China’s energy trade with Middle East set to surge since Beijing brokered last year’s Iran-Saudi deal, UBS says

- ‘We believe the Beijing Accord of March 2023 has significant economic and market implications that investors may have overlooked,’ says the Swiss bank

- Report says energy-related trade between China and the Middle East could raise the aggregate trade value of both regions by 11 per cent in 2030

“We believe the Beijing Accord of March 2023 has significant economic and market implications that investors may have overlooked,” he said in an analysis on Monday.

“We see energy representing a more trade-focused collaboration than seen to date, with likely more immediate monetisation potential and thus a quicker potential impact on share prices.”

In the six months immediately after the deal was signed, Saudi Arabia invested US$16 billion in the Chinese energy sector, according to data compiled by UBS.

Liu estimated that energy-related trade between China and the Middle East could raise the aggregate trade value of both regions by 11 per cent in 2030.

For renewables, the additional trade is expected to come from China’s increasing green energy penetration in the Middle East, as the region accelerates its energy transition by leveraging the country’s complete renewables equipment supply chain, according to Liu.

The Middle East has been increasingly importing renewable energy modules from China, the world’s largest wind turbine and solar panel maker. In 2023, China exported 14.5 gigawatts (GW) of solar modules to the region, up from 11.4GW in 2022, according to data from InfoLink Consulting.

Additional trade in the petrochemicals sector could come from the larger market share taken by the Middle East and China jointly from Europe, as European factories are likely to exit the market faster due to environmental, social, and governance (ESG) concerns and tight gas supply, UBS said.

“The implications of this theme are broad. Chinese renewables and especially grid equipment players are the most immediate beneficiaries,” said Liu.

“European petrochemicals are most at risk from this theme in the long term as higher cost bases could pressure market share.”

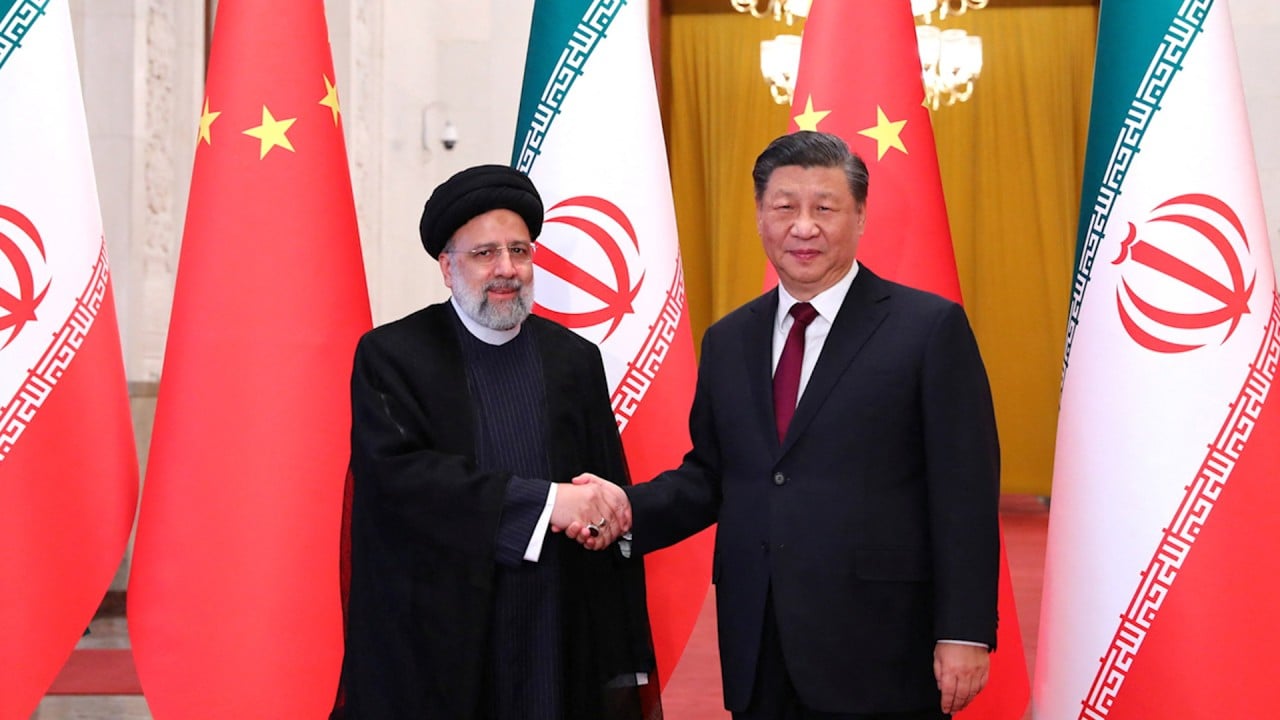

Spearheaded by the Chinese government and endorsed by President Xi Jinping in late 2013, the Belt and Road Initiative aims to improve trade and economic integration across Asia, Europe, and Africa.