Suning boss burns billion-dollar fortune as soured bet on Inter Milan delivers blow to founder’s ‘Walmart plus Amazon of China’ dream

- Oaktree’s takeover of Italian football club wiped out Zhang’s fortune, according to the Bloomberg Billionaires Index

- At its peak in 2015, Zhang Jindong’s wealth surpassed US$11 billion as his firm pushed to become the ‘Walmart plus Amazon of China’

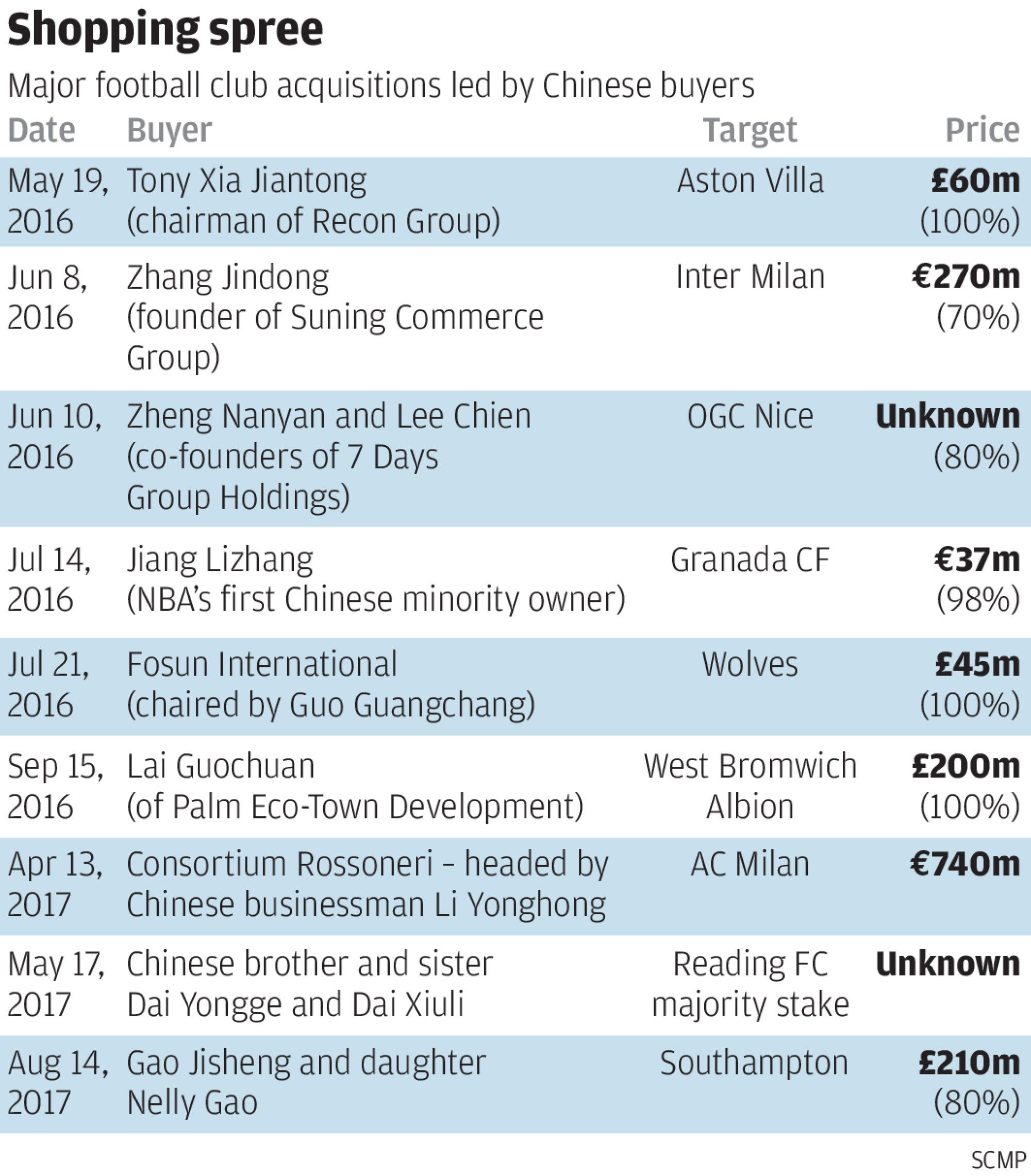

Zhang Jindong was worth about US$6 billion when he bought almost 70 per cent of the club in 2016. His private company, Suning Holdings Group, lacked the name recognition of Jack Ma’s Alibaba Group Holding or Hui Ka Yan’s China Evergrande Group, but Zhang was close to both founders and no less ambitious.

Buying Inter Milan would “raise the standards of local football, and also raises Suning’s profile as it expands globally,” Zhang said when he announced the deal.

Zhang was borrowing heavily to fuel Suning’s expansion, making him vulnerable when China’s growth sputtered. Following a failed investment in an Evergrande subsidiary and slipping sales at its retail arm, Suning defaulted on a €395 million (US428 million) debt to Oaktree, leading the US investment firm to take over the club.

It wiped out Zhang’s fortune in the process, according to the Bloomberg Billionaires Index. At its peak in 2015, his wealth surpassed US$11 billion.

Zhang was raised in China’s eastern city of Nanjing by an older brother after his parents died when he was a teenager. After graduating from university with a degree in Chinese literature, he started working as a clerk at a state-owned company and opened a cafe as a side gig.

While searching for a cheap air-conditioner for that business, he became friendly with a local distributor and began selling them full time in 1990, eventually establishing thousands of retail outlets selling home appliances. Zhang wanted Suning to be the “Walmart plus Amazon of China,” he told Stanford students in a 2013 speech.

As Suning invested in companies including Alibaba, it faced mounting competition from online vendors like JD.com and the headwinds of a slowing Chinese economy. Suning’s retail arm received an 8.8 billion yuan (US$1.2 billion) state-backed bailout in 2021. Months later, its 20 billion yuan investment in Evergrande went sour when the property developer defaulted.

Since then, revenue at publicly-traded subsidiary Suning.com Co has plunged, and one of the group’s entities is now facing a winding-up petition in Hong Kong.

Inter Milan, worth US$1.1 billion according to Sportico, had remained a bright spot in the empire. With Zhang’s son serving as its president, the team won Italy’s Serie A league in the 2020-21 season to end an 11-year drought. The club also reached the UEFA Champions League final last year, but was defeated by Manchester City of England.

Despite the club’s on-field success, Zhang’s Suning was forced to turn to Oaktree for a loan in 2021 after the pandemic shut stadiums. In recent weeks, Suning had been in talks with Pacific Investment Management Co to refinance the debt but could not agree on a deal in time.

Zhang might own assets that aren’t tracked by the Bloomberg Billionaires Index. Most of his holdings in Suning Holdings, Suning.com and Suning Real Estate Group Co. are pledged as collateral, according to filings.

Additional reporting by SCMP Reporter