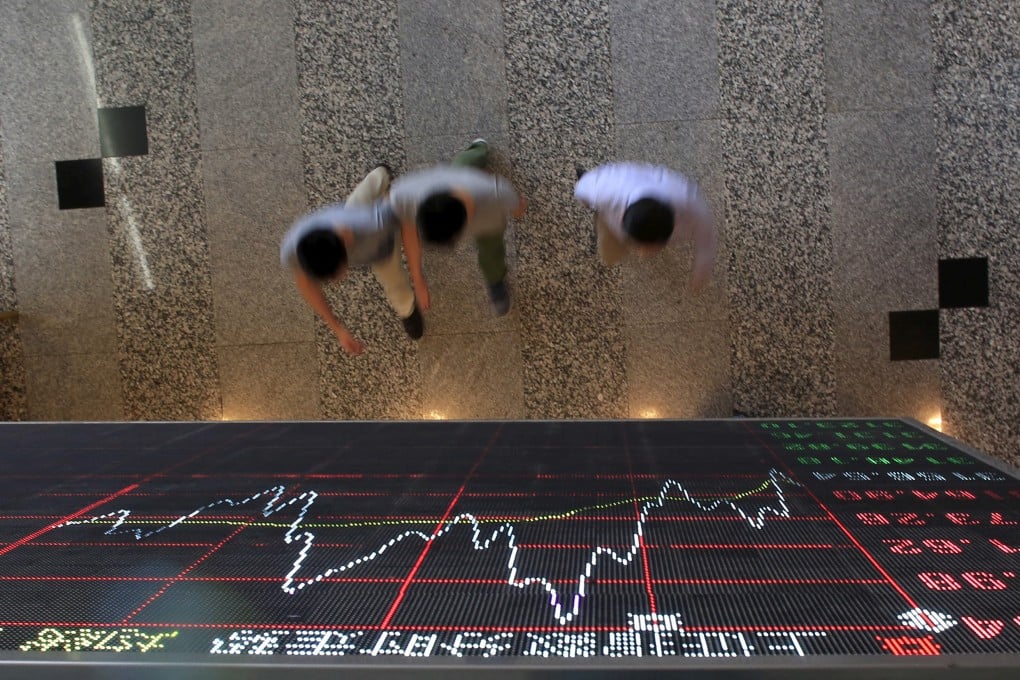

Goldman Sachs says China stocks may rise by 40% on market reforms as UBS goes overweight on mainland, Hong Kong shares

- Goldman sees a ‘potentially stronger risk appetite and a more conducive trading environment for A shares in the near term’

- UBS raises rating on the MSCI China Index and Hong Kong stocks to overweight, citing earnings resilience and policy support

Valuations for the yuan-traded stocks, also known as A shares, may expand by as much as 40 per cent if China’s market manages to close gaps with global leaders in terms of factors including dividend payouts, buy-backs, corporate governance and institutional ownership after the sweeping reforms, Goldman analysts led by Kinger Lau wrote in a note on Tuesday.

Meanwhile, UBS raised its rating on the MSCI China Index and Hong Kong stocks to overweight, citing earnings resilience and policy support.

China’s State Council, or cabinet, issued a nine-point guideline earlier this month to prop up the US$9 trillion stock market, which has been reeling from a faltering growth outlook and an exodus of foreign investors over the past year. The new guidelines stress the quality of listed companies, regulatory supervision and investor protection, marking a shift from a focus on development in previous policy frameworks.

It was the third time the cabinet has issued such a document directly targeting the stock market, with the previous two being in 2004 and 2014.