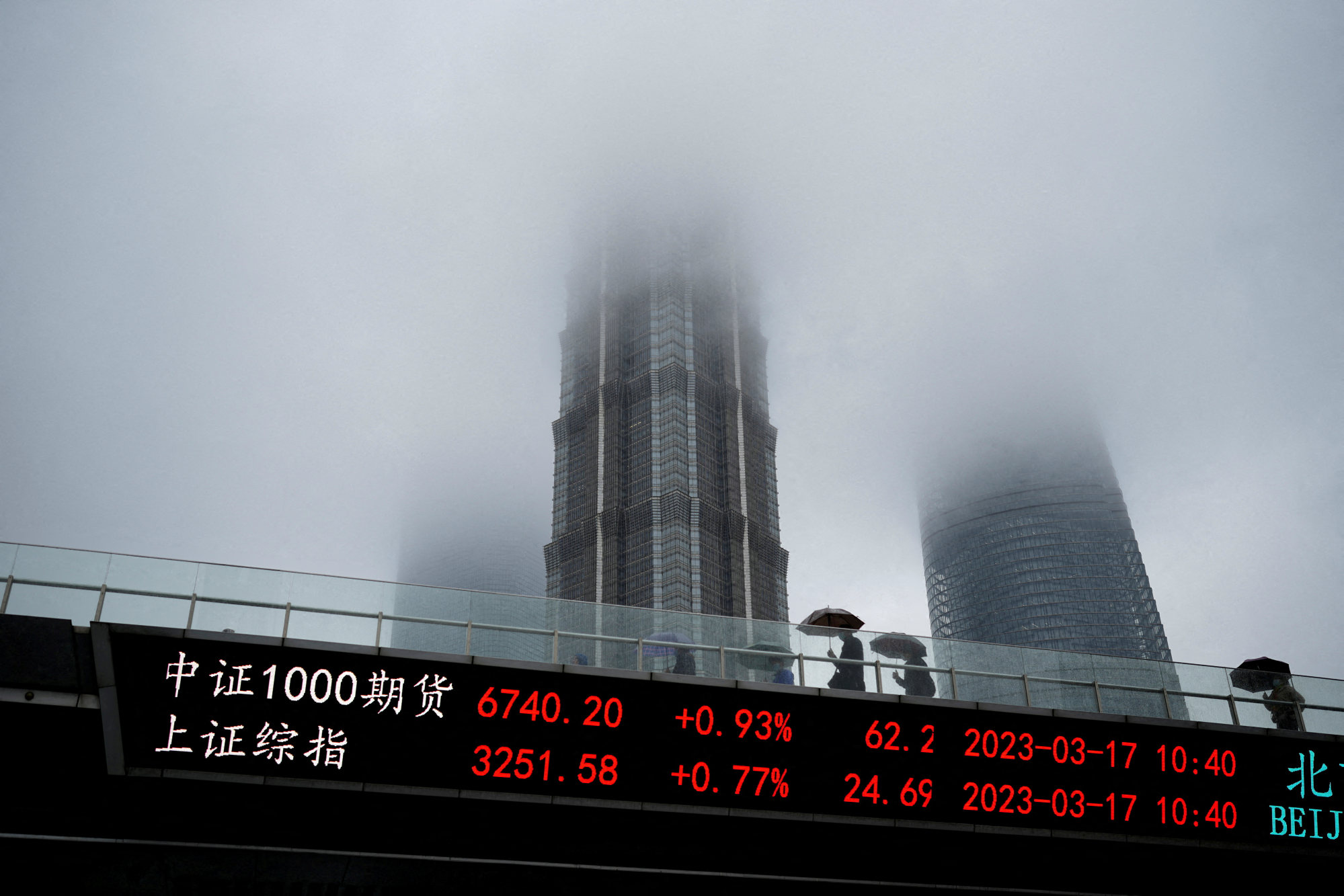

Stocks stuck in a rut in mainland China and Hong Kong as slower-than-expected economic recovery spooks bulls

- Only 49 per cent of fund managers expect a strong recovery in China in the year ahead, down from 79 per cent in April, according to Bank of America

- Traders believe recovery will not ‘in any way, shape or form be linear’, while youth unemployment in China is ‘unsettling and scary’, analyst says

Bullish stock traders are an increasingly rare breed after underwhelming April economic data dampened belief in a sustained stock rally tied to China’s post-Covid recovery.

A recent survey of Asian fund managers by Bank of America (BofA) showed that the number of investors bullish on China’s recovery has dropped significantly, with India unseating China as the favourite bet for investors in the region.

“This kind of sideways market is signalling a lack of conviction in either direction,” said Redmond Wong, a strategist at Saxo Markets in Hong Kong. “The economic data is largely cyclical and has large impacts on earnings in the current and probably next one or two quarters.”

Stocks in both mainland China and Hong Kong have barely budged over the past two months as initial euphoria over the end of China’s damaging anti-pandemic measures morphed into concern about the speed and strength of its recovery. Per capita consumer spending during the May “golden week” holiday came in below the pre-pandemic level, and a looming recession overseas may add to the pressure on external demand.

The set of disappointing April data has strengthened the argument that China’s economy is on the mend, but at a bumpy and much slower-than-expected pace.

While retail sales rose 18.4 per cent from a year earlier, the rise, which was largely due to a low base last year when Shanghai was placed under a two-month lockdown, fell short of the projection of 21.9 per cent growth. Property investment continued to contract in the January-to-April period, while youth unemployment hit a record high of 20.4 per cent – not counting almost 12 million university students who will graduate and enter the job market this summer.

Michael Burry, Temasek add JD.com, Alibaba holdings as Dalio offloads China stocks

“It is well understood that China’s recovery will not in any way, shape or form be linear like the recoveries of yesteryears, especially with youth unemployment hitting 20 per cent,” said Stephen Innes, managing partner at SPI Asset Management. “That is an unsettling and scary number.”

Trading interest in Chinese stocks has subsided quickly as investors shun risky assets. Combined daily turnovers on the Shanghai and Shenzhen exchanges dropped below the 1 trillion yuan (US$143 billion) threshold for a sixth consecutive day on Wednesday, after snapping a streak of 23 days in a row when trading values surpassed the mark, according to Bloomberg data. Hong Kong’s market is no better, with trading values sliding to a seven-month low of HK$66.2 billion (US$8.5 billion) on May 3.

The number of investors expecting a stronger economic recovery in China in the year to come dropped to 49 per cent of the respondents surveyed by BofA in the week from May 5 to 11, down from 79 per cent in April, according to the bank’s latest poll. Fund managers also believe that low risk appetite among Chinese households will make investments the lowest priority, the survey showed.

AI boom, China’s waning recovery to boost SOE, tech stocks rally: brokerages

Saxo’s Wong does not expect the rangebound trading pattern to end any time soon amid a lack of fresh catalysts and trading enthusiasm.

“It could happen when economic data improves or for whatever reason the market breaks the upside of the range and triggers the fear-of-missing-out buying alongside another round of bullish chorus,” he said. “Many investors are sitting on the sideline and positions are light overall in Chinese stocks now.”