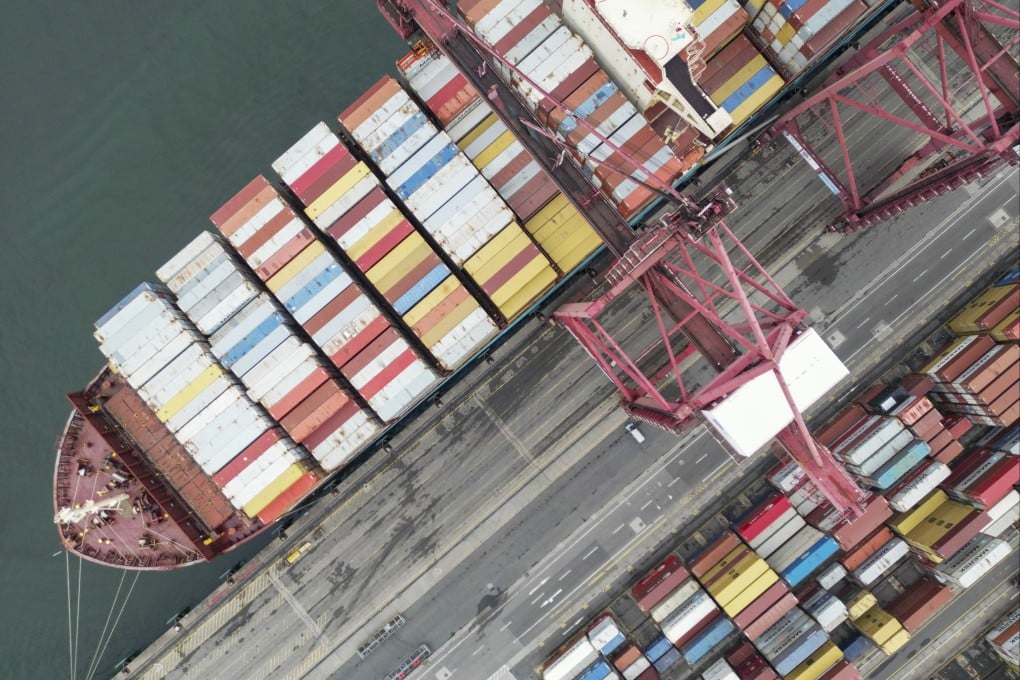

Climate change: launch of biofuel blended shipping fuel by Hong Kong firm is just the start of the search for the ultimate green solution

- Chimbusco Pan Nation Petro-Chemical says it has achieved a first for China by refuelling an ocean-going vessel using a climate-friendly marine biofuel mix

- The company needs to continue its search for other affordable long-term alternatives to meet the requirements of a decarbonisation drive by the industry, says director

The biofuel blend, which has a far lower carbon footprint than conventional bunker fuel, was used to power a vessel operated by Japanese shipping firm Kawasaki Kisen Kaisha last month, said director Calvin Chung Dik-hong.

“There are many options, such as methanol, liquefied natural gas (LNG) and ammonia, besides battery-powered and solar or wind energy-assisted vessels,” he told the Post. “Each has its advantages and disadvantages and no particular one is the clear winner. The industry is at an exploratory stage.”

Ammonia and methanol, traditionally made from fossil fuel, can now be produced as so-called green fuels if they are derived from hydrogen made using renewable energy.

In July the IMO, a United Nations agency responsible for regulating shipping, upgraded the global industry’s climate ambitions, committing its 175 member nations to net zero greenhouse gas emissions by 2050.