China’s 10-year sovereign bond jumps, driving yield to lowest since 2020 as bets on interest-rate cuts increase

- The yield on the benchmark government bond was 2.494 per cent on Wednesday and has dropped 6.7 basis points this year

- Analysts say the yield may drop further as traders expect more cuts in lending rates in 2024 amid iffy economic signals

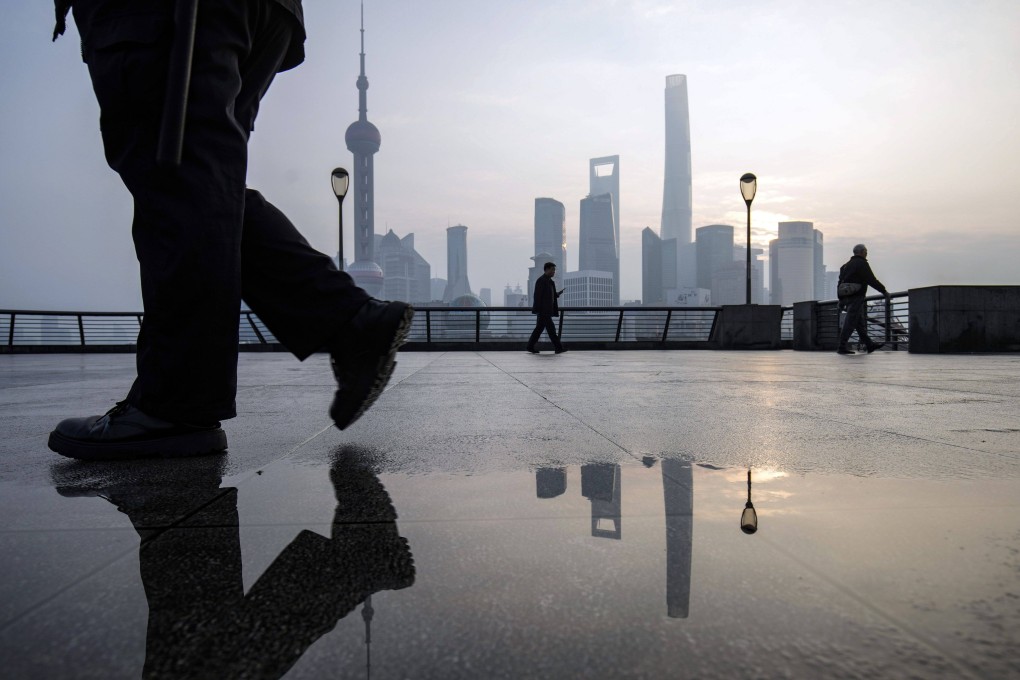

A jump in China’s benchmark 10-year government bond has sent its yield to its lowest since 2020 as traders ramped up wagers that policymakers will cut interest rates this year to rejuvenate growth.

The debt yield was 2.494 per cent on Wednesday, a level not seen since April 29, 2020, and has dropped 6.7 basis points this year, according to Bloomberg data. Bond yields move in opposition to prices.

The resilience in the debt market stands in sharp contrast with yuan-traded stocks, which are off to their worst start to a year in more than two decades.

Bond traders have been increasing their bets that more cuts in lending rates will be delivered in 2024 after a deluge of stimulus measures – including eased restrictions on home purchases and 1 trillion yuan (US$139.4 billion) in special sovereign bonds – have done little to fuel a strong recovery.

Meanwhile, cuts in the deposit rates by major commercial banks late last year have left more wiggle room for lower lending rates, with wider net-interest margins in place now.

“There’s no turnaround of weak fundamentals now on the backdrop of a sluggish property market, high levels of local-government debts and China’s transition to a new growth model,” said Zhang Jiqiang, an analyst at Huatai Securities in Beijing. “Looking forward into the second quarter, the yield may even test 2.4 per cent.”