Chinese power stocks surge on State Grid’s record US$574 billion investment plan

Utility’s five-year plan to modernise grids and boost renewables lifts electricity equipment makers as AI demand drives energy growth

Transformer makers Sieyuan Electric and Shanghai Guangdian Electric triggered the trading halt mechanism after surging 10 per cent on Friday morning. At least 11 mainland-listed companies rose 10 per cent or more in the morning before retreating in the afternoon. That bucked a decline in the CSI 300 Index, which slipped 0.41 per cent.

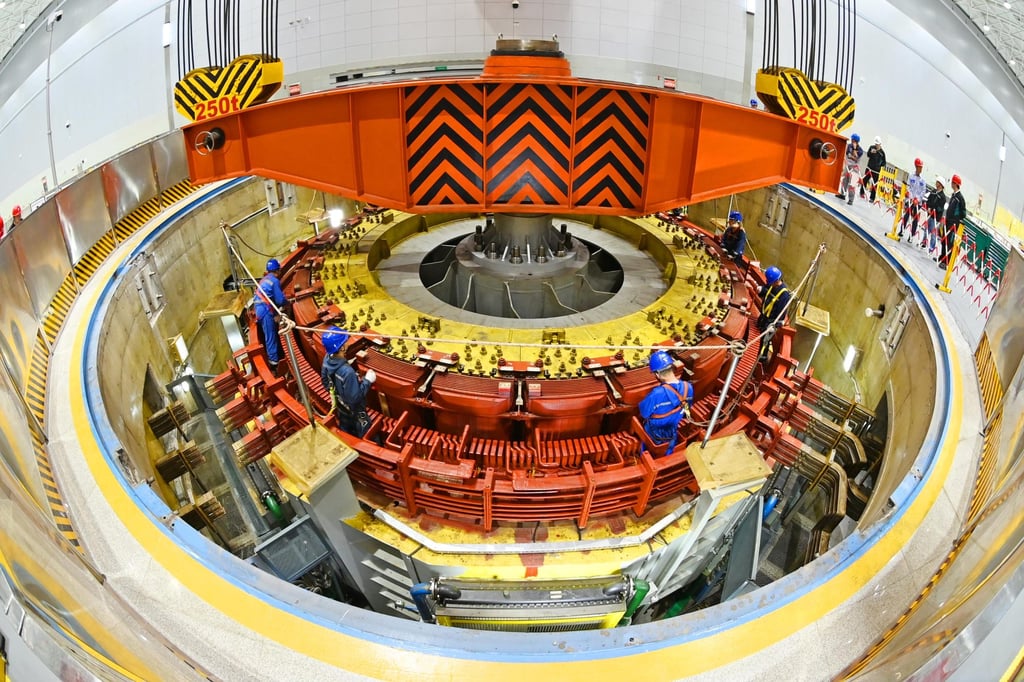

The funds would be used to build a “new type of power system”, with targets including adding 200 million kilowatts of renewable energy capacity annually and increasing the share of non-fossil consumption to 25 per cent by 2030, State Grid said. The company oversees electricity usage of 1.1 billion people across 88 per cent of China’s territory.

Main investments would be made in China’s western regions, where there was a surplus of power supply but a shortage of grids that could transmit the energy, according to Huatai Securities.

“The investment in non-ultra high voltage grids is expected to accelerate,” said Liu Jun, an analyst at the brokerage. “It’s clear that the weak power grids in the western region need to be upgraded against the backdrop of building a unified national power market.”