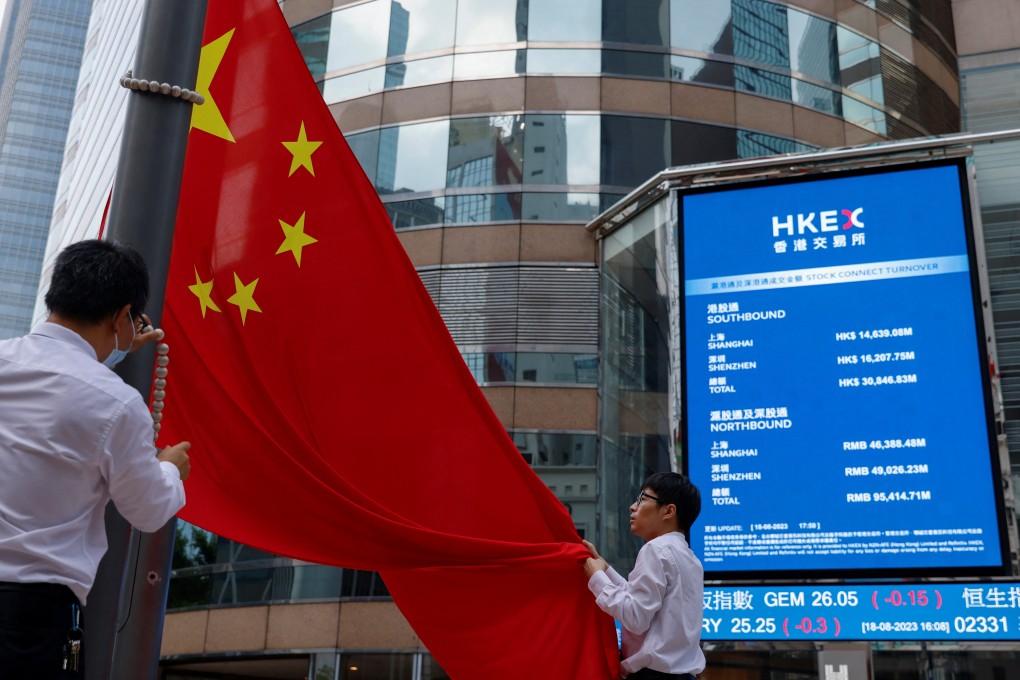

Hong Kong stocks slump to fresh 9-month low as regulators’ measures to prop up growth fail to inspire investors

- The latest measures unveiled by financial regulators to shore up the economy and the equity markets fell short of expectations

- The Hang Seng gauge tumbled almost 6 per cent last week for the worst sell-off in five months

The Hang Seng Index fell 1.8 per cent to 17,623.29 at the close, the lowest level since November 28 again. The Hang Seng Tech Index dropped 2.1 per cent and the Shanghai Composite Index retreated 1.2 per cent.

Among the biggest losers were shipping company Orient Overseas International, which tumbled 5.6 per cent to HK$113.90 after announcing that first-half profit decreased 80 per cent from a year earlier, and Xinyi Solar Holdings which sank 5.4 per cent to HK$6.51.

China Life Insurance lost 4 per cent to HK$11.12, and Ping An Insurance was down 3.5 per cent to HK$43.85.

Tencent Holdings shed 2.2 per cent to HK$318 and Alibaba Group Holding retreated 1.5 per cent to HK$85.70. Baidu sank 3.3 per cent to HK$121.90 before its earnings result due Tuesday.

“The policy focus will now strike a balance between short-term economic growth and the nation’s long-term strategy,” said Xu Chi, an analyst at Zhongtai Securities. “That means it might be unrealistic to see central-level fiscal stimulus measures expected by the market. The policies at this stage will more tilt towards boosting market confidence.”