As China pushes for use of carbon quotas as loan collateral, banks seek more clarity about creditors’ rights

- China’s national emissions trading scheme has made US$32.9 billion worth of carbon quotas available for use by banks as collateral

- It may be difficult for banks to resell quotas when they need to monetise them, analyst says

China’s national carbon exchange in Shanghai will allow banks to use carbon quotas as collateral, but bankers said that they needed more clarity on creditors’ rights, as well as more trading participants.

“As the [market] pricing of carbon quotas gradually emerges, these quotas will become effective collateral going forward, providing the basis of collateral pledges for banks to expand their financing [to borrowers],” Ye said.

02:38

China launches world’s largest carbon-trading scheme as part of 2060 carbon neutrality goal

“As carbon quotas trading moves to an exchange trading environment from being traded over-the-counter, this should be a positive for the prospects of using such quotas for the purpose of collateralising loans,” said Frank Fang, head of commercial banking, Hong Kong at HSBC.

And while loans being collateralised with such quotas is not new in China, the industry does need more clarity on details such as the enforceability of creditors’ rights against such collateral under Chinese laws, among others, Fang added.

01:24

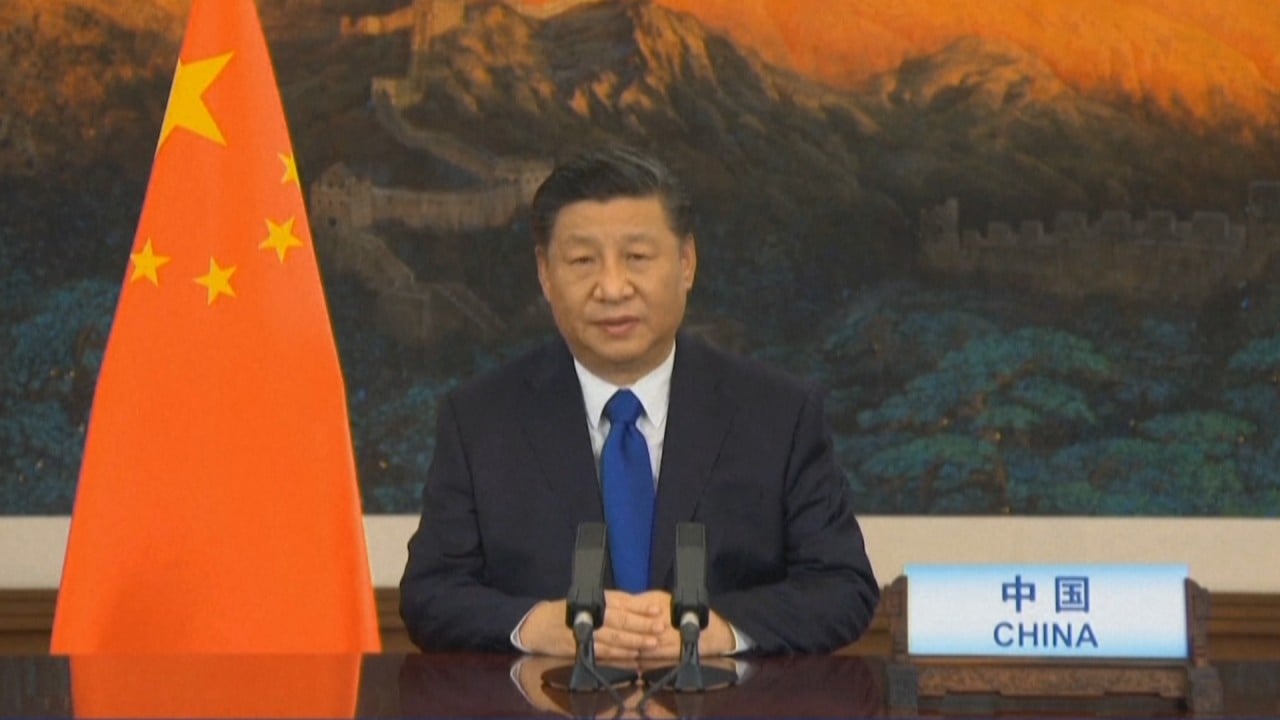

China to reduce carbon emissions by over 65 per cent, Xi Jinping says

Hubei Yihua Chemical Industry, for example, obtained a 40 million yuan loan from Industrial Bank in September 2014 that it used on improving its energy conservation capacity. The loan, which was secured by a pledge of carbon quotas, was offered in collaboration with the Hubei Emission Exchange using the 2.1 million tonnes of emissions the chemical company had as collateral.

Other exchanges, such as the Guangzhou Carbon Exchange, have, however, partnered with banks in offering emissions quota-backed loans under a hypothecation arrangement, whereby the borrower of the loan still has full ownership of the quota. This is in contrast with loans secured by a pledge, whereby the lender takes possession of quotas, forestalling their use by the borrower.

The Hubei and Guangzhou exchanges were part of Chinese emissions trading pilot programmes that began in seven regional markets in 2013-2014, before the national exchange went live last week.

39:35

Sustainability: Green bonds to help drive China's push towards carbon neutrality

Industry players say there is a lack of national standards that could help banks tackle such regional discrepancies. These variations also raise questions about how banks can enforce their legal rights against such collateral.

Some analysts also doubt whether banks could resell carbon quotas in the market as easily as other tangible collaterals, such as a factory building, in the case of a default.

“The national ETS covers only coal-fired and gas-fired power generators, so the scope is inherently limited in terms of sectors, and it may be difficult for banks to resell quotas when they need to monetise them,” said Dennis Ip, head of Hong Kong and China utilities and renewables research at Daiwa Capital Markets.

03:05

China vows carbon neutrality by 2060 during one-day UN biodiversity summit

“Banks may have to ensure that there will be buyers for quotas before lending to a borrower, to make sure that they can monetarize the assets in the case of a default,” Ip added.