Advertisement

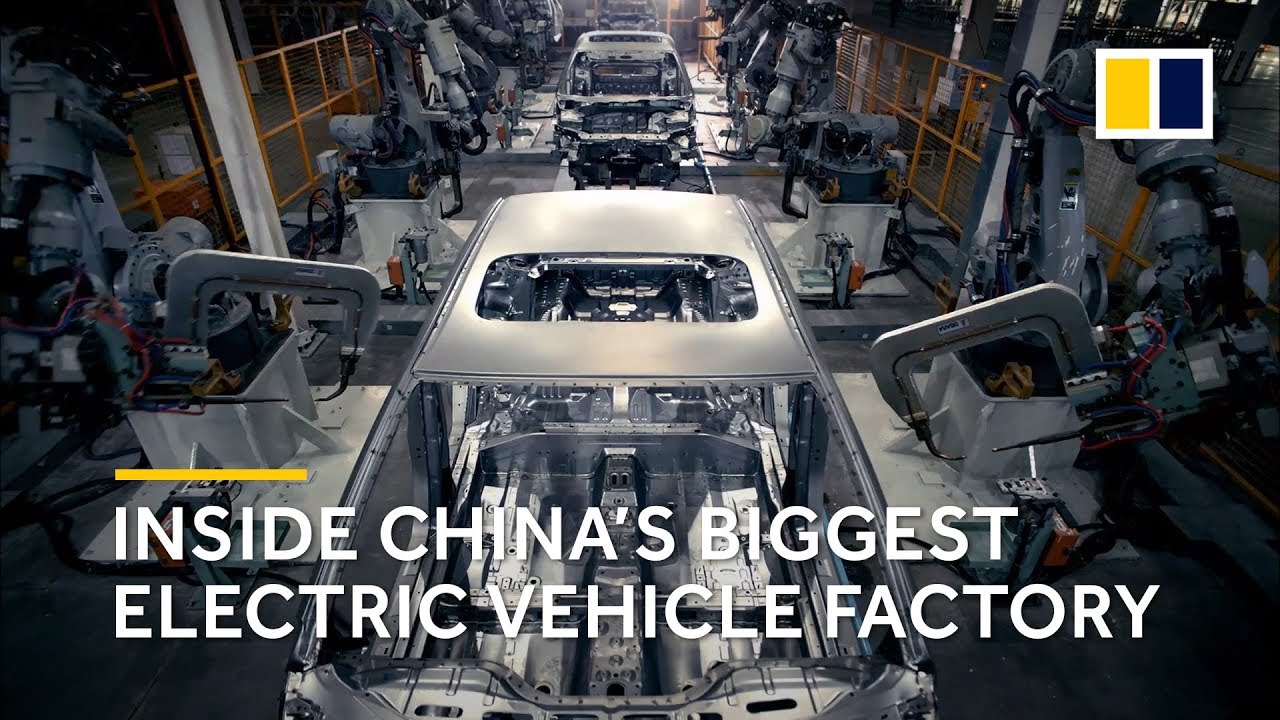

Electric carmaker BYD expands Shenzhen production base to keep pace with fast-growing Chinese market

- Expansion of industrial estate in Shen-Shan Special Cooperation Zone aims to generate annual sales of 100 billion yuan from next summer

- The local authority was quick to grant approval, and construction is already under way, just a few weeks after the carmaker bought the land

2-MIN READ2-MIN

BYD, the Chinese company that recently overtook Tesla as the world’s largest electric vehicle (EV) builder, has begun expanding one of its production bases in Shenzhen as it strives to tap Chinese motorists’ growing penchant for battery-powered cars.

The second phase of construction at its industrial estate in Shen-Shan Special Cooperation Zone will cost 20 billion yuan (US$2.9 billion) and aims to generate annual sales of 100 billion yuan when it becomes operational in July, 2023.

The local authority was quick to grant approval, and construction is already under way, just a few short weeks after the carmaker bought the plot of land.

Advertisement

The rapid pace of approval reflects Shenzhen’s goal of accelerating the development of the special cooperation zone with high-quality growth, the municipal government said in a statement posted on its official WeChat account on Thursday.

“New-energy vehicle (NEV), as a promising industry that offers new jobs and creates technological innovations, is a new darling of local economic policymakers,” said Gao Shen, an independent analyst in Shanghai. “BYD, as the industry’s bellwether, has obtained huge support from the local government so that it could kick off the expansion quickly.”

The facilities, covering 3.79 million square metres, will focus on making core components for BYD’s electric cars.

Advertisement

Advertisement

Select Voice

Select Speed

1.00x