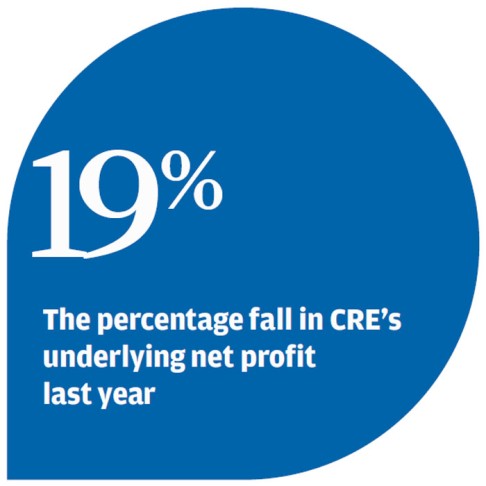

Profit fall fails to hold back CRE

Mainland retailer says it will keep opening up to 400 stores every year amid mounting expenses

Food and beverage retailer China Resources Enterprise (CRE) said it would continue its robust expansion, even after being hit by the expenses incurred in opening new stores and ballooning advertising costs last year.

Chief financial officer Frank Lai Ni-hium said CRE would continue opening 300 to 400 new stores every year and that the firm was looking for new acquisition targets following the purchase of Kingsway Beer. That deal is set to be completed in July.

"Our target is to open 300 to 400 stores every year. That plan will not be changed easily, regardless of the operating environment," Lai said.

"We aim to gradually expand our market share and we won't stop looking for good merger and acquisition opportunities. This year, our focus will be meat and fresh fruits."

Ng Fung Hong, a company under the group that has a monopoly in fresh beef and pork supplies in Hong Kong, sparked public concern last year when it raised beef prices six times.