Hong Kong stock rally fizzles before Alibaba report as traders look to earnings, buy-backs, state support to lift sentiment

- Hang Seng Index retreated from the highest level since January 11; markets are banking on Alibaba’s earnings to add to other recent bullish report cards

- State fund support may not sustain this week’s mini-rally as drivers of negative sentiment are not being addressed, says Brock Silvers at Kaiyuan Capital

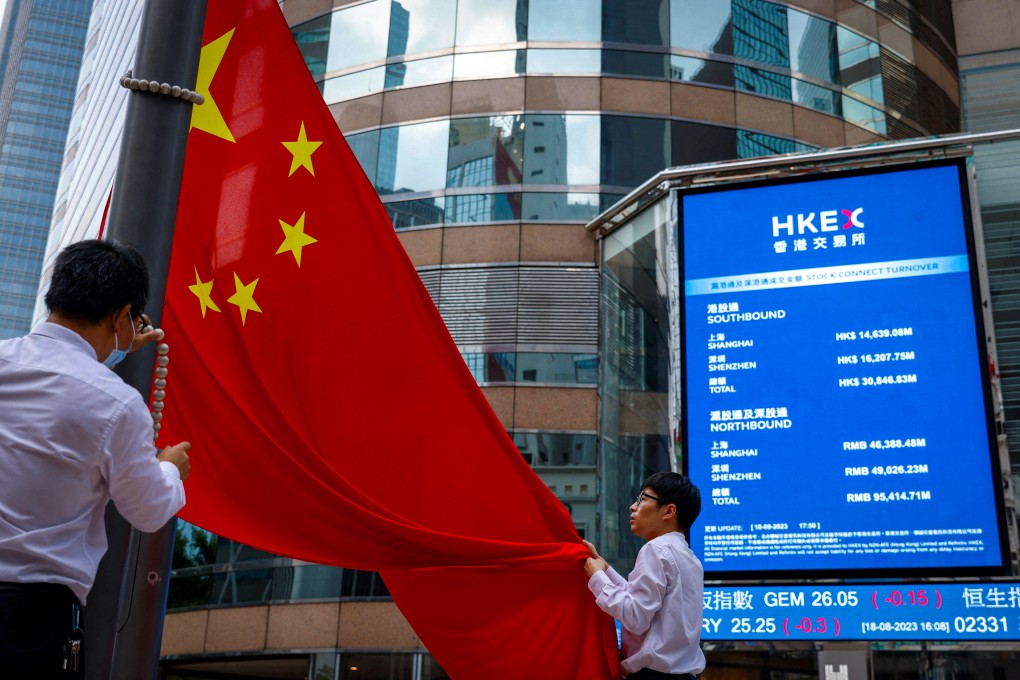

The Hang Seng Index slipped 0.3 per cent to 16,081.89 on Wednesday, reversing a 1.7 per cent gain. The Tech Index lost 1.6 per cent, while the Shanghai Composite Index advanced 1.4 per cent.

Alibaba Group dropped 1.5 per cent to HK$74.90, overturning an earlier 1.4 per cent gain on optimism quarterly income from the operator of Taobao e-commerce platform will exceed forecasts. Rival JD.com declined 2.6 per cent to HK$90.35. Chip maker SMIC slumped 8 per cent to HK$14.12 and PC maker Lenovo lost 4.3 per cent to HK$8.12.

Net income for Alibaba, the owner of this newspaper, probably rose 20 per cent to almost 48 billion yuan (US$6.7 billion) in the December quarter from the preceding three months, according to analysts tracked by Bloomberg. Other earnings on Tuesday from fast-food chain operator Yum China and chip maker SMIC beat market consensus.

Corporate actions like buy-backs may keep the market upbeat, in a week when China’s state-run funds and market regulator have intervened to arrest a slump in confidence. Stocks listed in Shanghai, Shenzhen and Hong Kong have lost more than US$5 trillion since early 2021 as China’s post-Covid economic recovery ran out of gas.