Advertisement

Exclusive | CALB aims for ‘aggressive’ expansion in its goal to be among the world’s top three EV battery makers

- CALB is eyeing a total capacity of 500 gigawatt-hours (GWh) in 2025, more than 42 times the 11.9 GWh it produced last year

- The Jiangsu-based company raised US$1.26 billion in its Hong Kong IPO, aiming to achieve the top three global ranking within five years, its CEO says

3-MIN READ3-MIN

Daniel Renin Shanghai

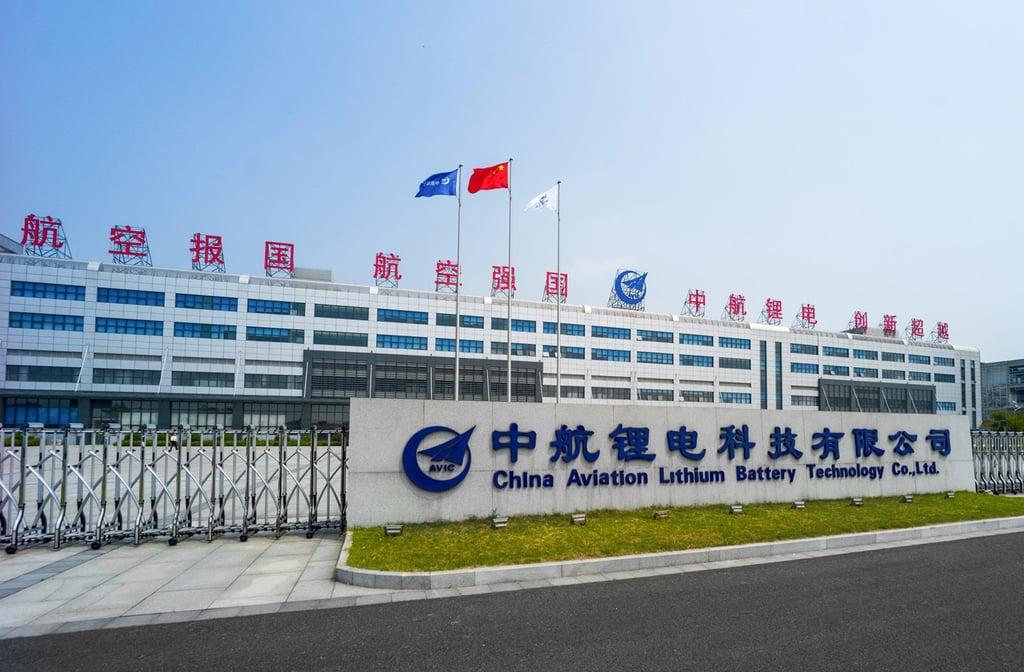

China Aviation Lithium Battery (CALB) aims to become one of the world’s three biggest suppliers for electric cars, using funds it has raised from its Hong Kong initial public offering (IPO) to expand “aggressively” and upgrade its technology, according to the company’s chairwoman and CEO.

The company counts Xpeng, Leapmotor, Geely Auto’s affiliate Viridi E-mobility Tech (Ningbo) and Guangzhou Automobile Group’s EV marque Aion among its customers. It is eyeing a total capacity of 500 gigawatt-hours (GWh) in 2025 – more than 42 times the 11.9 GWh it produced last year.

CALB is well on track to expand capacity to 100 GWh in 2023, said its chief executive Liu Jingyu, in an interview with South China Morning Post, before her company’s shares began trading in Hong Kong.

Advertisement

“We have accumulated technologies to improve energy density, reliability and stability of batteries,” she said. “Our cutting-edge technologies have paved the way for further innovations in making higher-quality battery cells.”

The Jiangsu-based company, which raised HK$9.9 billion (US$1.26 billion) after pricing its IPO at the bottom of the marketed range.

Advertisement

Advertisement

Select Voice

Select Speed

1.00x