Explainer | How China Evergrande’s Hui Ka-yan is saving his property empire from sinking under US$340 billion in liabilities

- Debt-laden developer enters a critical make-or-break third quarter, as restructuring awaits approvals from courts, voting by offshore creditors

- Saddled with US$340 billion in total liabilities, founder Hui is fixing US$20 billion of defaulted offshore bonds, claims and obligations in first act of survival

The Shenzhen-based group is seeking approvals from courts in Hong Kong and Cayman Islands later this month, and from a host of creditors some time in August or September, to reorganise the most urgent portions of its 2.44 trillion yuan (US$340 billion) of liabilities.

Here’s a look at Evergrande’s latest financials, and how the 64-year old Hui is trying to save his empire from China’s corporate graveyard.

What do the latest financial report cards show?

Evergrande recorded a net loss of 105.9 billion yuan for the year ended December 31, 2022, after incurring a 476 billion yuan deficit in 2021. It earned 8.1 billion yuan of profit in 2020. Revenue fell to 230.1 billion yuan in 2022 from 250 billion yuan in 2021 and 507 billion yuan in 2020.

It had only 4.3 billion yuan of unencumbered cash on December 31, 2022.

How much does Evergrande owe banks and creditors?

The group had 2.44 trillion yuan in total liabilities on December 31, 2022. The largest category was trade and other payables, totalling 1 trillion yuan.

It had 612.4 billion yuan of borrowings in 2022, little changed from 2021. The average cost of money was 8.12 per cent a year, versus 8.38 per cent in 2021. Some 20 per cent of its interest-bearing debt was offshore debt, according to its accounts.

There were 1,519 outstanding cases against the company as of end-2022, involving a total of 395.4 billion yuan. The group’s material contingent liabilities rose to 46.8 billion yuan from 9.2 billion yuan a year earlier.

What is the worst-case financial scenario?

Deloitte Advisory (Hong Kong) performed a recovery analysis involving 80 per cent of Evergrande’s net asset value as of November last year. Offshore creditors may be able to recover 9.73 billion yuan, assuming the developer is forced into liquidation.

Offshore unsecured creditors may recover only 2.05 cents to 3.53 cents for every dollar owed, the firm estimated, while investors holding Evergrande’s defaulted dollar-denominated bonds may get back only 5.92 cents to 9.34 cents per dollar.

Shareholders, who have contributed more than 4.2 billion yuan of equity to the company and rank last in the repayment queue, are likely to see their capital completely wiped out.

How many junk-rated bonds and other debts are in default?

Under its debt restructuring plan, Evergrande is dealing with two groups of creditors involving about US$20 billion of claims.

How will Evergrande repay its creditors in the workout plan?

Evergrande plans to issue new bonds to both classes of creditors plus hybrid securities that are convertible into its own shares, and into equities of its two key units involved in property management services and new-energy vehicles.

For class A creditors, Evergrande will issue new bonds maturing in 10 to 12 years, paying cash interest of 2 to 3 per cent a year (or additional new bonds in lieu of coupon payments). It will also issue new bonds maturing in five to nine years, paying 5 to 7 per cent annual coupon, which may be elected by both classes of creditors.

Both sets of creditors will have an option to receive a security package comprising

-

New bonds that must later be converted into Evergrande shares equivalent to 29.9 per cent of its enlarged capital after five years

-

New bonds that can be exchanged into a 21.6 per cent stake in Evergrande Property Services after two years

-

New bonds exchangeable into a 38.9 per cent stake in Evergrande New Energy Vehicle Group after two years

In essence, the workout entails handing out more than US$15 billion in new bonds and converting at least US$4.25 billion of debt into the equity in the three companies.

How will Evergrande redeem the new bonds in future?

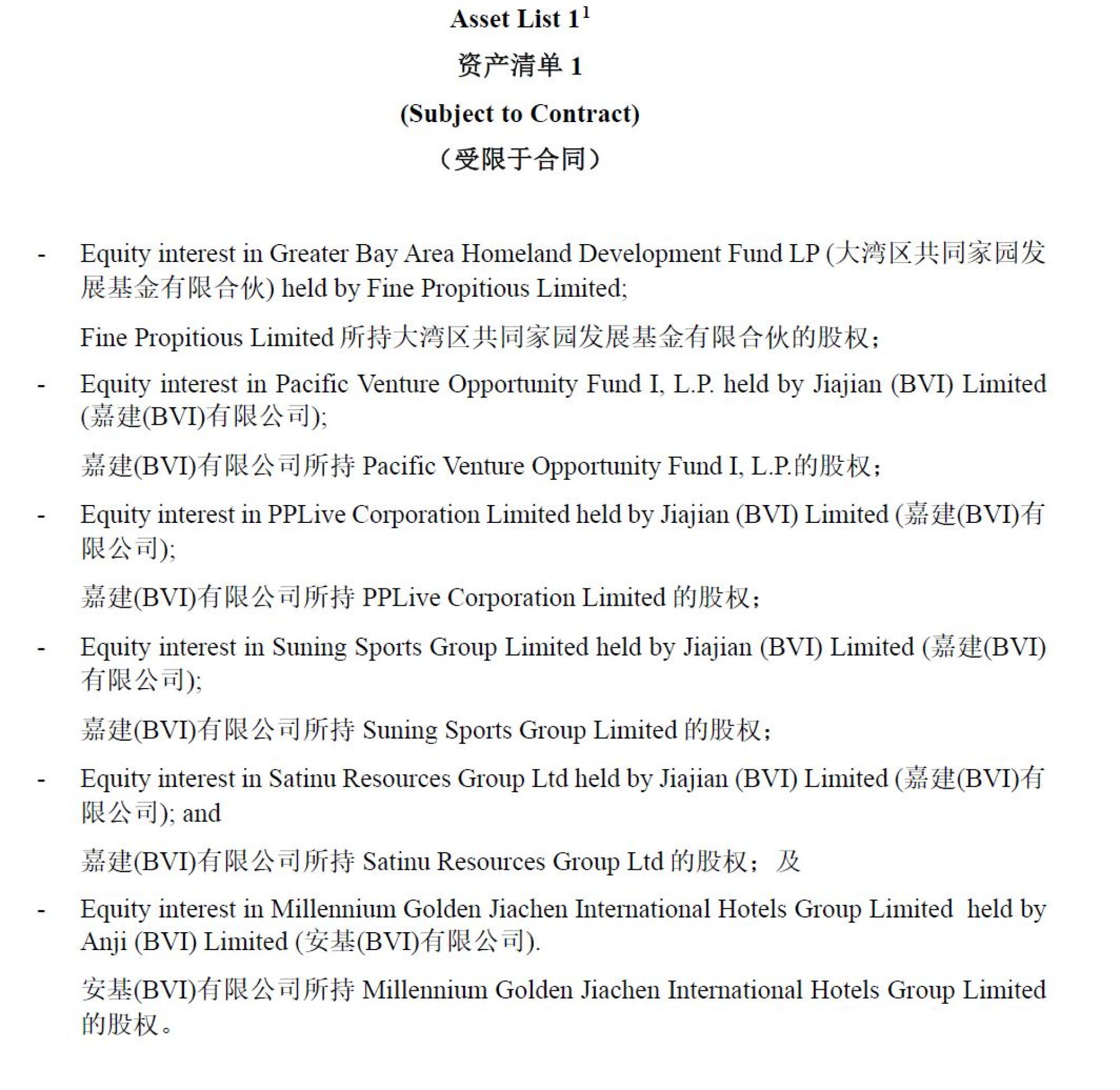

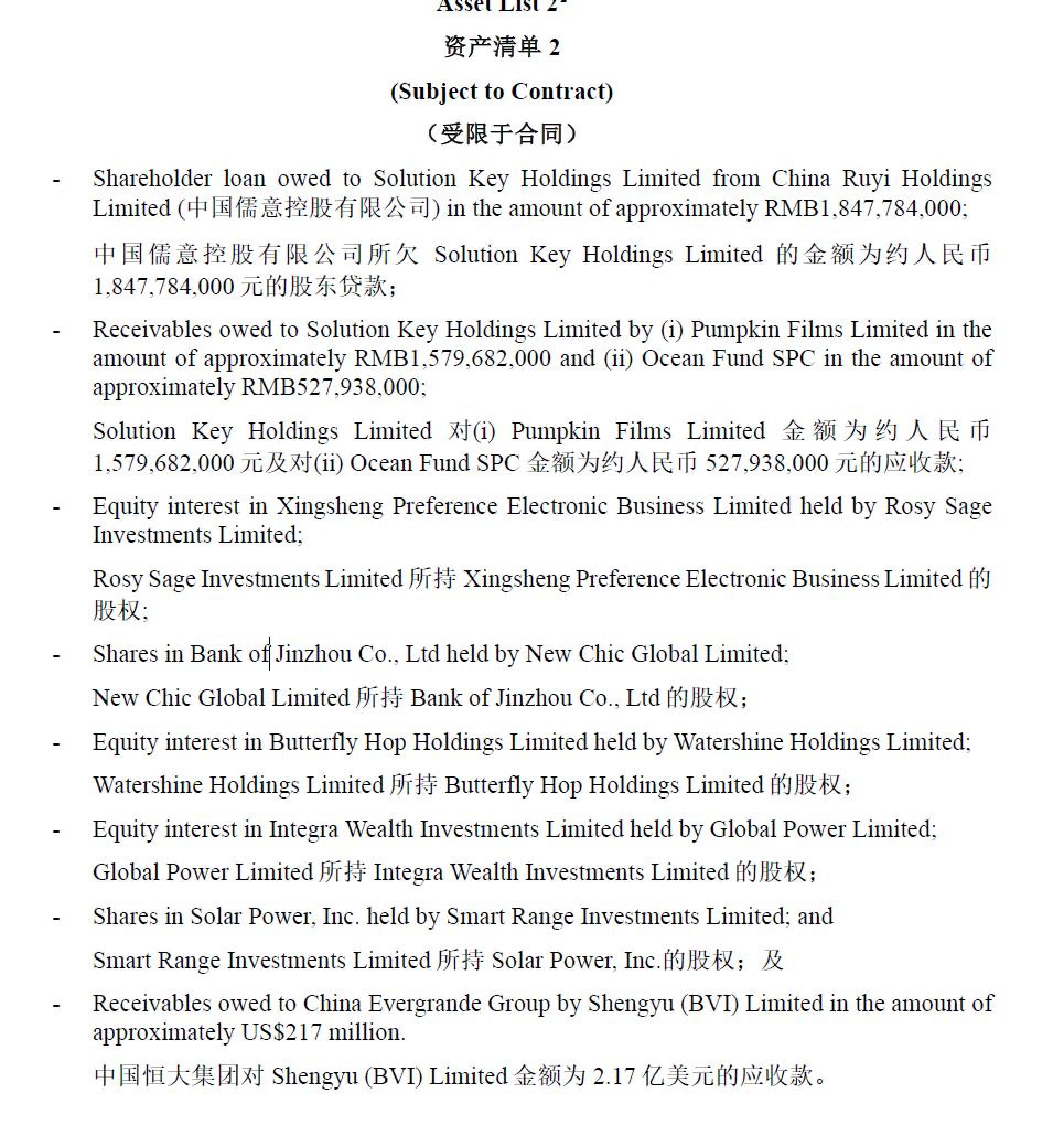

As a backstop, Evergrande and Hui have pledged several parcels of “noncore offshore assets” that are said to be unrelated to its property business in mainland China to creditors in the restructuring.

The assets, valued at about US$4 billion in August 2022, may be sold to raise cash to redeem the new bonds.

What is the implied market value of Evergrande shares?

The future conversion or exchangeable price is 55.75 HK cents each for China Evergrande shares, HK$2.30 each for Evergrande Property Services shares and HK$3.84 each for Evergrande NEV shares.

What are the key dates in the restructuring timeline?

-

July 24-25: Evergrande is seeking the approvals from courts in Hong Kong, Cayman Islands and Eastern Caribbean for consent to convene scheme meetings of creditors

-

Late August: assuming consent from the courts, Evergrande expects to hold the scheme meetings and apply to the same courts again to sanction the workout plan

-

Late September: Evergrande expects the restructuring to be legally effective

-

Late September: Evergrande expects to file for Chapter 15 proceedings in US bankruptcy court to give its debt restructuring plan worldwide recognition

What analysts say about the debt and restructuring

Kaiyuan Capital: “The results will not make offshore debt restructuring any easier for Hui Ka-yan,” said Brock Silvers, chief investment officer. “Creditors were unimpressed with Evergrande’s earlier offers, and the results now reveal balance-sheet problems that seem potentially terminal.

“This should significantly lessen the already low appeal of Hui’s offer of extended maturity notes.

“Evergrande’s financial accounts, which even its chosen auditor could not support with an opinion, merely highlight the dramatically increased credit risk Hui has asked bondholders to accept.

“I don’t see any cause for optimism with regard to next week’s Hong Kong court hearing. Evergrande is likely to have to approach creditors with an enhanced offer if it hopes to resolve its ongoing US bond woes.”

CreditSights: “Unsurprisingly, the headline figures were ugly,” Sandra Chow, co-head of Asia-Pacific research in Singapore, said in a report on July 18. “It is hard to base any meaningful analysis on the [latest] figures, especially given the questions over their accuracy and the fact that they are already over seven months out of date.”

Evergrande’s bond prices were relatively unchanged after the release of its results, and were trading between 5.4 cents and 7.2 cents at the time of the report. The lack of secondary price action is unsurprising, given Evergrande’s ongoing restructuring, she added.