A successful US-China trade deal would boost copper, aluminium prices, analysts say

- Two biggest risks to global metals and mining industries are China’s slowdown, trade war, many surveyed executives say

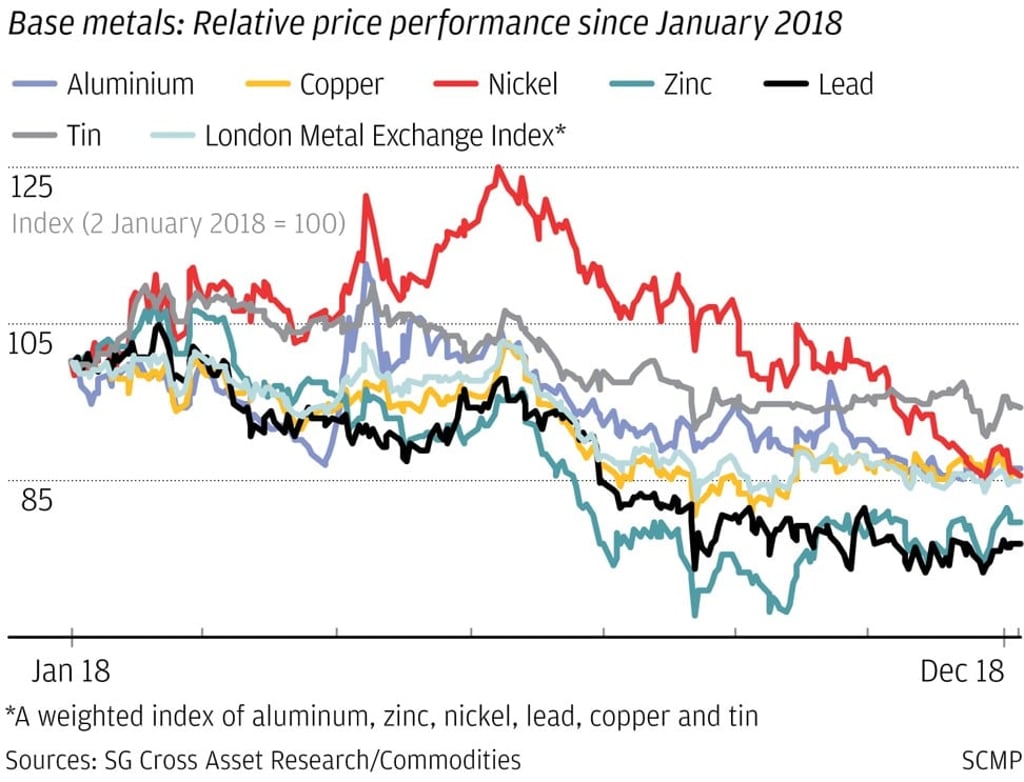

- Copper and aluminium prices are up this year, after steep falls in 2018

The recent rebound in prices of several key industrial metals will continue this year – and would get an added boost by a successful US-China trade deal, analysts say.

But prices of such metals may be volatile, analysts said, as the US and China try to work out difficult issues. Washington accuses China of behaving unfairly by forcing technology transfers for market access, applying non-tariff barriers, and violating intellectual property rights.

“Recent US equity market sell-offs and increasing threats to the US economy by the trade war may incentivise [President Donald] Trump to make a quick deal … but the number of issues at stake are not easy to resolve and will likely inject persistent volatility into markets,” Citi’s analysts said in a research report.

US President Donald Trump recently expressed optimism that world’s two largest economies will reach a deal. A 90-day trade truce expires on March 1, and more talks are ahead. However, the US’s chief trade negotiator Robert Lighthizer said the two sides have not even agreed on a draft framework for an agreement.