China Evergrande’s EV unit plunges 69 per cent, wiping out US$2.7 billion in market value as stock resumes trading after 16-month suspension

- Evergrande NEV’s shares slumped as much as 69 per cent after trading resumed for the first time since March 31 last year, with some 465 million shares changing hands

- The company reported a loss of 27.7 billion (US$3.9 billion) yuan last year, narrowing the deficit from 56.3 billion yuan in 2021

Evergrande NEV plunged by as much as 69 per cent to HK$1 on Friday, trading for the first time since March 31 last year on the Hong Kong stock exchange. It recouped some of its losses to close 61 per cent lower at HK$1.24, with around 465 million shares, or 4 per cent of its outstanding shares, changing hands.

The sell-off underscores investors’ mounting concern about the company’s ability to remain afloat, as its parent China Evergrande Group has been bogged down by daunting debt restructuring efforts. Evergrande NEV had liabilities of 183.9 billion yuan (US$25.7 billion) and assets of 115.2 billion at the end of last year, according to its latest annual result released on Wednesday. The company’s shares have lost 98 per cent of their value since hitting an all-time high on February 17, 2021.

Evergrande NEV now has a market capitalisation of HK$13.1 billion (US$1.7 billion), less than 2 per cent of China’s biggest EV maker BYD, according to Bloomberg data.

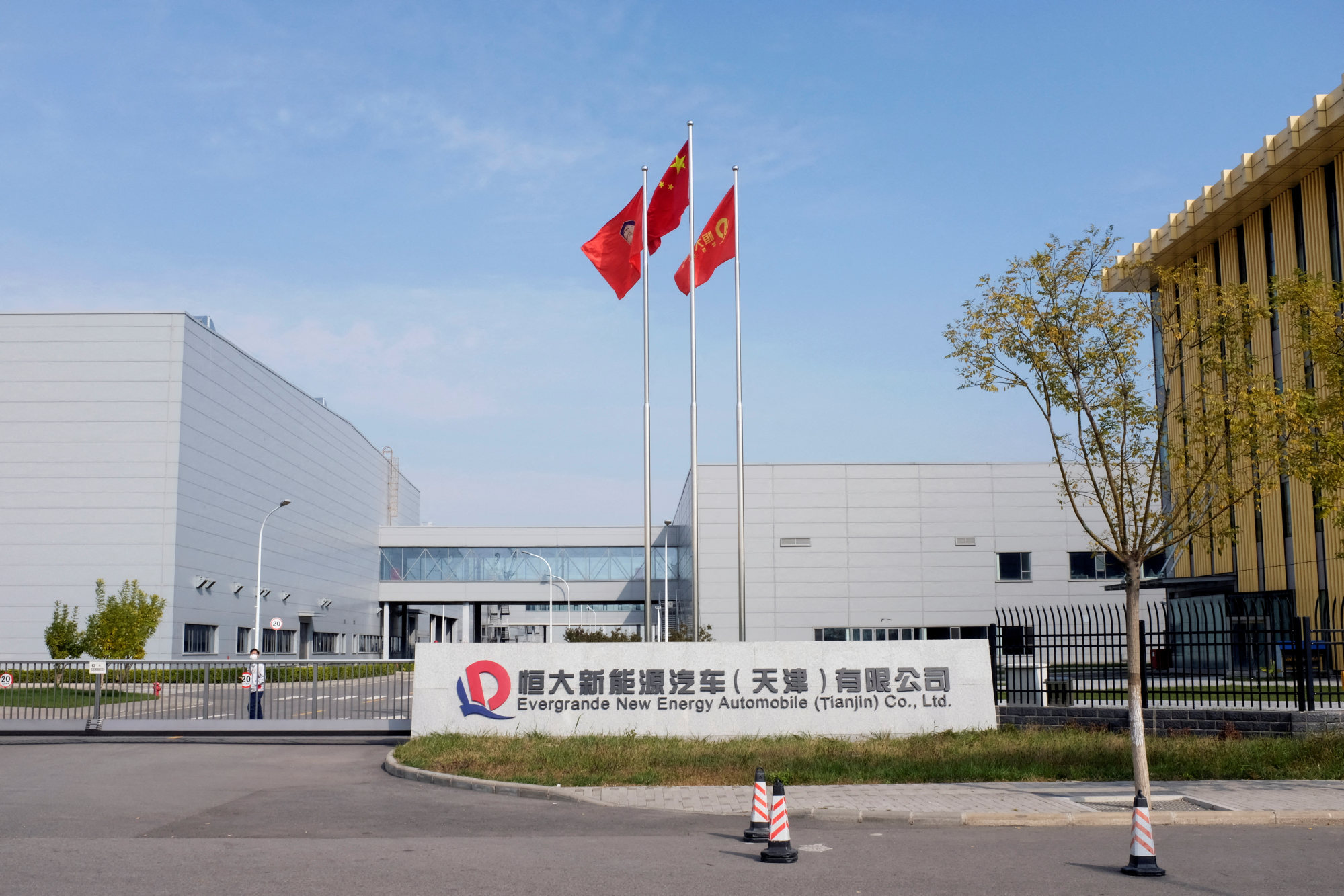

The company said in the filing that because of the liquidity crisis it has been unable to fully utilise the production capacity of its Tianjin plant and pay workers’ salaries on time. It plans to tap equity or debt financing to raise about US$500 million to finance the production and sales of Hengchi 5, its only EV model, as well as business operations.

Evergrande NEV reported a loss of 27.7 billion yuan last year, down from 56.3 billion yuan in 2021, according to its annual reports.

So far, the EV maker has delivered more than 1,000 units of the Hengchi 5 model and achieved mass production, Evergrande NEV said. The company aims to roll out the Hengchi 6 and 7 models going forward, it added.

The trading resumption of Evergrande NEV is significant for China Evergrande Group, which has a 59 per cent stake in the EV maker, as the troubled property developer is in talks with creditors to restructure its debts and may use its stake in the carmaker to offset some debt payments.

Shares of China Evergrande Group have been suspended since March 18 last year pending debt restructuring. The stock last closed at HK$1.65, 95 per cent lower than the record high on October 20, 2017.

Another listed unit, Evergrande Property Services Group, has also been halted from trading from the same date. It last traded at HK$2.30, 88 per cent off its peak on February 17, 2021.

Suspensions of more than 18 months lead to delisting, according to the Hong Kong exchange’s rules.