Chinese EV battery maker CATL expects 2023 profit to jump as much as 48 per cent as it maintains huge advantage over rivals

- The world’s largest EV battery manufacturer expects net profit for 2023 to have climbed by as much as 48 per cent

- ‘CATL has maintained its advantage over smaller domestic rivals,’ Soochow Securities said in a research note

Its fourth-quarter profit, which is derived by comparing the full-year earnings estimate and its nine-month results published in October, would be 11.35 billion yuan to 14.35 billion yuan, an increase of 8.9 per cent to 37.6 per cent from the previous three months.

“Rising sales volume in tandem with lower production costs boosted its profitability in the fourth quarter,” Soochow Securities said in a research note on Wednesday. “CATL has maintained its advantage over smaller domestic rivals.”

The EV battery maker reported an unexpected quarter-on-quarter profit drop of 4.3 per cent in the three months ending September 30, owing to a currency exchange loss caused by a volatile Chinese yuan.

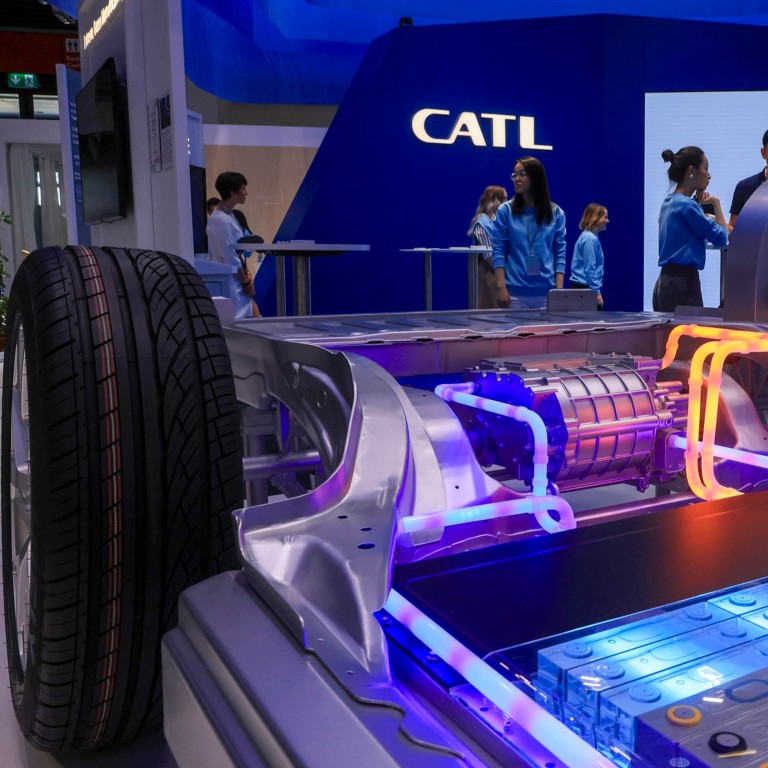

CATL, which had a 37.4 per cent share of the global market with an output of 233.4 gigawatt-hours (GWh) of batteries in the first 11 months of 2023, sold 40 per cent of its products outside mainland China.

Technically, 1GWh of batteries is enough to power about 13,000 electric cars with a driving range of 500 kilometres.

In the world’s largest EV market, about two out of every five new cars taking to the streets are powered by battery.

Deliveries of electric cars in the mainland account for about 60 per cent of the global total.

The Shenxing battery can offer a 400km driving range after just 10 minutes of charging and reach 100 per cent capacity in just 15 minutes as a result of its so-called 4C charging capabilities.