China’s Ganfeng to pay nearly US$1 billion for its third lithium mine in Argentina to bolster resource for electric vehicle batteries

- Ganfeng Lithium agreed to pay US$962 million for all of Lithea, which operates the Pozuelos-Pastos Grandes lithium salt lake projects in northwestern Argentina

- The projects, with a combined resource volume estimated at 11 million tonnes of lithium carbonate, rank third among Argentina’s 10 largest deposits

Ganfeng Lithium, China’s largest producer of lithium salts, has agreed to pay US$962 million for a lithium brine deposit in Argentina, its third in the South American nation, to bolster its hoard of resources for producing electric vehicle battery packs.

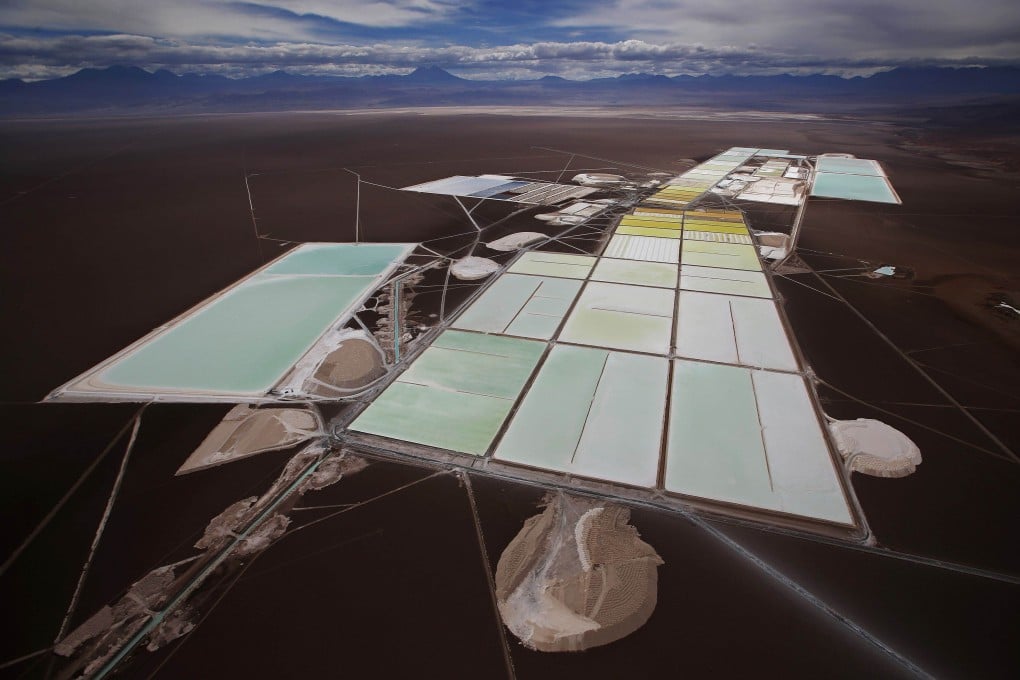

The company based in Jiangxi province will buy all of Lithea, which operates the Pozuelos-Pastos Grandes lithium salt lake projects in Salta province in northwest Argentina, according to a statement.

The two projects have a combined mining area covering 13,470 hectares (33,285 acres), about one eighth the land mass of Hong Kong. Canada’s Lithium Americas and Arena Minerals also operate mining projects in the region.

The main product of the Pozuelos-Pastos Grandes projects is lithium carbonate, an inorganic compound mainly used as the raw material for producing lithium battery cathode. The projects have a combined resource volume estimated at 11 million tonnes of lithium carbonate.

The projects can initially produce 30,000 tonnes of lithium salts initially, which can be expanded to 50,000 tonnes if conditions are favourable, Ganfeng said in a filing to Hong Kong’s bourse late on Monday. Phase one commercial production was scheduled for 2024.