End of Hong Kong quarantines a catalyst for stock rebound after US$1.2 trillion market rout, analysts say

- Money manager Invesco and China Construction Bank’s investment banking unit predict a ‘meaningful’ and ‘sustainable’ recovery

- The Hang Seng Index has slumped 21 per cent this year

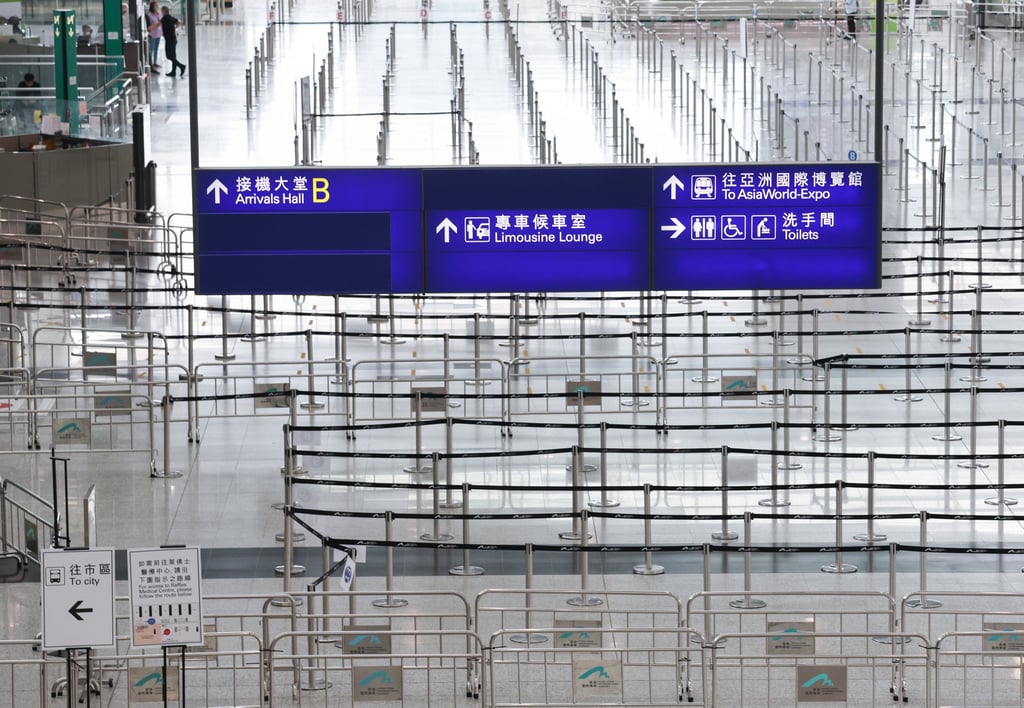

Hong Kong stocks will stage a “meaningful” and “sustainable” rebound from bouts of sell-offs that have wiped away US$1.2 trillion in market capitalisation this year after a widely expected end to the city’s travel restrictions, according to US money manager Invesco and China Construction Bank’s investment banking unit.

The sweeping change in policy after more than two and a half years will restore investors’ confidence in the economy and get the city back on feet as a financial hub, according to CCB International, while Invesco sees a recovery in the tourism-linked sectors that have been battered by the Covid outbreaks.

Lee said in a press briefing on Tuesday that the city would take an orderly approach to easing travelling curbs, without giving a specific timetable.

“Hong Kong stocks will have a sustainable rebound, with the improvement on both internal and external environments,” Cliff Zhao, a strategist at CCB International in Hong Kong, said in an interview on Wednesday. “The arrangement will be conducive to the recovery in the local economy, solidify Hong Kong’s position as a global financial centre and boost confidence in Hong Kong’s stocks.”

The Hang Seng Index dropped 1.8 per cent on Wednesday as traders braced for a widely expected 75-basis point increase in the US benchmark interest rate later today to tamp down inflation.