Stocks gain on China stimulus bets while AI firms slip amid regulatory risk and weak TSMC report slams SMIC and chip makers

- Gains built on China stimulus bets faded amid a sell-off in Baidu and other AI-related stocks on valuation concerns

- Hedge funds have switched out of onshore stocks over the past two months in favour of Chinese stocks listed in Hong Kong and New York: Goldman report

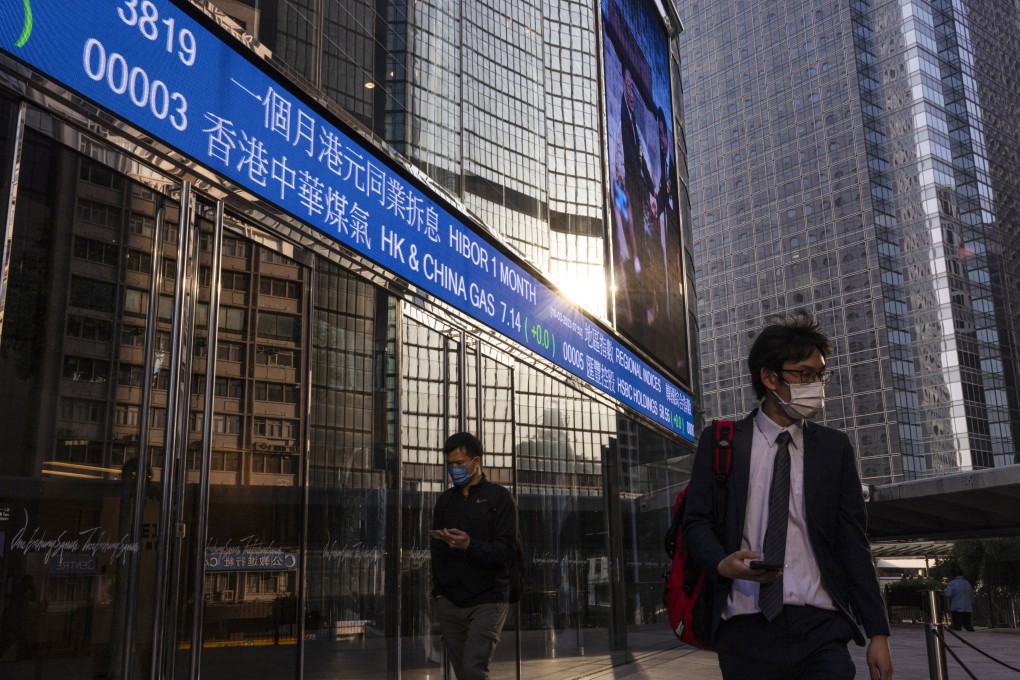

The Hang Seng Index added 0.8 per cent to 20,485.24 at the closing of Tuesday trading, the most since March 29. The Tech Index erased losses to log a 0.3 per cent gain, while the Shanghai Composite Index declined 0.1 per cent.

Alibaba Group rose 1.6 per cent to HK$99.30 and HSBC advanced 1.1 per cent to HK$54.80 while WuXi Biologics surged 5.6 per cent to HK$50. Developer Longfor Group rallied 7.5 per cent to HK$23 and peer Country Garden surged 14.1 per cent to HK$2.34.

The softer inflation data “suggest post-Covid recovery momentum remains weak, to the disappointment of markets,” Nomura analysts including Ting Lu said in a note to clients on Tuesday. “We expect Beijing to step up policy support in the coming months.”

Separately, producer prices fell 2.5 per cent following a 1.4 per cent drop in February, the statistics bureau added, deepening a deflationary trend over six months.