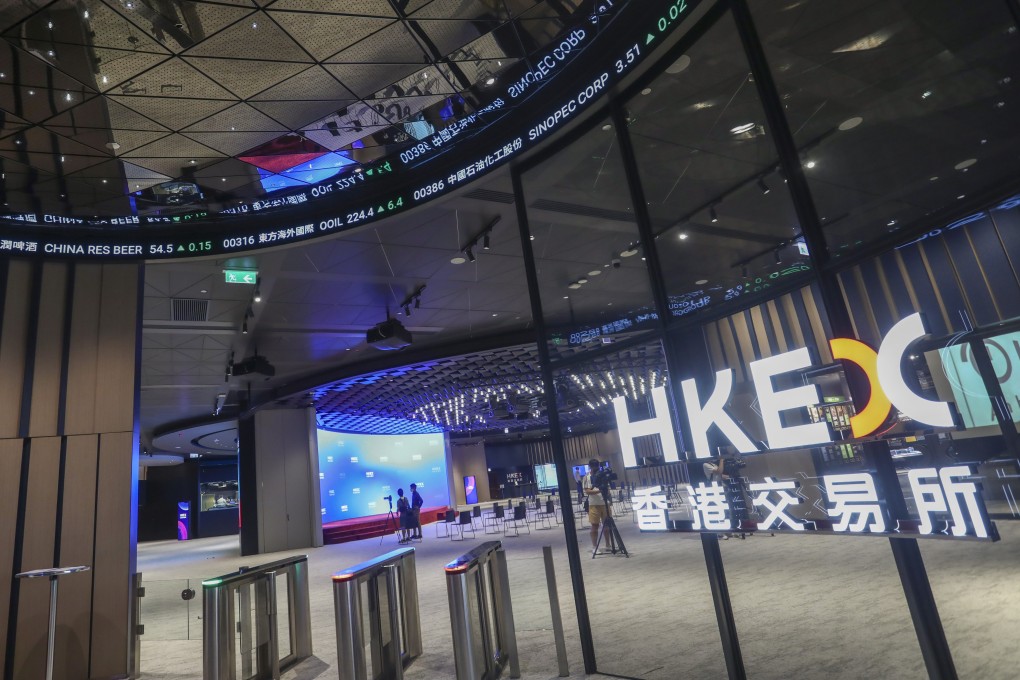

China’s property crisis sinks all as Vanke services arm faces investors in Hong Kong’s moribund IPO market

- Five Chinese residential services firms that launched IPOs this year have lost a combined US$264.5 million in market value since listing

- Most of the 41 companies that collected US$12 billion of proceeds from IPOs since 2019 have slumped, many by more than 80 per cent, Bloomberg data shows

China Vanke is spinning off its property management services unit in Hong Kong. Should investors part with their cash to buy into the new US$1 billion listing? Recent stock performances of its peers suggest they should look elsewhere.

Investors have lost a combined HK$2.1 billion (US$264.5 million) in market value since five such Chinese residential services firms completed their initial public offerings (IPOs) this year, according to data compiled by the Post. They fell by 0.1 per cent to 50 per cent, or 26 per cent on average.

The industry’s stock market track record is not great either over a longer horizon. Most of the 41 companies that collected US$12 billion of proceeds since 2019 have slumped, many by more than 80 per cent, according to Bloomberg data. Ten of the 11 IPOs in 2021 traded below their offer prices, as did 18 of the 19 in 2020.

“Demand will definitely be affected as the property management sector is part of the broader real-estate industry that is suffering from lower stock prices and valuations,” said Wang Chen, a partner at Xufunds Investment Management in Shanghai. “If home sales slump, growth in the areas under management will also be affected.”

China’s property market slump remains an albatross around the neck of the local economy. Stricken by Covid-19 lockdowns, home sales have tanked every month since July 2021, the worst streak in 24 years. Many cash-strapped developers are squaring off with foreign creditors to fend off bankruptcies after more than US$20 billion of debt defaults.