Smaller Chinese EV battery makers grab market share from giants CATL, BYD as demand for green cars expected to double this year

- Small battery players like Farasis and Ruipu have launched new products to take on market leaders CATL and BYD

- Farasis, backed by Mercedes-Benz, accounted for 2.3 per cent of the market in August, up 0.5 percentage points from July

Small players like Farasis Energy and Ruipu Energy have launched new products to take on market leaders Contemporary Amperex Technology Limited (CATL) and BYD, offering EV makers more choices.

“The rise of emerging battery companies is happening just in time, as surging sales of EVs in the world’s largest automotive market have created huge demand for high-performance batteries,” said Chen Jinzhu, chief executive of Shanghai Mingliang Auto Service, a consultancy firm.

“In the near term, their increasing market share will not be enough to redraw the industry’s landscape, but heightened competition can technically knock down prices and improve overall quality [of battery cells].”

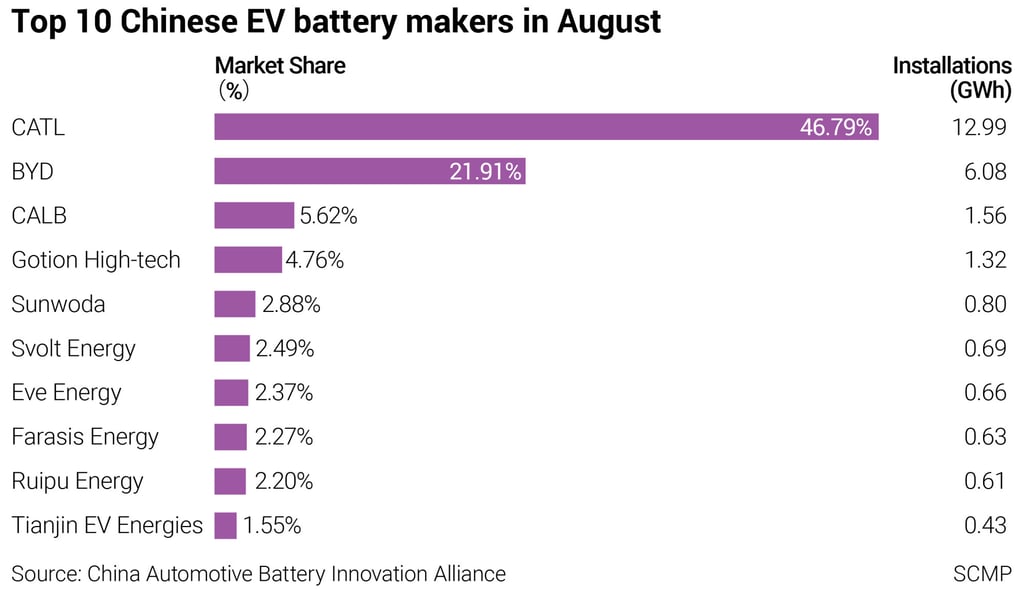

According to the China Automotive Battery Innovation Alliance, the five largest EV battery makers on the Chinese mainland saw their market share drop in August at a time when the number of batteries installed hit an all-time high of 27.8 gigawatt-hours (GWh), up 121 per cent year on year.

CATL, the world’s largest EV battery maker, held a 46.8 per cent share in August, compared to 47.2 per cent in July.