Why is Hong Kong upset about an export industry that doesn’t exist? Look to Beijing for the answer

Hong Kong doesn’t have an aluminium industry. I doubt these domestic metal exports represent anything but paperwork subterfuge to make China’s contentious trade surplus with the US look smaller.

The Hong Kong government and industry players lashed out yesterday at Washington’s plan to impose tariffs on aluminium imports from the mainland and the city, which has been dragged into escalating Sino-US trade tensions. - SCMP, February 28

I have an updated version of the Pokemon Go game for you. Let’s see if you can find Hong Kong’s aluminium products export industry. Big prizes on offer.

Go on. It should be easy. I accept that you will not find one of the giant smelters that turns bauxite ore into aluminium ingots. Any of these, with their huge demands for electricity, would be uneconomic in Hong Kong.

But this still leaves you with lots of possibilities for mini plants that turn empty aluminium soft drink cans into window sidings, or air conditioning vanes.

And even if we are not talking of melting and repouring the stuff, surely we must have plenty of shops that cut and bend aluminium into shape for the aluminium-based products that we manufacture and export to the United States.

Get on the hunt. There are big prizes, as I say. If a threat to this crucial Hong Kong industry so angers our government and “industry players” that they “lashed out” at a US proposal to impose tariffs, then it must be easy to find their places of work. Haul out your smartphone and let’s play Aluminium Go.

It is to laugh. What we have here, of course, is the usual deliberate confusion of domestic exports and re-exports.

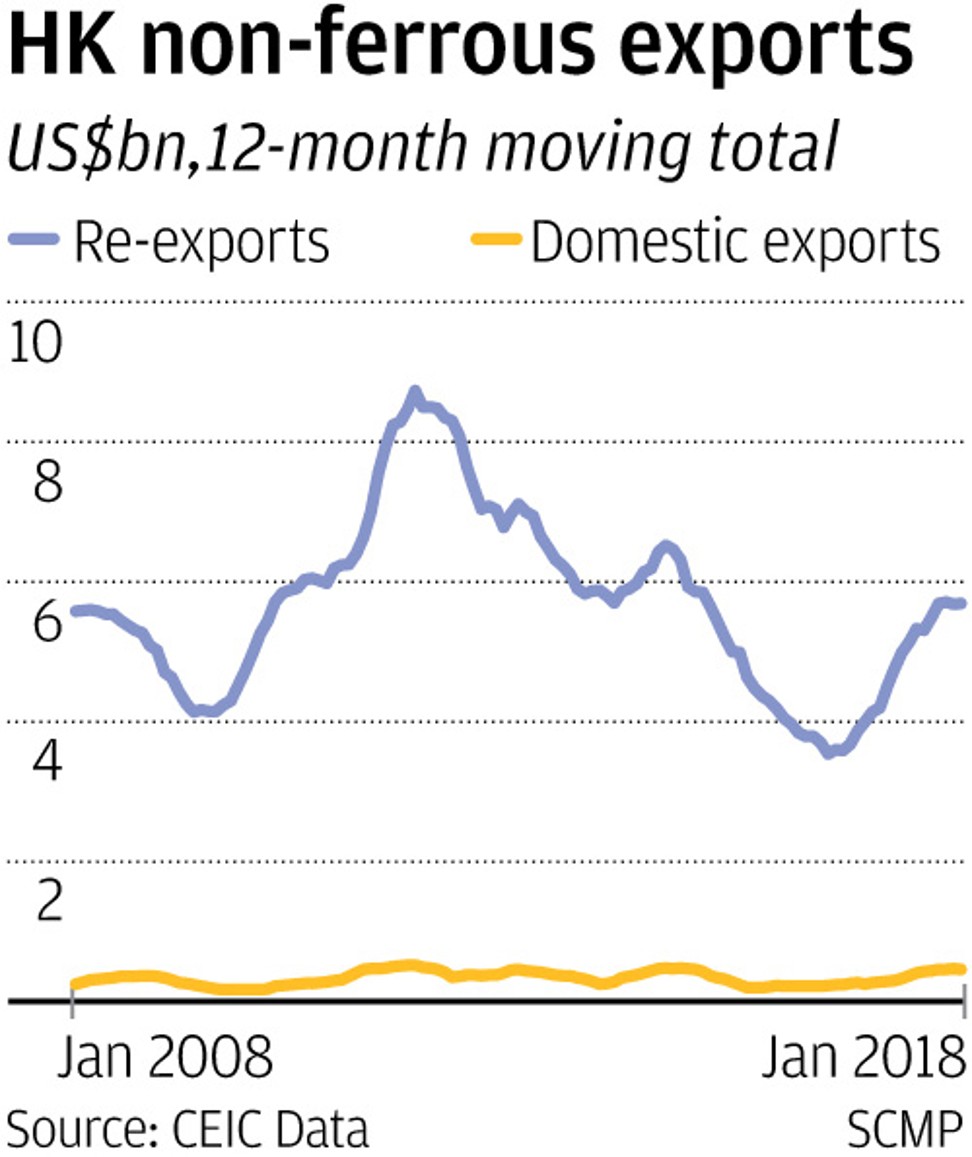

The first chart should set it into perspective. Last seen, our re-exports of non-ferrous metals were running at about US$5.7 billion a year, more than 10 times as much as domestic exports of non-ferrous metals. Do the same for metal products and re-exports run at more than 200 times domestic exports.

Let’s also have it straight that none of this is anything but a shipping technicality. Re-exports undergo no work here, and I also hugely doubt that these domestic exports of metals represent anything but paperwork subterfuge.

We do not have a metals bashing export industry. Aluminium Go will find you nothing but illusion.

It suits officialdom in Beijing, however, to pretend that exports to the US routed through Hong Kong are actually exports to Hong Kong, not the US. This makes the mainland’s contentious trade surplus with the US look smaller.

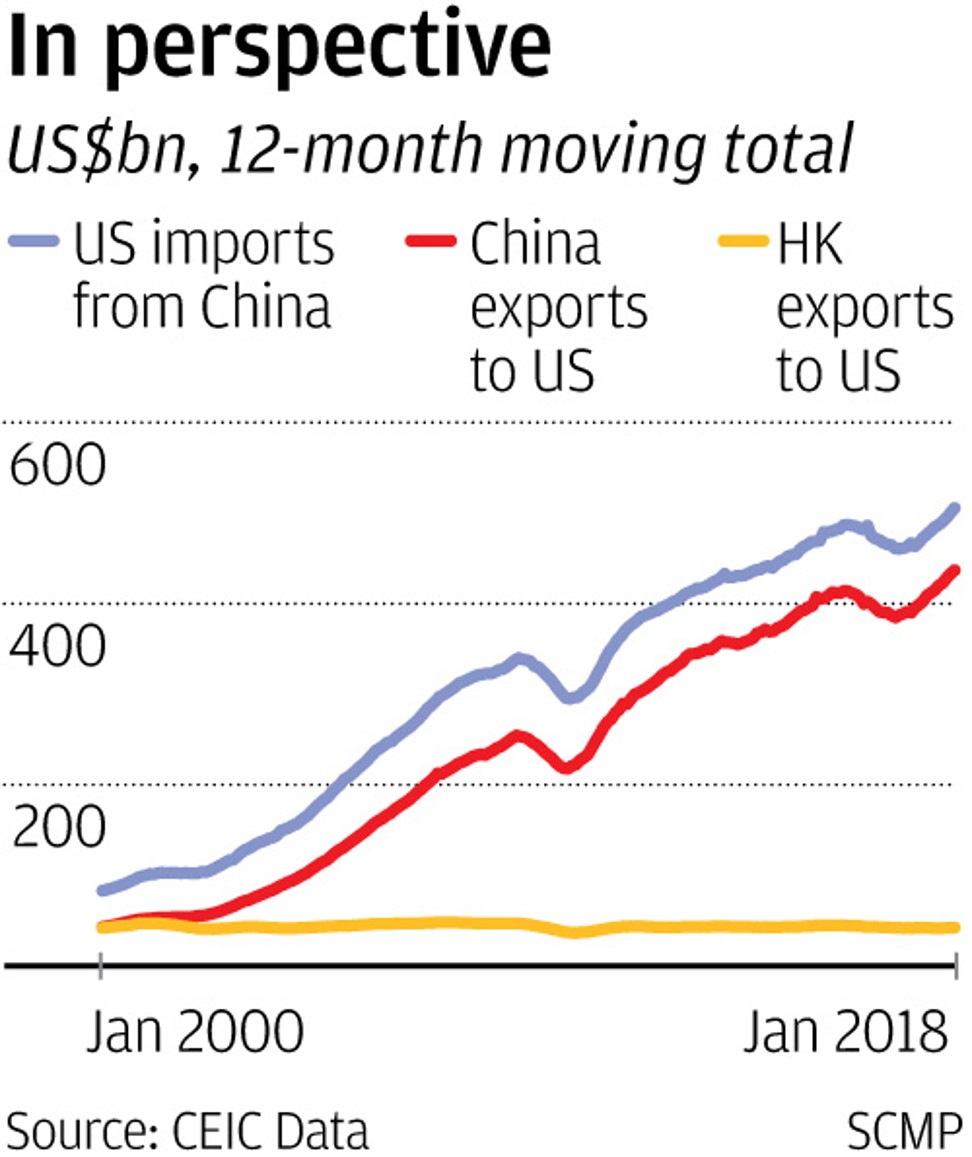

The second chart sets out the story here. The top line in the blue gives you the US figures for imports from China. The line underneath it in the red gives you China’s figures for exports to the US.

Making up most of the difference is the line at the bottom of the chart. This represents Hong Kong’s total exports to the US. These have run at a consistent US$40 billion to US$45 billion a year for the last 20 years. As they say in mathematics, QED (look it up yourself).

Thus when Commerce Secretary Edward Yau Tang-wah protests the US tariff threat as “this unilateral and discriminatory act that is based on unfounded allegations”, well, any allegation of Hong Kong having an aluminium export industry is certainly unfounded, that much is definitely true.

But you know where to look for the ventriloquist.