Outlook for electric vehicle metals positive as supply issues to keep prices at elevated levels by 2025, analysts say

- The recent spike in electric vehicle (EV) materials like lithium, nickel and neodymium - driven by a demand-supply imbalance - is being gradually relieved

- Prices for some EV battery and motor metals will have to be sustained at high levels to encourage production growth, says Castilloux of Adamas Intelligence

“In the longer term, we expect to see tight supplies for a handful of EV battery and motor metals, and we will need to sustain these higher prices to encourage production growth, but not high enough to induce consumers to engineer them out,” said Ryan Castilloux, managing director of Adamas Intelligence. “By around 2025, we will see shortages for nickel and lithium, which will slow production of batteries and EVs.”

However, the recent sharp demand-supply imbalance will not be sustained, since it was driven by delayed purchases, as well as seasonal and pandemic-driven incentives from EV distributors to revive sales and move inventories, Castilloux said. He expects the prices of the EV metals to see moderate correction in the next few weeks to months as demand and supply gradually come closer to balance, but prices will remain higher than last year’s average.

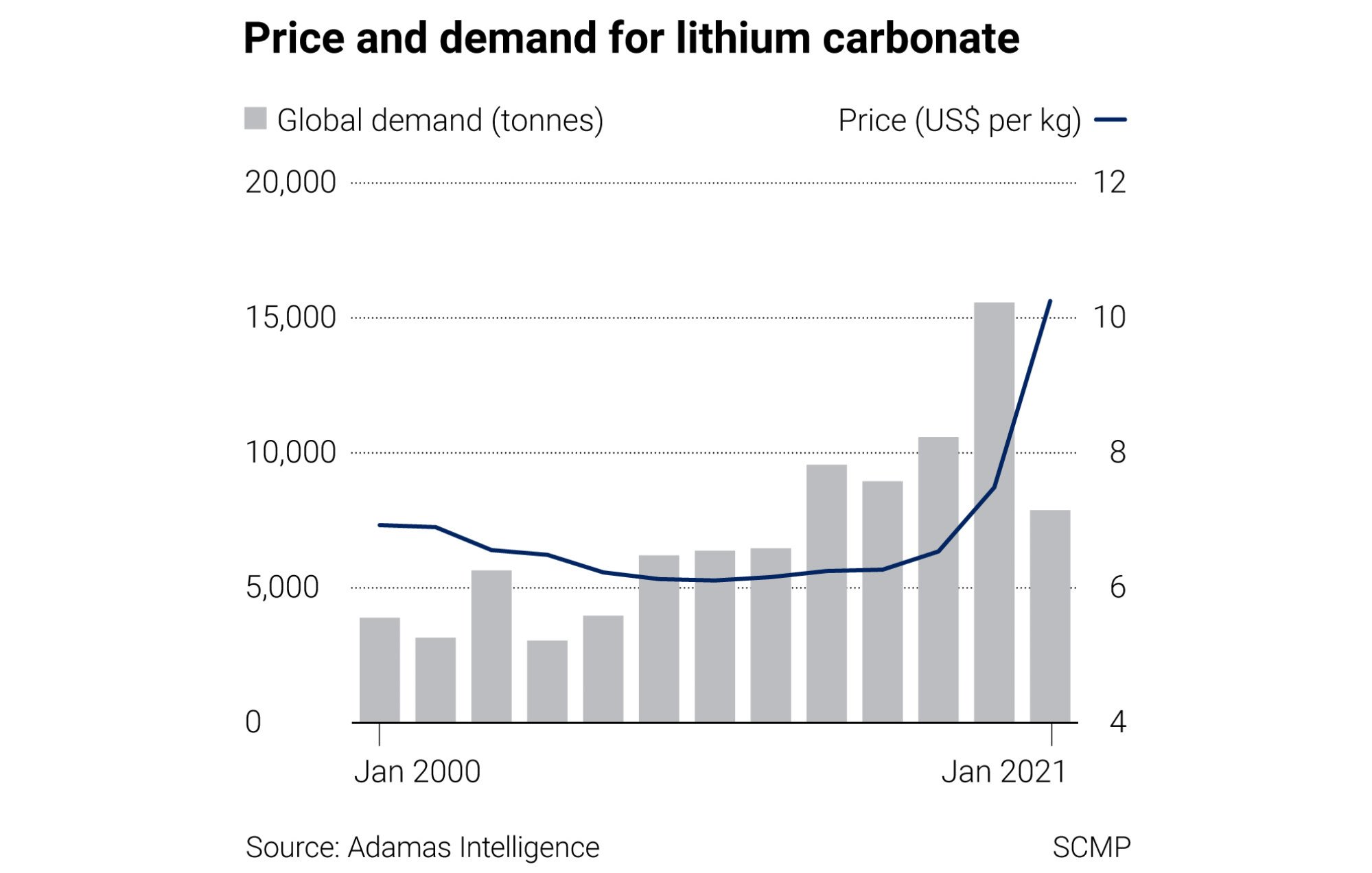

Neodymium-praseodymium oxide, used heavily in permanent magnets found in EV motors, saw prices rise by 78 per cent between May and January. The price of lithium carbonate, used in EVs and mobile phone batteries, has jumped 80 per cent in the past three months, after a three-year slump because of rising EV demand and slowing supply.

While the price of lithium carbonate is not expected to revisit the record high seen in 2017 any time soon, it will be sustained at higher levels as faster growth in EV sales continues to lift demand for batteries and raw materials, said David Merriman, who specialises in battery and EV materials at Roskill Information Services.

China, the world’s largest EV market, may see new energy vehicles sales jump 40 per cent to 1.8 million units this year, spurred by Beijing’s supportive policies and new model launches, according to a forecast by China Association Automobile Manufacturers.

This could see new energy vehicles – battery-powered EVs, plug-in petrol-electric hybrids and hydrogen fuel-cell vehicles – make up 7 per cent of total car sales. Beijing’s “Made in China 2025” master industrial plan envisioned 20 per cent of new cars on the streets to be new energy vehicles by 2025.

Copper usage in EVs could amount to more than three times that of those powered by conventional internal combustion engines, according to energy and metals mining consultancy Wood Mackenzie. Roskill, meanwhile, expects the additional demand for copper from the proliferation of EVs to amount to one million tonnes in 2030, or 2.6 per cent of 38 million tonnes of total global copper demand that year.

“EVs are going to be tomorrow’s story for copper rather than today’s,” said Jonathan Barnes, principal consultant for copper at Roskill. “By 2024 or 2025, they will have a more meaningful impact.”