Stay overweight on China stocks to capture upside momentum as UBS, Deutsche Bank back economic outlook

- Policy support is seen as a key driver to current upside momentum, chief EM strategist at Alpine Macro says

- Money managers at UBS, Deutsche Bank back assessment, counting on Beijing’s zero-Covid pivot to deliver stronger economic growth

Investors should continue to overweight China in their emerging-market allocation in the first quarter to capture more of the rebound that began in November, the Montreal-based research firm said in a report on Tuesday. A more pro-growth stance means favouring growth and cyclical stocks over value and defensive bets, it added.

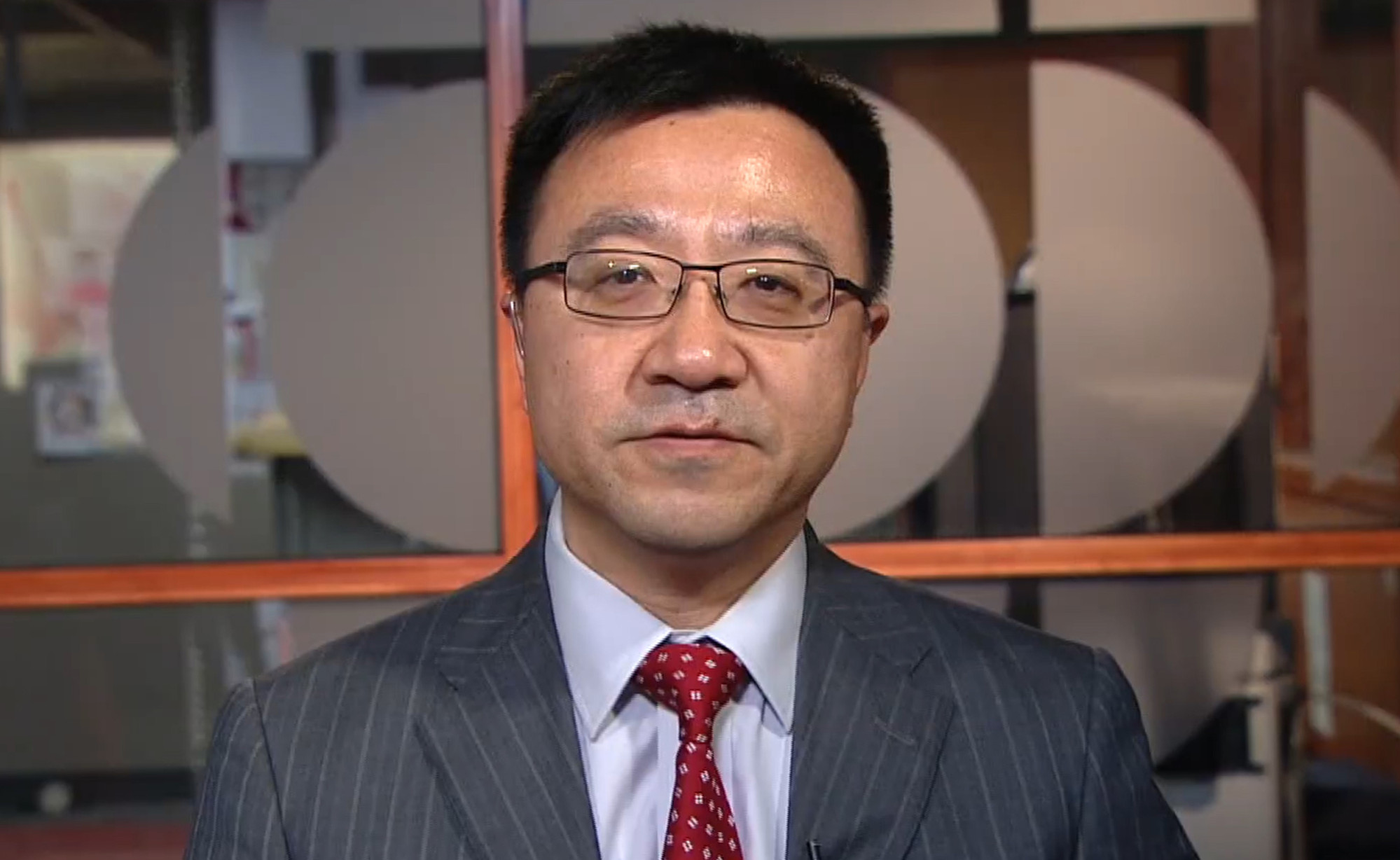

“Chinese stocks have finally begun to outperform in the past two months, and we expect more upside,” Yan Wang, chief strategist for emerging markets and China, said in the report. “We expect Chinese growth to surprise to the upside. This, together with depressed valuations and weak earnings expectations, makes a compelling case for Chinese stocks.”

Among other Asian markets, the research firm raised its allocation on Malaysia, the Philippines, South Korea and Thailand, and downgraded Indonesia.

The MSCI China Index has risen faster than developing markets elsewhere since the November trough, by as much as 20 percentage points versus the broader emerging markets. China analysts at Wall Street firms have been mounting buy calls on the promise of border reopening while Chinese officials dial down geopolitical tensions.

With zero-Covid restrictions firmly in the rear-view mirror and the Omicron tsunami currently sweeping the country at astonishing speed, the impact of the pandemic is likely to burn out very quickly, Alpine Macro said. Infections in some northern cities such as Beijing appear to have already peaked, and traffic and business activity has begun to recover, it added.

Economic momentum in China is likely to be stronger next year, with growth of around 5 per cent, Deutsche Bank’s wealth managers said in a report published last month. Spending on holiday travels will benefit Thailand, Malaysia and the Philippines, it added.

“Strong capital flows to safe havens caused marked declines in valuations in northern Asian markets, such as South Korea, Taiwan and China in 2022,” the bank’s Chief Investment Office said in a report. “The average drop in these markets was around 20 per cent, a trend that has now been partly reversed. These markets may make a comeback when the macroeconomic environment and investor sentiment improve.”

Early pain for China reopening stocks as Wall Street firms mount buy calls

Meanwhile, UBS said in its yearly forecast report that a rebounding China may create a needed boost to the global economy.

“China is signalling the relaxation of zero-Covid measures, even in the face of elevated case counts,” Barry Gill, head of investments at UBS Asset Management, said in its 2023 outlook. “This suggests a commitment to such a shift in policy, which should allow for a boost in consumption.”

While the process is unlikely to play out in a straight line, the upbeat view is fortified by other policy adjustments including the most comprehensive support for the property sector to date, he added.

Alpine Macro noted that all self-imposed growth restrictions, such as the zero-Covid policy, the crackdown on the real estate sector and regulatory scrutiny of tech firms, have been removed. Odds of another flip-flop are low, given the damage to policy credibility,” it added.