Stock Connect: fewer holidays to bring US$110 billion trading boost for HKEX and mainland bourses

- Optimisation process could reduce the number of non-trading days by half, likely starting from next year, with tweaks to settlement and clearing facilities

- Foreign investors could get at least four extra days to trade A shares, while mainland funds get eight more days to trade Hong Kong-listed stocks, brokers say

Global money managers will probably get up to five additional days annually to trade yuan-denominated stocks, following a plan to expand clearing and settlement facilities on affected holidays, some brokers estimated. Mainland investors in turn could get about eight extra days to trade Hong Kong-listed stocks, they said.

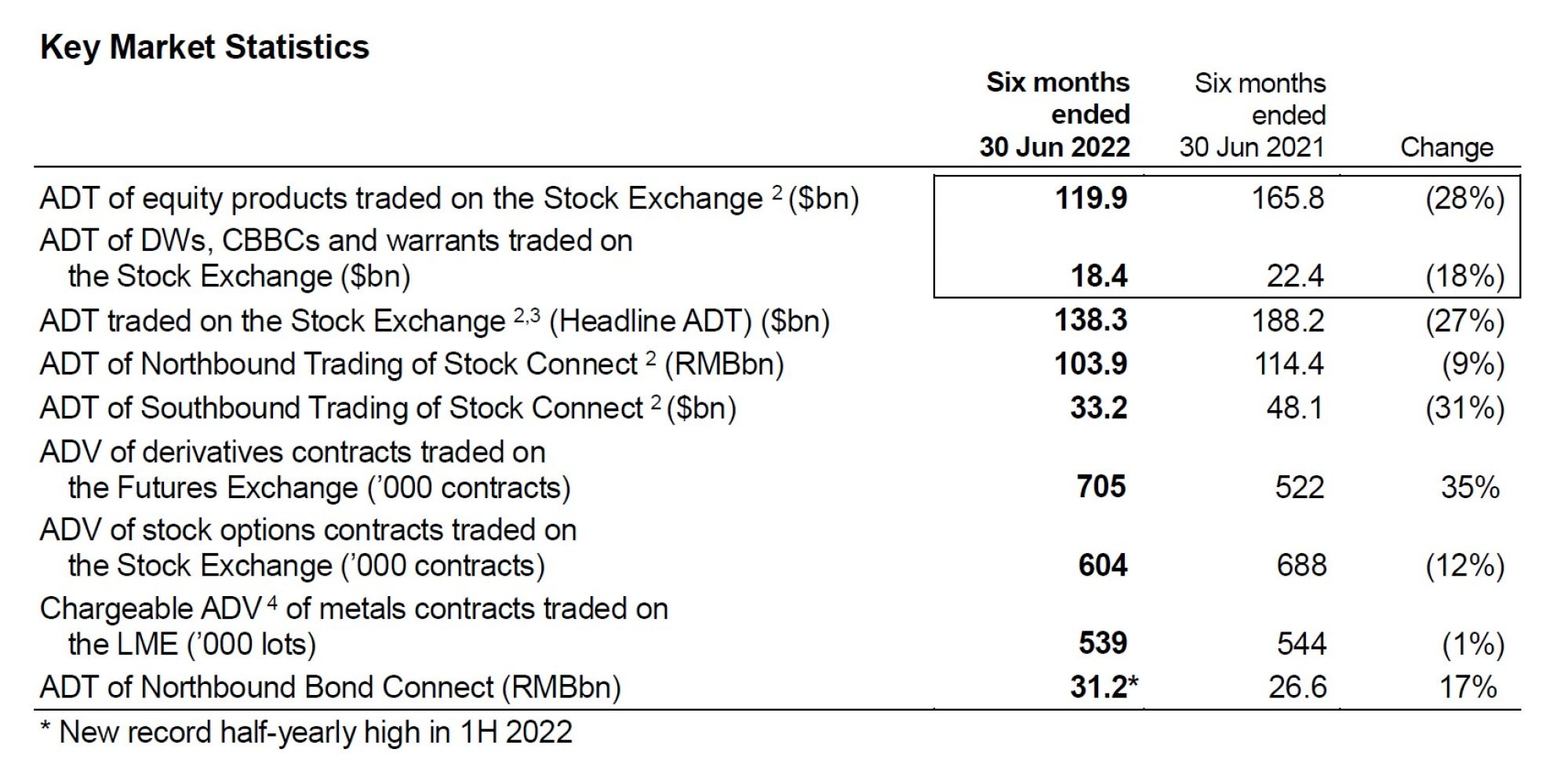

About 104 billion yuan (US$15.3 billion) worth of stocks changed hands every day through the Northbound channel in the first six months this year, according to stock exchange data, versus HK$33.2 billion (US$4.2 billion) via the Southbound channel. A record 120.1 billion yuan and HK$41.7 billion changed hands daily in 2021.

“This will be good in making sure of continuity in trading and for investors to hedge market risks,” said Dai Ming, a fund manager at Huichen Asset Management in Shanghai. “There are more occurrences of black-swan events this year that have triggered wild swings on these markets.”

The joint effort will help minimise market disruptions caused by a mismatch in holiday calendars, frustrating fund managers on both sides of the border. Index compiler MSCI has cited the issue as one hurdle preventing it from adding more Chinese equities in its emerging-market indices, which track companies with US$6.47 trillion capitalisation.

The Stock Connect scheme, which linked Hong Kong with Shanghai in November 2014 and with Shenzhen in December 2016, was created to foster a two-way investing flow, allowing China to widen access to global investors and deepen its capital markets, within a capital-control regime.

Overseas investors held 2.6 trillion yuan of Chinese stocks on June 30, or about 3.5 per cent of the onshore market capitalisation, according to official data. Mainland funds held 1.9 trillion yuan worth of Hong Kong-listed stocks, or 5.5 per cent of the city’s market capitalisation.

The clearing houses in Hong Kong and the mainland will take additional shifts on holidays to conduct trade settlements, readjust the settings on share-registration days for new trading sessions and work out corresponding risk-management measures, according to the CSRC.

“The move will help Stock Connect participants better prepare for changes on the market,” said Fu Beijia, an assistant fund manager at HSBC Jintrust Fund Management in Shanghai. “The optimisation is expected to reduce the number of non-trading days and improve continuity in trading.”

The number of trading days will increase by four each year going forward for offshore investors to trade yuan stocks, according to China International Capital Corp, while Guotai Junan Securities estimated five more days. Both of them expect mainland investors to gain at least eight days to trade Hong Kong-listed stocks.

The importance of trading calendars for both markets have gained significance this year, when price swings have become wilder on major economic and political events. China’s crackdown on tech companies, Russia’s invasion of Ukraine, Shanghai lockdowns, and China-US hostility are among some of the biggest market-moving headlines.

The HSI Volatility Index hit a two-year high in March, while a gauge of the 30-day realised swings on the CSI 300 Index jumped to a level not seen since April 2020 in May.

“Less unsynchronised trading closure on the mainland China and Hong Kong markets will help weed out some undesired discrepancy in stock prices,” said Dai of Huichen Asset Management.

.jpg?itok=zSWXqQCw)