China forms rare earths giant to protect its dominance in global output as market share falls

- The China Rare Earth Group may help tighten China’s control over the internationally strategic minerals, analysts said

- It was formed via the merger of units under Aluminium Corporation of China (Chinalco), China Minmetals Corporation and Ganzhou Rare Earth Group

The newly formed China Rare Earth Group will control more than a third of mainland China’s rare earths mining industry.

Its formation via the merger of units under state-owned Aluminium Corporation of China (Chinalco), China Minmetals Corporation and Ganzhou Rare Earth Group has been approved by the State Council, the State-owned Assets Supervision and Administration Commission said in a statement on Wednesday.

“After this restructuring, our controlling shareholder will be changed from China Minmetals Corporation to the newly formed group,” China Minmetals Rare Earth said in a filing to Shenzhen’s stock exchange on Thursday.

The formation of China Rare Earth Group will help speed up the more sustainable development of the ion-absorbed type of rare earth ore found in southern China, and support investment in new technologies for separating and processing it into higher value products, China Central Television reported.

After the merger, China Rare Earth Group will own resources in the provinces of Jiangxi, Shandong, Sichuan and Hunan, as well as the Guangxi Zhuang autonomous region, according to a China Galaxy Securities report late in September.

It will control 37.6 per cent of China’s rare earths mining – including a close to 70 per cent share for heavy rare earths – and almost 42 per cent of the national ore separation and processing volume, the brokerage noted.

“Amid surging rare earth prices and tightening control of the resource by various countries, rare earth may become a strategic tool for China to wield international influence,” said China Galaxy analyst Hua Li in the report.

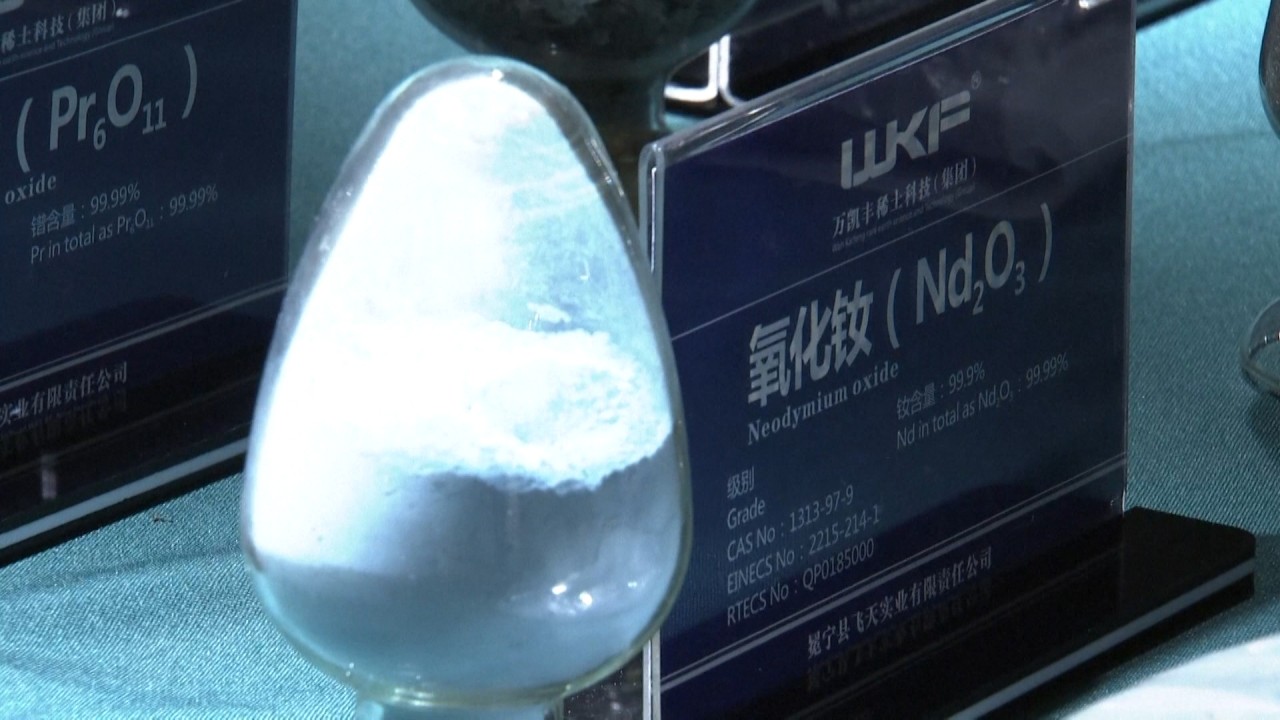

Heavy rare earths – such as dysprosium used in nuclear reactors – commonly found in southern China are more limited in supply and more valuable than northern China’s light rare earths like praseodymium and neodymium that are used in electric cars and wind turbine magnets.

Rare earth prices, as tracked by a composite index compiled by the Association of China Rare Earth Industry, have gained 88 per cent in the past year.

In the last three decades, China has invested heavily in facilities that carry out the lion’s share of global rare earth mining and ore processing work. The process of extracting the ore is detrimental to the environment.

But the United States – the world’s largest producer in the 1980s – ramped up its output by 36 per cent last year to 38,000 tonnes as the metals’ strategic value has grown. Rare earth minerals are vital components in the production of smart electronic devices, wind turbines, electric cars and military equipment.

Myanmar raised it production by 20 per cent to 30,000 tonnes last year, while Madagascar doubled its output to 8,000 tonnes.

China’s production grew 6 per cent to 140,000 tonnes.

China’s share of global output has slipped from 86 per cent in 2014 to to 58.3 per cent last year, according to the US Geological Survey. It boasted 36.7 per cent of global reserves last year, ahead of Vietnam and Brazil’s 18 per cent.