Why China’s costly “green energy certificate” has not helped cash-strapped renewable energy firms

China’s pilot “green energy certificate” trading scheme has not proven to be an effective replacement for hefty state subsidies. But things are expected to change when the scheme becomes compulsory next year

Three months after its launch, China’s first “green energy certificate” trading scheme has raised only 5 million yuan (US$800,000) for the country’s cash-strapped renewable energy companies, who are owed 75 billion yuan in government subsidies.

The figures, cited by Hou Yuhan, marketing director at the nation’s largest wind turbine producer Xinjiang Goldwind Science & Technology, highlight the challenges Beijing faces in balancing the interests of electricity consumers and producers while ensuring the nation meets its clean energy consumption target.

The voluntary “green certificate” trading and subsidy scheme is likely to require polluters, including coal-fired power generators, to buy “certificates” from renewable energy suppliers. Intended as an eventual replacement for subsidies paid to clean energy suppliers, the pilot programme was launched on July 1 to help ease the pressure on the government to implement frequent and unpopular power price increases to foot the ballooning subsidy bill.

“If we only rely on voluntary purchases, it could hardly play a significant role to fund our clean energy development aspirations,” she said.

Most voluntary purchases are by firms seeking to meet their own corporate social responsibility goals.

Kevin Gong Xu, a Shanghai-based senior energy procurement manager at Johnson Controls, a US energy efficiency products provider, said China’s green certificates can cost up to three times more than those in other markets, as sellers are only willing to accept small discounts to the subsidies they are owed.

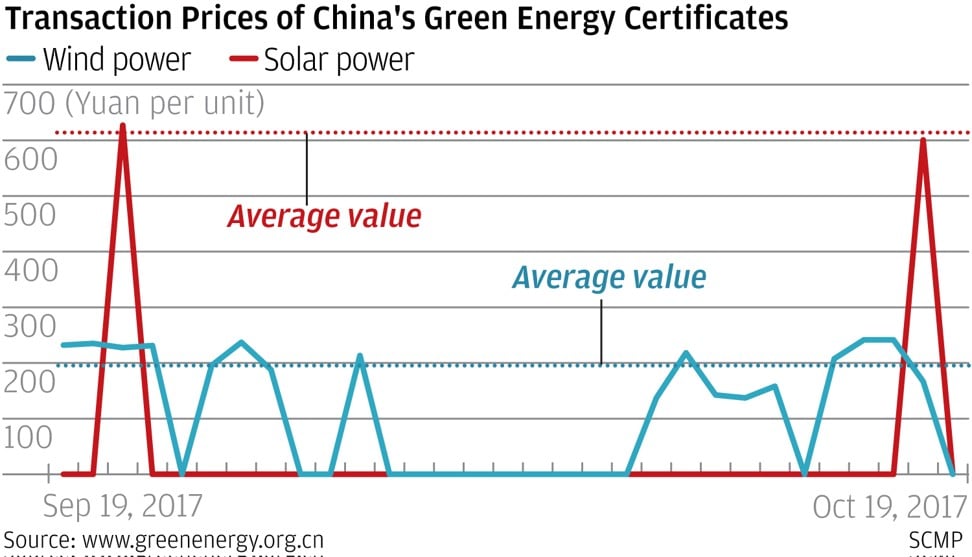

The daily average certificate transaction prices for wind power ranged from 137.2 to 241.5 yuan per megawatt-hour, according to data from state-run trading platform greenenergy.org.cn, operated by the China National Renewable Energy Centre.

The National Energy Administration last year announced it will make green certificate purchases compulsory from next year to help wind and solar farm developers resolve their cash flow problems.

Beijing would rather force electricity suppliers to reduce their operating costs than to ask power users to shoulder the full burden of consuming cleaner but more expensive energy.

The administration has yet to clarify whether it will be compulsory for coal-fired power producers or power distributors to buy green energy certificates, which will hurt their profit.

What is clear is that, unless they can meet either the clean energy production or consumption quotas, coal-fired power generators and distributors will have to buy the certificates to bridge the shortfall.

Ren Dongming, head of a renewable energy development research unit at policymaker National Development and Reform Commission, said the highly contentious quota system has been debated for over a decade and has encountered strong resistance from parties that may have to bear the extra financial burden, namely coal-fired power generators and distributors.

When the green certificate system becomes mandatory next year, new wind and solar projects will no longer be able to enjoy subsidies in the form of higher power tariffs than coal-fired plants, while projects already in operation are not expected to be affected, Ren said.