a plan to expand clearing and settlement facilities on affected holidays, some brokers estimated. Mainland investors in turn could get about eight extra days to trade Hong Kong-listed stocks, they said.

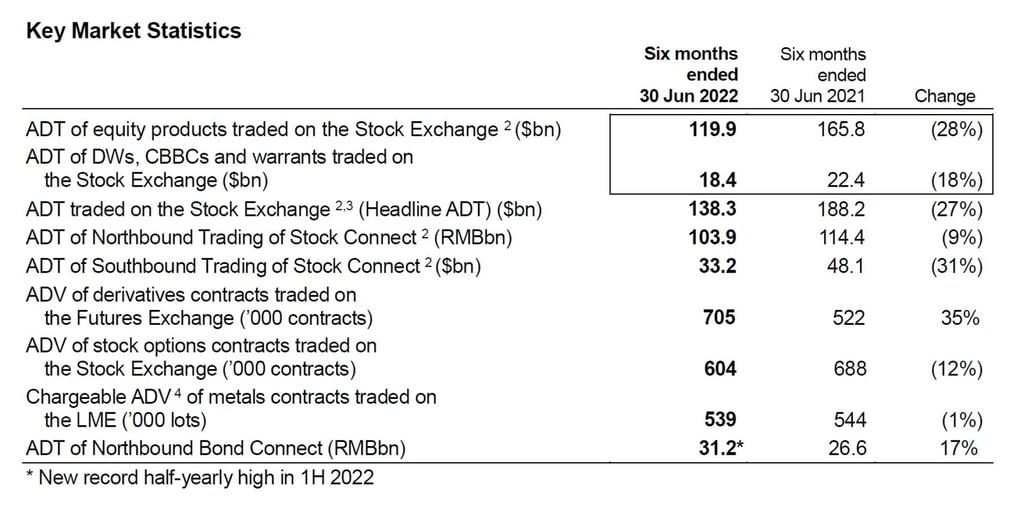

About 104 billion yuan (US$15.3 billion) worth of stocks changed hands every day through the Northbound channel in the first six months this year, according to stock exchange data, versus HK$33.2 billion (US$4.2 billion) via the Southbound channel. A record 120.1 billion yuan and HK$41.7 billion changed hands daily in 2021.

“This will be good in making sure of continuity in trading and for investors to hedge market risks,” said Dai Ming, a fund manager at Huichen Asset Management in Shanghai. “There are more occurrences of black-swan events this year that have triggered wild swings on these markets.”

The joint effort will help minimise market disruptions caused by a mismatch in holiday calendars, frustrating fund managers on both sides of the border. Index compiler MSCI has cited the issue as one hurdle preventing it from adding more Chinese equities in its emerging-market indices, which track companies with US$6.47 trillion capitalisation.