Solar industry bouncing back on mainland China after prolonged downturn

Energy firms are once again developing huge projects thanks to financial sweeteners

The mainland's solar panel industry is showing signs of booming again after a prolonged downturn - raising fears of another bust when the splurge of public money that is driving a spike in demand dries up.

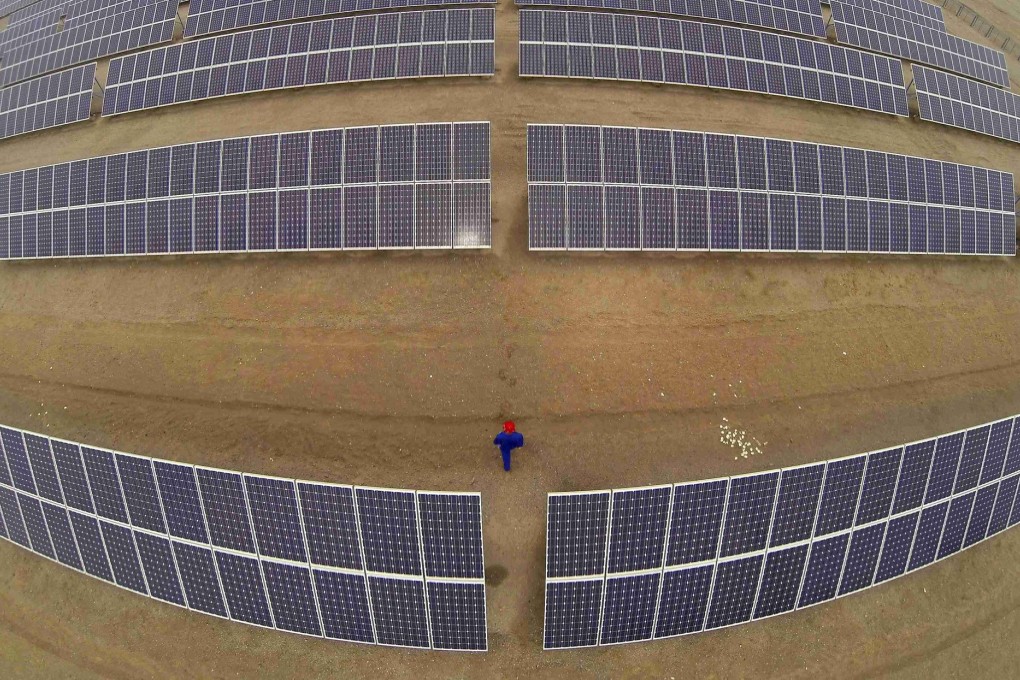

Lured by generous power tariffs and financing support to promote renewable energy, mainland firms are racing to develop multibillion-dollar solar generating projects in the Gobi desert and barren hills of China's vast north and northwest.

The sweeteners have not only lured traditional energy investors like China Power Investment Corp, but also a host of solar panel makers and even companies such as toll road operator Huabei Express and Jiangsu Kuangda Auto Textile Group.

Some solar panel manufacturers, encouraged by a recovery in sales in the last two quarters - largely on surging demand from China and Japan - are expanding production capacity, even though the overall sector remains mired in a severe glut.

But industry officials worry fast-growing generation capacity will increase fiscal pressures on China and Japan and force them to cut subsidies, which will then hit demand, just as happened with previous big solar users Germany, Spain and Italy.

"The key is whether the Chinese government is determined enough to boost solar generation," Sun Haiyan, senior executive at Trina Solar, said when asked if the current solar expansion in China was sustainable.

China already boasts solar manufacturing capacity of about 45 gigawatts, enough to meet global demand this year.