Advertisement

Tesla rival BYD triples first-half profit to US$520 million on surging electric car sales in China

- The Shenzhen-based carmaker’s earnings per share of 1.24 yuan (US$0.18) beat analysts’ median forecast of 0.42 yuan

- BYD sold 641,000 pure EVs and plug-in hybrids in the first six months of the year, 300 per cent more compared with a year earlier

Reading Time:2 minutes

Why you can trust SCMP

5

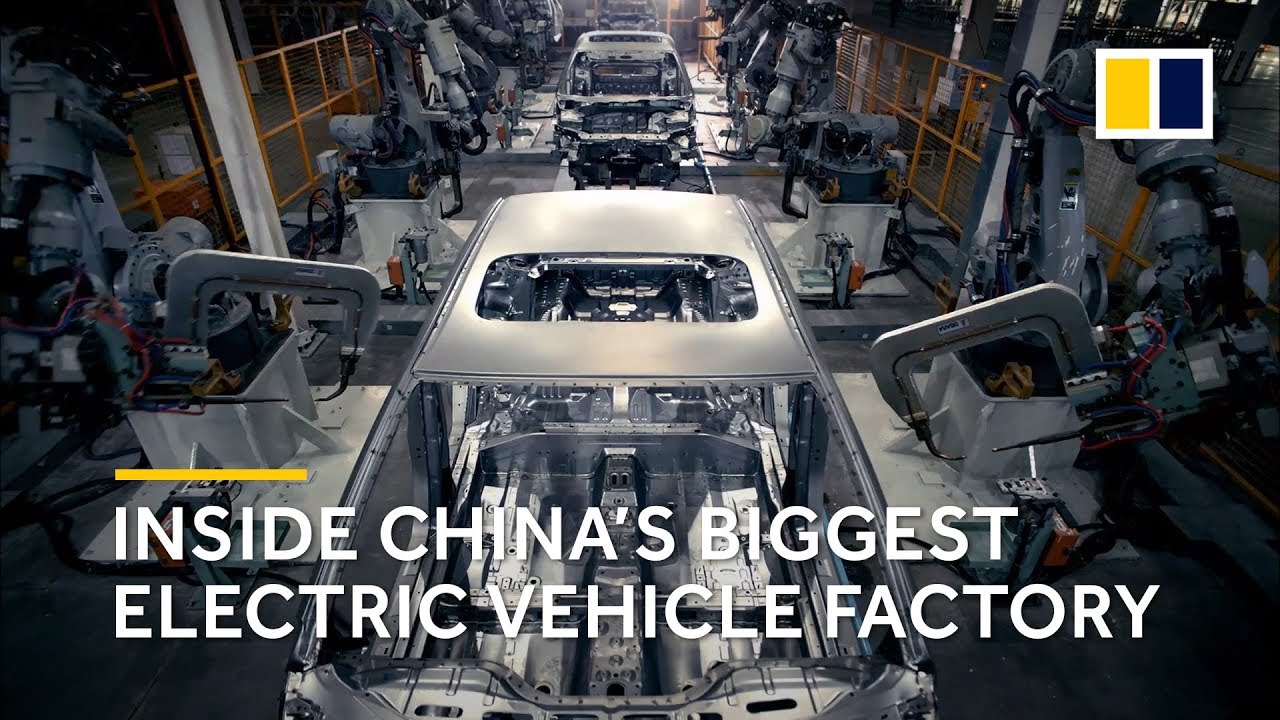

BYD, the Chinese carmaker that recently overtook Tesla as the world’s largest electric vehicle maker, more than tripled its first-half profit on the back of a 300 per cent jump in sales. In the process it handily beat analysts’ estimates.

Net profit from January to June hit 3.6 billion yuan (US$520 million), compared with 1.17 billion yuan a year ago, while revenues rose 65.7 per cent to 15 billion yuan, according to its interim report published after the market close on Monday.

The earnings per share of 1.24 yuan (US$0.18) beat a median forecast of 0.42 yuan, Bloomberg’s survey of analysts showed.

Advertisement

BYD achieved its first-half profit despite a strained automotive supply chain when citywide lockdowns in Shanghai and Changchun, the two major car-making bases in China, forced thousands of assemblers and component makers to at least partially suspend production between March and May.

“BYD’s EVs and hybrid cars are now widely recognised by Chinese drivers as high-quality cars,” said Chen Jinzhu, chief executive of Shanghai Mingliang Auto Service, a consultancy firm. “Its new models offer customers value for money.”

Advertisement

Advertisement

Select Voice

Choose your listening speed

Get through articles 2x faster

1.25x

250 WPM

Slow

Average

Fast

1.25x