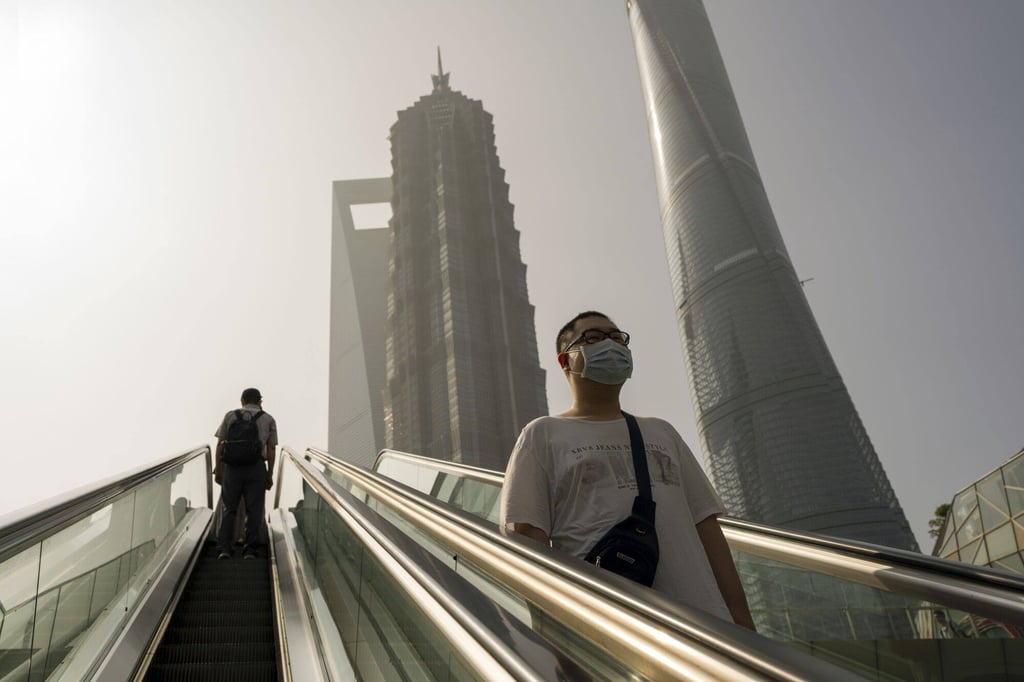

China’s office vacancy rates rise in top cities as growing oversupply of premium space hits amid economic malaise

- In Shanghai, the vacancy rate for grade-A office space is expected to reach 19 to 21 per cent by the end of the year

- High levels of new inventory are about to hit the market in top cities including Shanghai, Beijing, Guangzhou and Shenzhen, putting pressure on rents

Companies in China’s top-tier cities will have a good chance to reduce office rental costs in the second half of the year due to a faltering economy and an increasing supply of new space.

With vacancy rates on the rise in Shanghai, Beijing, Guangzhou and Shenzhen, rents will continue to drop as landlords come under pressure to sign leasing agreements, according to property consultancy CBRE.

In Shanghai, the mainland’s commercial and financial hub, the vacancy rate of grade-A office space is expected to reach 19 to 21 per cent by the end of the year, compared to 18.7 per cent in June, while average rents could decline by as much as 0.5 per cent.

“China’s economy and property market failed to live up to expectations after the reopening,” said Sam Xie, head of research at CBRE China. “Newly built office space to hit the market [in the coming months] will benefit corporate tenants as they will have bargaining chips to negotiate with landlords on rent rates.”