Goldman Sachs slashes estimate for overseas buying of onshore Chinese stocks by US$50 billion this year, citing a host of issues

- Geopolitical tensions, rising interest rates globally and a weakening yuan will weigh on overseas investment in mainland-listed Chinese companies, Goldman says

- US bank expects foreign investors to buy US$25 billion of onshore shares via the Stock Connect link this year, compared with its earlier prediction of US$75 billion

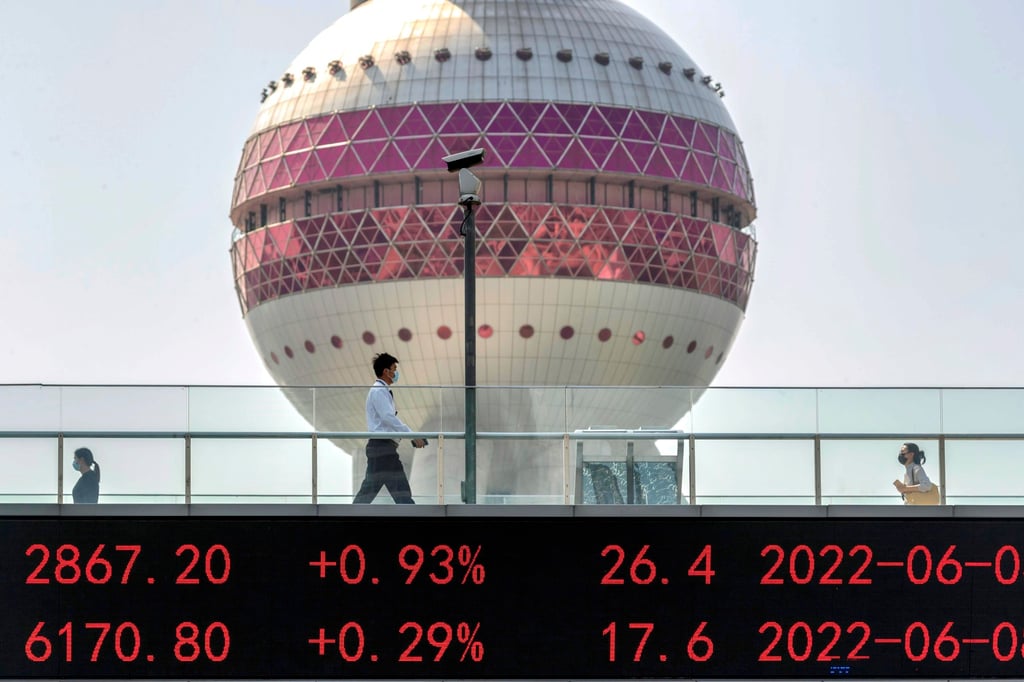

Global traders will probably buy US$25 billion of yuan-traded shares via the cross-border Stock Connect programme in 2022, while mainland buying of Hong Kong-listed stocks could amount to US$50 billion, analysts led by Si Fu and Kinger Lau wrote in a report on Tuesday. The US bank previously predicted US$75 billion of net buying in each direction.

Overseas buying of Chinese shares has only totalled US$9 billion so far this year, and mainland purchases of Hong Kong stocks have tallied US$28 billion, Goldman said. The bank attributed the sluggishness to rising tension between Beijing and Washington, monetary policy tightening by global central banks, fewer jumbo new offerings and capital flight from the mainland because of the yuan’s depreciation.

Overseas traders have been net sellers of Chinese stocks in two of the seven months this year. They sold 45 billion yuan (US$6.6 billion) worth of shares in March before a two-month lockdown was imposed in Shanghai and 21.1 billion yuan in July, according to data from Hong Kong stock exchange.

China’s CSI 300 Index has slumped 17 per cent this year, with a rebound from the lifting of the Shanghai lockdown fizzling out, while the Hang Seng Index has lost 18 per cent.

Still, Goldman is upbeat about fund inflows into Chinese stocks, predicting that overseas buying will rise to US$65 billion in 2023 and around US$50 billion annually through 2030 when foreign ownership is expected to rise to 9 per cent from 4.4 per cent currently.