China stocks: recovery bets doubted as empty shipping containers pile up at Shanghai, Ningbo, Shenzhen ports

- With containers stacking up at Chinese ports, the outlook for exports looks weak, challenging bullish calls from money managers on the economic upturn

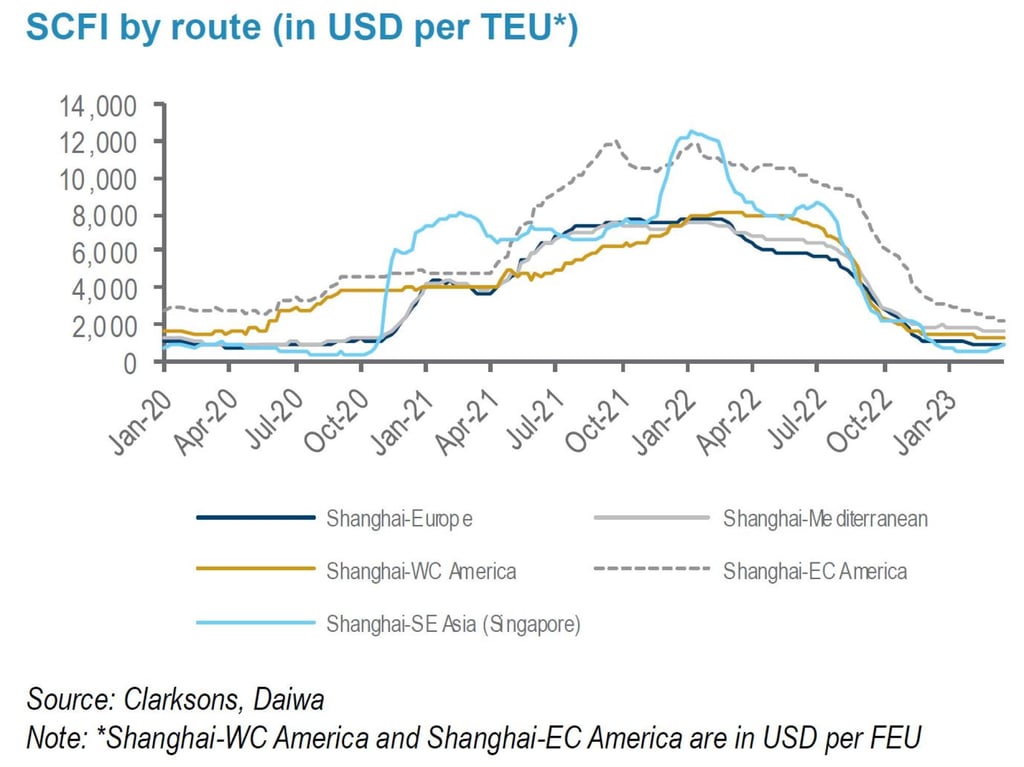

- An index of freight rates for 15 shipping routes has dropped 18 per cent this year, taking the slump to 82 per cent since January 2022, according to Shanghai Shipping Exchange

Investors putting their money on the mainland’s recovery theme may find their stock bets premature as one major part of the economy struggles. Empty shipping containers are piling up in major ports from Shanghai to Ningbo and Shenzhen as exports shrink.

Local media reports and posts on social media in the past month suggest idled containers are hitting multi-year highs, painting a bleak picture on the outlook for exports, challenging bullish calls from Wall Street banks on the economic upturn.

“We are generally cautious on export-linked stocks such as shipping lines and port operators this year,” said Wang Chen, a partner at Xufunds Investment Management in Shanghai. “External demand is supposed to be sluggish, given all the happenings overseas. These stocks won’t be the focus of our allocation this year.”

An index of freight rates for 15 shipping routes has dropped 18 per cent this year, according to Shanghai Shipping Exchange, bringing the slump to 82 per cent since January 2022. That is a red flag for investors holding the share of shipping stocks and port operators, some analysts cautioned.

Shanghai International Port has risen 3.9 per cent in Shanghai to 5.5 yuan this year, while Ningbo Zhoushan Port has added 2 per cent to 3.65 yuan. Cosco Shipping Energy Transportation, the nation’s biggest, has appreciated 13 per cent in Shanghai to 11.35 yuan. The onshore market’s benchmark CSI 300 Index rose 4 per cent over the same period.

China’s exports shrank 6.8 per cent in the January-February period from a year earlier, adding to a 9.9 per cent decline in December, government reports showed. The outlook is clouded by the Federal Reserve’s policy tightening that has kept economists alert to a possible recession this year.