China’s blistering solar sector is bracing for a slowdown

Solar farm developers are being squeezed as falling solar panel prices aren’t enough to offset delays in government subsidy payouts

The sizzle will finally come off China’s solar power industry next year with a major slowdown unavoidable, according to analysts and industry executives.

The world’s largest industry harnessing the sun’s energy to generate electricity may finally succumb to cash flow difficulties, as overdue government subsidies weigh on developers’ capacity to fund new projects.

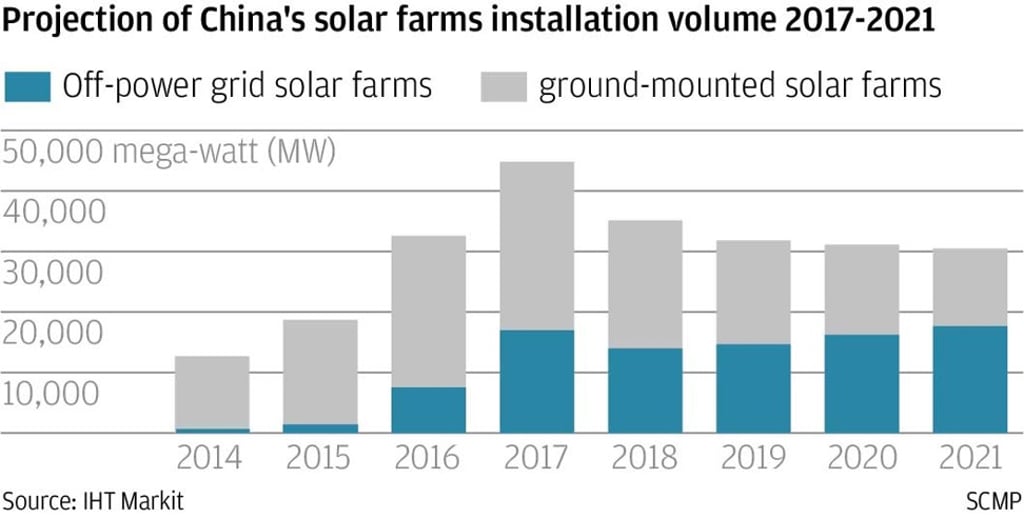

It could lead to the first drop in annual solar farms installation since 2014, if projections unveiled in the Photovoltaic Exhibition and Conference of China are realised.

“With developers’ elevated debt leverage and lengthening collection periods of tariff subsidies, projects’ payback periods are getting too long for comfort,” said Zhuang Yan, chief commercial officer at Canadian Solar.

Frank Xie Feng, senior analyst at consultancy IHS Markit, projected China’s annual solar farms installation to ease to between 30,000 and 35,000 megawatts (MW) in the four years to 2021.

This year China is set to install a record 45,200 MW of solar capacity, roughly half the global total.