Sinopec, China’s top refiner, to fast track energy transition as EVs erode demand for fuel

- Sinopec will adjust the product output of its refineries to produce more chemicals and less motor fuel as sales of EVs continue to rise, chairman Ma Yongsheng says

- The company, which aims to become carbon neutral by 2050, reported a 6.2 per cent drop in greenhouse gases emissions last year, its first in five years

The Beijing-based company will adjust the product output of its refineries, build more petrol stations that also provide charging services for EVs, and boost its hydrogen production capacity, said Ma Yongsheng.

“We will push forward efforts for our existing refineries to produce more chemicals and less motor fuel,” he told reporters on Monday.

“We will also boost our output of natural gas, a cleaner-burning fuel, and expand hydrogen production – especially that of green hydrogen.”

Currently, most of China’s and Sinopec’s hydrogen output comes from the conversion of coal and natural gas – both of which are carbon intensive raw materials.

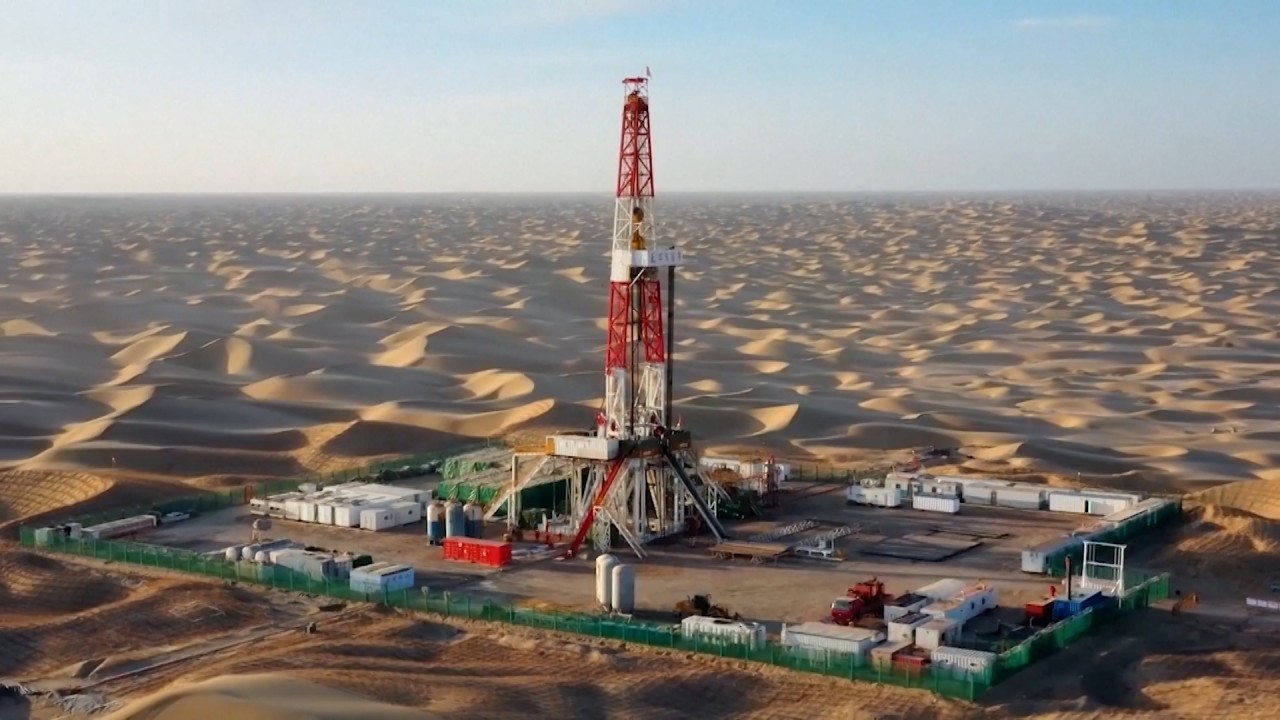

Sinopec is building facilities in the Xinjiang Uyghur and Inner Mongolia autonomous regions powered by wind and solar energy to convert water into so-called green hydrogen, which has a much lower carbon footprint. The Xinjiang plant will come online this year, Ma said.

Last year, Sinopec invested 20 billion yuan (US$2.9 billion) on hydrogen, wind and solar energy projects, said chief financial officer Shou Donghua.

Sinopec sets green hydrogen goals to help China become carbon neutral

On Sunday, Sinopec announced that it would seek independent shareholders’ approval to issue 2.24 billion Shanghai-traded shares to its parent, China Petrochemical Corporation.

The share issuance will raise as much as 12 billion yuan to fund the production of clean energy and “high value-added” materials, such as polyolefin elastomer and ethylene vinyl acetate, which are used in solar panels, adhesives, wires and cables.

The company is aiming to become carbon neutral by 2050, to help China reach the same goal by 2060.

Sinopec’s greenhouse gases emissions fell 6.2 per cent to 161.79 million tonnes last year, according to its latest sustainability report. It was the first significant decline in five years, thanks to lower refinery throughput and initiatives on clean energy utilisation, energy conservation, and carbon dioxide and methane capture.

A major contributor was the 16.3 per cent rise in the recovery of methane, a highly potent greenhouse gas, to 834 million cubic metres.

Sinopec reported a 6.9 per cent decline in net profit to 66.3 billion yuan for 2022, 6 per cent lower than the average estimate of 15 analysts polled by Bloomberg.

Sinopec to spend 30 billion yuan over five years to get off fossil fuels

The shares fell 3.4 per cent on Monday, after falling as much as 7.7 per cent.

A 49 billion yuan jump in oil and gas production profit and a 3.3 billion yuan profit increase from fuel marketing was offset by a 53 billion yuan fall in oil-refining profit.

Its chemicals operation incurred a 14.1 billion yuan loss, compared with a profit of 11.1 billion yuan in 2021, as demand contracted due to the Covid-19 pandemic and higher feedstock costs as a result of high oil prices.

Sinopec projected a 0.2 per cent increase in crude oil production to 280.86 million barrels, and a 3.2 per cent rise in natural gas output to 1.29 trillion cubic feet.

It is eyeing domestic fuel sales of 175 million tonnes, after it dropped 5.1 per cent to 162.5 million tonnes last year. Even so, the volume will still be short of the 184.5 million tonnes seen in 2019 before the pandemic affected demand.

Sinopec’s 2023 guidance reflects the Chinese economy’s emergence from the pandemic, which would help lift its profit margins, Sanford Bernstein senior analyst Neil Beveridge said in a note on Monday.

The company declared a final dividend of 0.195 yuan per share, taking the full-year payout to 0.355 yuan, lower than the 0.47 yuan in 2021. The payout ratio fell to 71 per cent from 80 per cent in 2021.