Alibaba, Tencent, tech stocks pare gains in Hong Kong on ‘indecipherable’ fines while China deflation, Fed rate concerns persist

- Alibaba Group, Tencent pared gains on bets the latest billion-dollar fines will mark the end of China’s tech sector crackdown

- Hong Kong’s biggest developers surrendered an advance, despite biggest easing measures since 2009 on mortgage financing limits for first-time house buyers

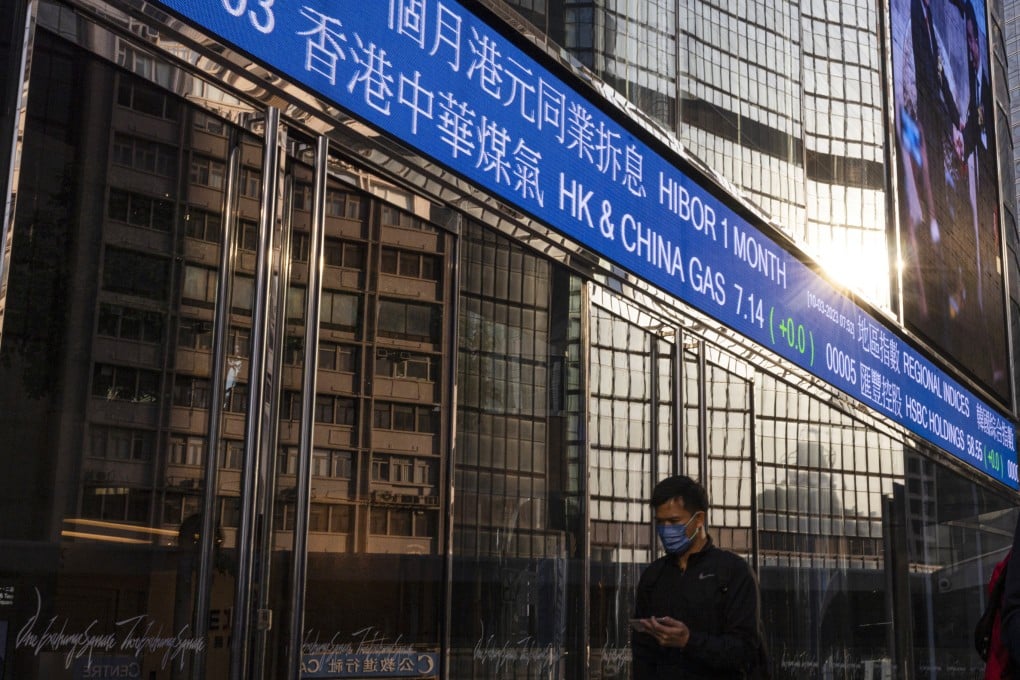

The Hang Seng Index advanced 0.6 per cent to 18,479.72 at the close of Monday trading, recovering from a five-week low. The benchmark earlier surged by as much as 2.2 per cent. The Tech Index added 1.1 per cent while the Shanghai Composite Index advanced 0.2 per cent.

Alibaba Group climbed 3.2 per cent to HK$87, following an 8 per cent rally in New York trading on Friday in the stock’s biggest gain since March. Tencent gained 0.7 per cent to HK$328.80. Tech peers like Meituan added 1.7 per cent to HK$121.10 while Baidu strengthened 0.2 per cent to HK$137.70.

The People’s Bank of China on Friday penalised Ant Group, an Alibaba Group Holding affiliate, 7.12 billion yuan (US$984.3 million) in what analysts deemed as the closure to years of crackdown on unfair market practices. The central bank fined Alipay 3.09 billion yuan and Tenpay 2.99 billion yuan. Alibaba Group is the owner of this newspaper.

“The fines are significant yet still indecipherable,” said Brock Silvers, chief investment officer at Kaiyuan Capital in Hong Kong. “As one-off expenses, they will not change long-term views. Confidence in China’s investability has hit a generational low, and regulatory instability could re-emerge at any moment with new, unexplained and unappealable billion-dollar fines.”

The MSCI China Index, dominated by tech giants listed at home and abroad, has lost more than US$1 trillion in market value since its peak in early 2021, according to Bloomberg data, in the aftermath of China’s antitrust crackdown and Covid-19 lockdowns.