Chinese plastic makers’ bets on cheap US gas are foiled by disruptions at Panama and Suez

- Some 44 per cent of the new propylene-producing capacity set to open in China from 2020 to 2025 will be based on PDH, according to JPMorgan

- margins at those plants fell to an average of US$55 a tonne in North Asia, compared to nearly US$200 the year before, according to S&P Global Commodity Insights

The Chinese petrochemical sector’s bet on profiting from a steady supply of cheap US gas to make plastics is quickly going awry, as twin choke-points for shipping upend trade flows and drive up costs.

China has invested heavily in its petrochemical industry in recent times. But the massive expansion in capacity accelerated last year just as the Chinese economy was stuttering, slowing consumption and creating a glut of plastics across Asia.

A large proportion of the new plants use propane, which is mostly imported from the US.

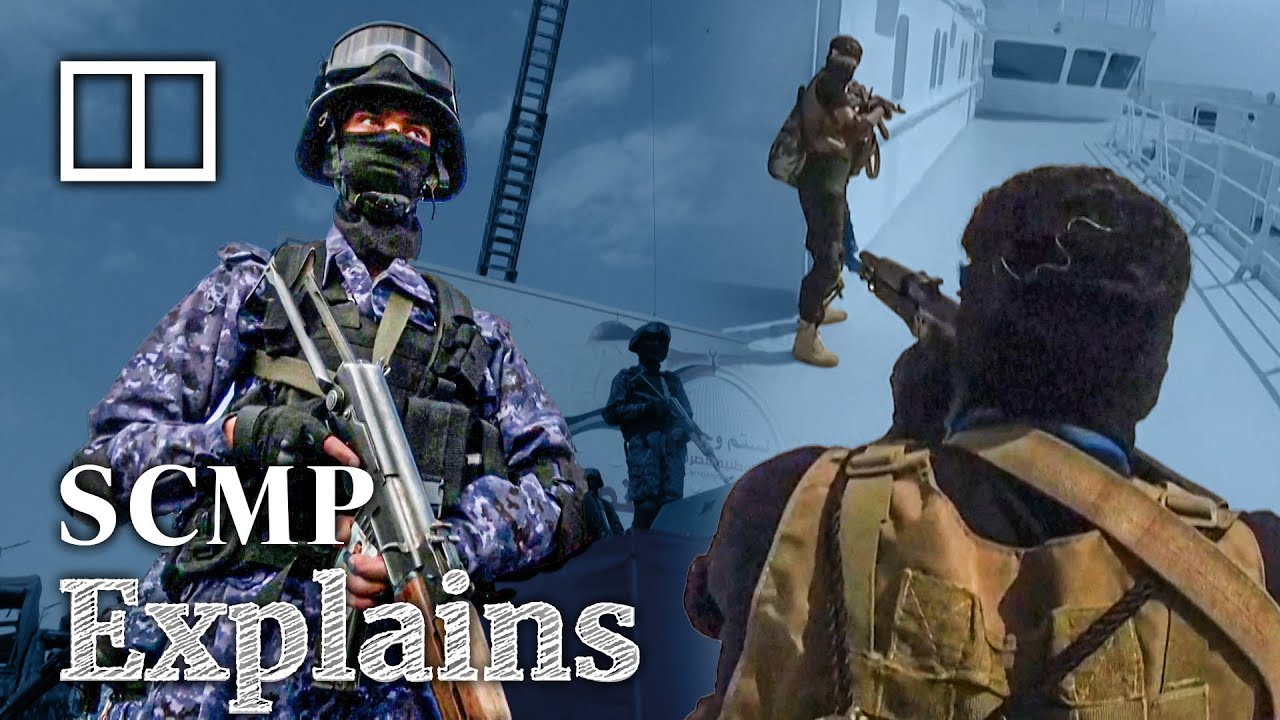

That is posing a fresh challenge as shipping crises in the Panama Canal and the Red Sea raise freight costs and curb access to US supplies.

As a result, the new wave of budding players that employ propane dehydrogenation (PDH) technology – once seen as a promising corner of the petrochemical sector – are being forced to scale back.