Invesco, Nomura pour cold water over chances of China’s Politburo launching massive stimulus package

- The Politburo is due to meet by the end of July to review China’s first-half economic performance and set the policy tone for the rest of the year

- The June data ‘suggests a lower probability of robust stimulus measures’, Invesco says

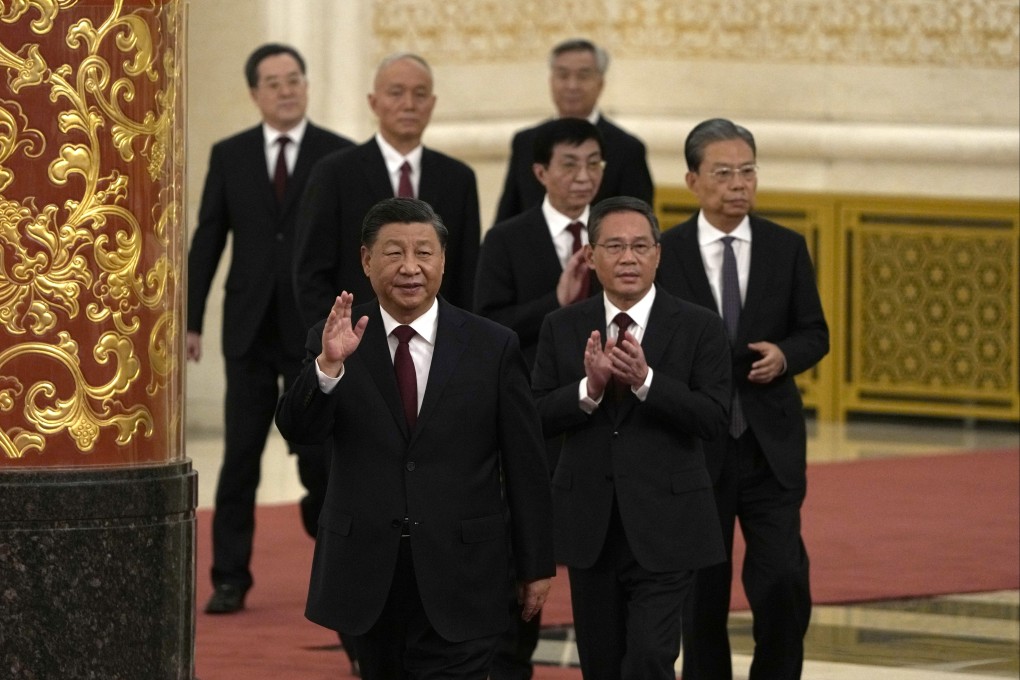

President Xi Jinping and his 23 colleagues in the Politburo are due to convene a meeting by the end of July to review China’s first-half economic performance and set the policy tone for the rest of the year.

The Politburo meeting is on stock traders’ radars, and they will look for any clues on how Xi’s government will steer the world’s second-largest economy out of a slowdown after growth momentum has moderated. Piecemeal measures aimed at reviving growth – from 10 basis-point cutbacks in borrowing costs to loosening of the property market in smaller cities – have so far failed to impress investors, with benchmarks of both onshore and offshore stocks lagging other key markets in Asia.

The CSI 300 Index dropped 0.4 per cent on Tuesday, extending the 0.8 per cent drop recorded a day earlier, while the Hang Seng Index slid 2.1 per cent as trading resumed after being suspended because of a typhoon in Hong Kong.