HKEX, Alibaba, BYD lead Hong Kong stock rally as China’s stamp duty, margin cuts revive confidence

- Stocks rallied on the back of China’s measures to lift market confidence, following an exodus of foreign funds from onshore markets

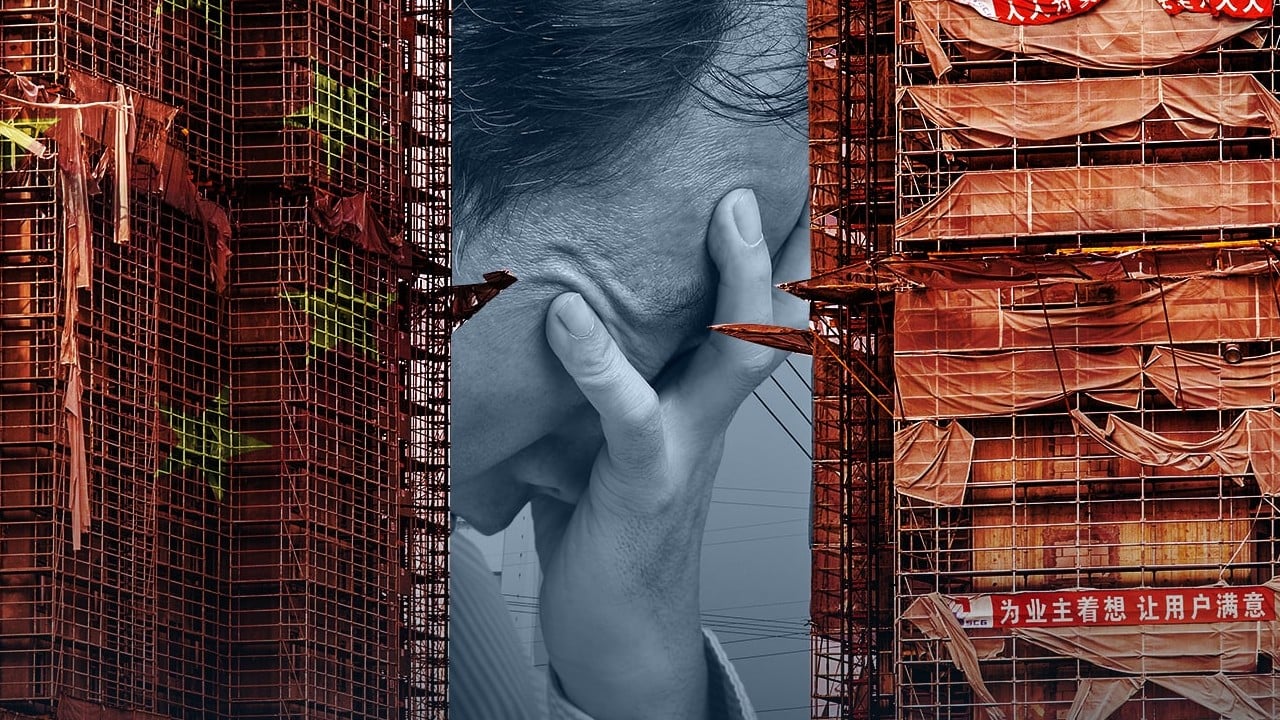

- Rally eluded China Evergrande, which crashed 79 per cent, as the stock resumed trading after a 17-month suspension over its debilitating debt crisis

The Hang Seng Index rose 1 per cent to 18,130.74 at the close of Monday trading. The benchmark earlier surged by as much as 3.4 per cent, the most since July 25. The Tech Index gained 1.7 per cent while the Shanghai Composite Index jumped 1.1 per cent.

Bourse operator Hong Kong Exchanges and Clearing climbed 3.3 per cent to HK$297.20, while PC maker Lenovo surged 3 per cent to HK$8.28. China Merchants Bank added 1 per cent to HK$31.05 after reporting a 9.2 per cent increase in first-half profit. Alibaba Group gained 1.6 per cent to HK$88.90 and Meituan added 1.9 per cent to HK$134.70.

Elsewhere, BYD advanced 0.7 per cent to HK$225.20, Xiaomi rose 0.8 per cent to HK$12.20 and Ping An Insurance strengthened 2.1 per cent to HK$45.40. The trio are due to post their latest earnings results this week.

“These are some of the most forceful measures I’ve ever seen in this round of the efforts to rescue the market,” said Dai Ming, a fund manager at Huichen Asset Management in Shanghai. “The market has already found the bottom here at least for the short term. Lots of investors will turn bullish and increase their positions now.”