No sharp rebound for China’s tourism industry amid staff shortages, reluctance to spend among consumers

- Not prepared to serve a rising number of tourists, Shanghai travel agency executive says

- A full recovery will not occur until next year: McKinsey analyst

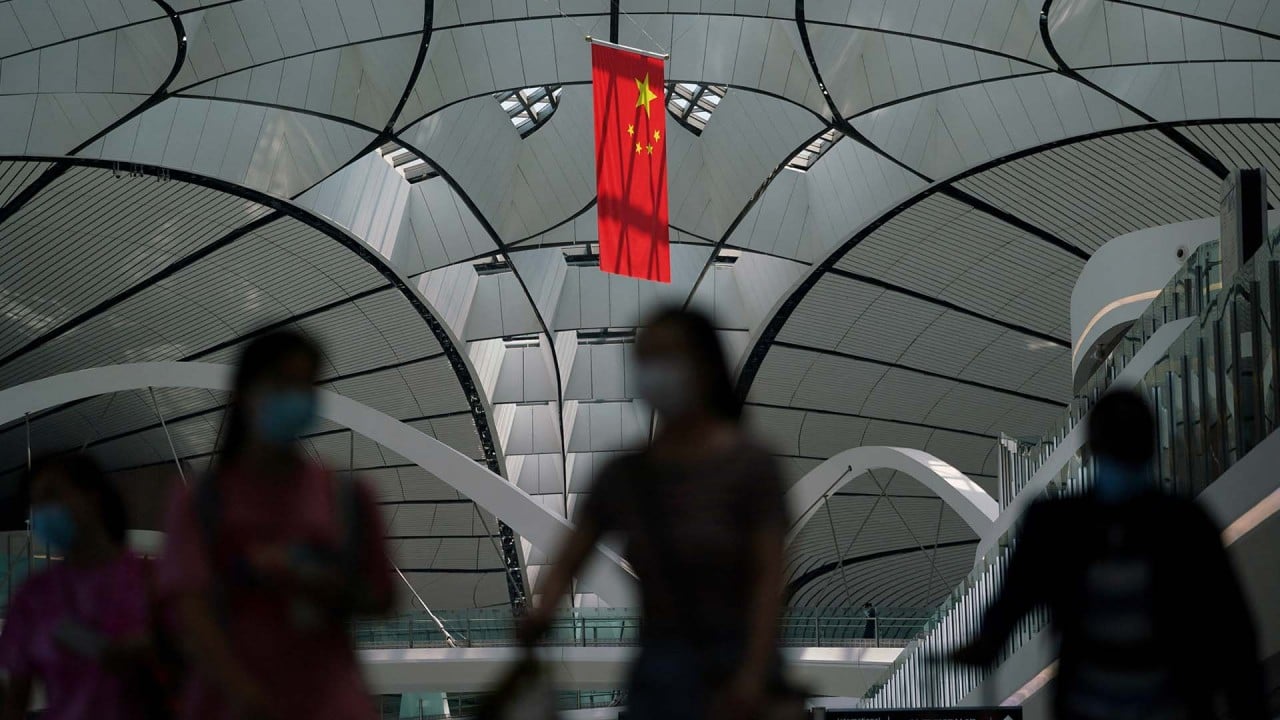

Optimism about a recovery in China’s tourism sector in the post-Covid-19 era might prove to be short-lived, as hotels, airlines and tourism must first hire back all the staff they let go. Moreover, consumers are still not in a mood to spend.

“We are not prepared to serve a rising number of tourists since we are short of employees,” said Zheng Honggang, CEO of Shanghai-based Kate Travel. “The pace of recovery will turn out to be slow.”

The loss of staff over the past three years cannot be compensated for by a hiring spree, because many former employees of the tourism sector have secured jobs in other industries, he added.

Why do mainland tourists visit Hong Kong? McKinsey finds many reasons

“Business travel is rebounding sharply, buoyed by surging cross-border travel by company executives,” said Jackey Yu, a partner with global consultancy McKinsey. “But in summer, overall travel business [in China] is expected to recover to just 40 to 50 per cent of 2019 levels. A full recovery will not occur until next year.”

Worldwide, tourism was among the industries worst affected by the Covid-19 pandemic. A reopening of China, the world’s most populated market, had heightened hopes of a business boom.

“Some analysts were overly optimistic,” said Franco Feng, CEO of Shanghai-based travel services firm Shenxiaokou. “Air tickets are still expensive, because the number of international flights remains low. Lots of tourists are taking a wait-and-see approach.”

In February, carriers added 355,000 international seats compared with January. The international capacity was, however, operating at 18 per cent of the levels reported in the same month in 2019, according to the global travel data provider OAG.

Resorts World sees quick recovery for Hong Kong’s passenger cruise market

A recovery in international flights capacity expected from April to June is projected to reach about 65 per cent of 2019 levels, Rob Morris, global head of consultancy at Ascend by Cirium, said in a report recently.

There will be 110 million border crossings from mainland China in 2023, reaching two-thirds of the level of 2019, according to a forecast made by the China Outbound Tourism Research Institute. China was the world’s largest source of outbound tourists before the pandemic, with 170 million trips and a contribution of US$253 billion to the global economy in 2019.

Chinese consumers have stored up 6 trillion yuan (US$869.2 billion) in excess savings during the pandemic, tripling from levels reported in 2019, according to data published by Tianfeng Securities. Thousands of businesses, from restaurants and tea houses to amusement parks and hotels, expected Chinese consumers to splash the cash in “revenge spending” in the post-pandemic era.

However, “people are not going to spend heavily on consumer items or entertainment services soon”, said Yin Ran, an angel investor in Shanghai. “Many consumers are not confident about their job prospects and wage incomes.”