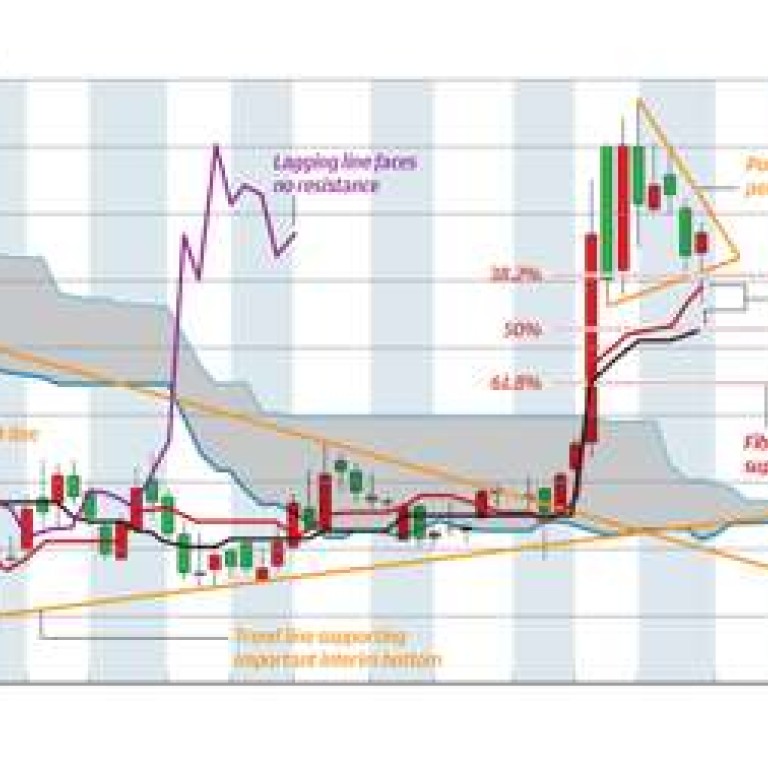

Chart of the day: Copper bottomed

December’s consolidation in Shanghai copper futures prices has eased the overheated and overbought situation created by November’s spectacular change in tone while keeping momentum strongly bullish. What had been very pedestrian performance since December 2015 saw this market spring into life, breaking secular trend-line resistance and a flat-topped weekly Ichimoku cloud in what we see as the start of a new major rising trend. Traded volume has been increasing all year while open interest picked up in the second half. Moving averages this week have supported prices and while Fibonacci retracement support holds investors should brace for another rally early next year. Measured targets from this potential pennant formation are 54,300 and possibly 59,300 yuan per tonne.

Nicole Elliott is a technical analyst