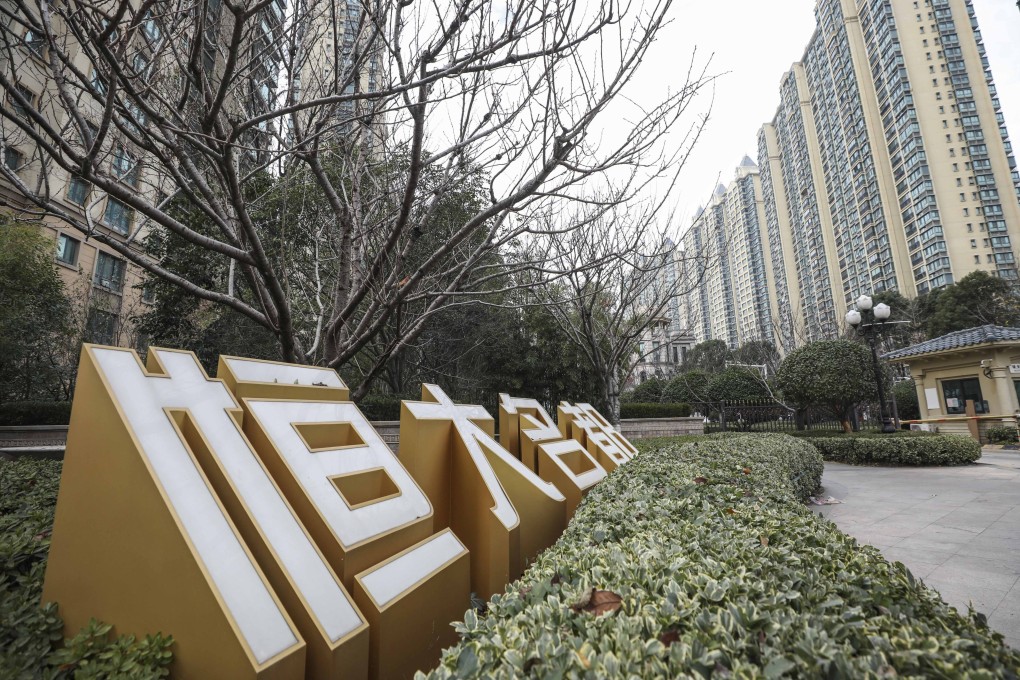

Explainer | How China Evergrande’s Hui Ka-yan is saving his property empire from sinking under US$340 billion in liabilities

- Debt-laden developer enters a critical make-or-break third quarter, as restructuring awaits approvals from courts, voting by offshore creditors

- Saddled with US$340 billion in total liabilities, founder Hui is fixing US$20 billion of defaulted offshore bonds, claims and obligations in first act of survival

The Shenzhen-based group is seeking approvals from courts in Hong Kong and Cayman Islands later this month, and from a host of creditors some time in August or September, to reorganise the most urgent portions of its 2.44 trillion yuan (US$340 billion) of liabilities.

Here’s a look at Evergrande’s latest financials, and how the 64-year old Hui is trying to save his empire from China’s corporate graveyard.

What do the latest financial report cards show?

Evergrande recorded a net loss of 105.9 billion yuan for the year ended December 31, 2022, after incurring a 476 billion yuan deficit in 2021. It earned 8.1 billion yuan of profit in 2020. Revenue fell to 230.1 billion yuan in 2022 from 250 billion yuan in 2021 and 507 billion yuan in 2020.

It had only 4.3 billion yuan of unencumbered cash on December 31, 2022.

How much does Evergrande owe banks and creditors?

The group had 2.44 trillion yuan in total liabilities on December 31, 2022. The largest category was trade and other payables, totalling 1 trillion yuan.