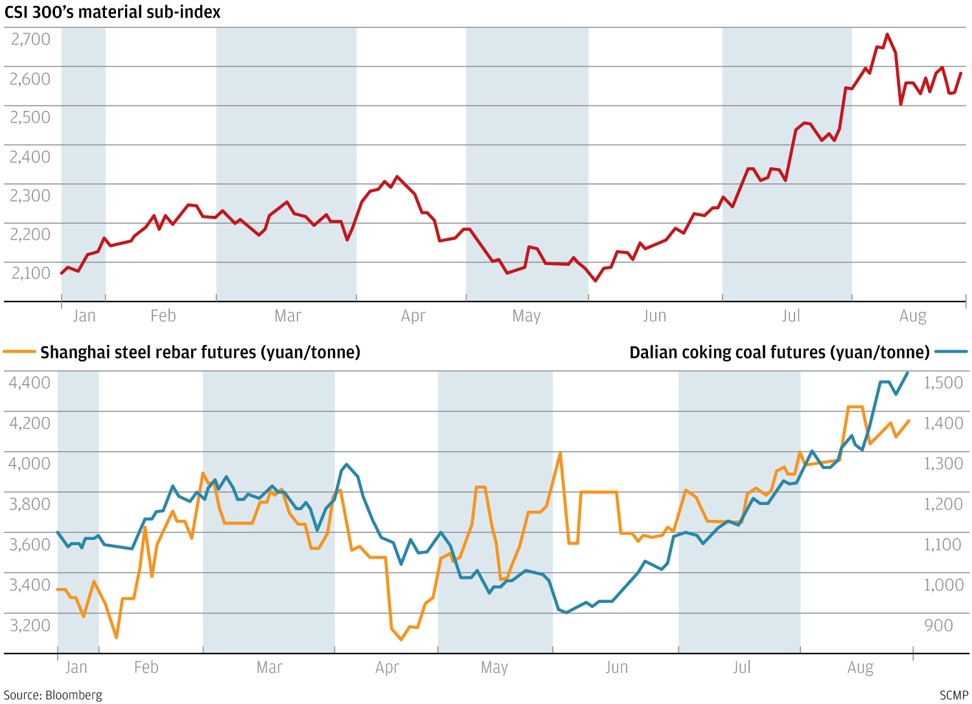

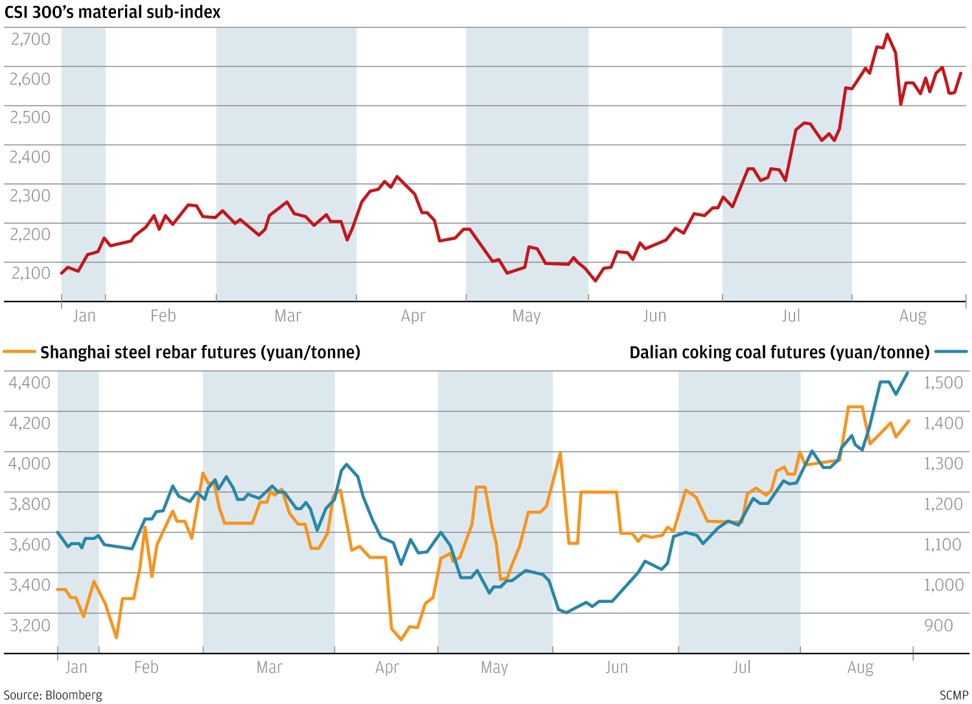

The mainland’s raw material stocks, the best-performing sector over the past three months, are showing signs of cooling on jitters that policymakers will move further to rein in the binge on the commodity market. The gauge has fallen 3.9 per cent from this year’s high registered on August 9 after jumping as much as 31 per cent since June. With commodity prices surging this year, the Shanghai Futures Exchange responded by raising the costs of trading steel rebar contracts and imposing a cap on the daily transaction number of new contracts this month, while the Dalian Commodity Exchange tightened the margin requirement for coking coal futures. Meanwhile, the China Iron and Steel Association said this week that steel prices were unlikely to rise “significantly”, given an expected increase in supply. According to Shenwan Hongyuan Securities, surging raw material prices will crimp profit at domestic manufacturers and undermine the country’s efforts to develop high-end manufacturing. Steel rebar prices have advanced 40 per cent this year in Shanghai and coking coal has jumped 37 per cent in Dalian.